Operator JV Management Part 1

Reducing partner drag and accessing other rewards from engaging differently with non-operating partners. No more “Do what I say, not what I do.”

To this day, our Standards of JV Portfolio Governance Excellence remain the only tool for companies to independent- ly calibrate themselves against peers on the journey to excellence.

December 2020 — A DECADE AGO, we established a set of objective tests to allow companies to calibrate how well they are governing their portfolios of joint ventures. At the time, many companies were waking up to the materiality, risks, and untapped performance potential of their joint ventures, especially those that the company did not operate or control. Major HSE incidents at Macondo and Samarco – both joint ventures – and a series of high-profile bribery and corruption scandals and partner litigation further elevated the appreciation for risks in joint ventures in ensuing years. To this day, our Standards of JV Portfolio Governance Excellence remain the only tool for companies to independent- ly calibrate themselves against peers on the journey to excellence.[1]This article does not provide any accounting or legal advice or recommendations.

To take stock, we recently benchmarked 45 large natural resource companies against our Standards. This research included participation from 80% of the world’s largest public and state-owned companies in the oil and gas, chemicals, mining, and renewable energy sectors. To gather inputs and test our findings, we conducted more than 200 interviews over a six-month period, reviewed hundreds of company documents, and previewed our results in individual company sessions and four JV Roundtables we hosted for the oil and gas, chemicals, mining, and renewable energy industries.

What follows is a more detailed discussion of the context, findings, and

recommendations from our research.

Most leading energy and other natural resource companies hold large and material portfolios of joint ventures (Exhibit 1). In chemicals, mining, and renewable energy, firms like BASF, Dow, SABIC, BHP, Anglo American, Iberdrola, and Ørsted own interests in 20-40 or more controlled and non-controlled joint ventures, including production assets, supporting infrastructure plays such as transport or storage joint ventures, and more broadly-scoped business joint ventures. In oil and gas, the numbers are even higher, especially among majors like Shell, Total, and ExxonMobil which hold portfolios of 100 or more joint ventures that on average account for 75% of upstream production.

Companies are under pressure on a variety of fronts to drive meaningful change in this installed base.

ESG Reporting and Performance Pressures. Investors, governments, local communities, customers, and the public are demanding that companies improve their environmental, social, and governance footprints across their assets. This pressure now extends directly into a company’s joint ventures, including those it does not control. Rockefeller Asset Management and EDF just released a report entitled “The Emission Omission” which argues that there is an “accountability gap” in the labyrinth of non-operated assets run by a company’s production partners because environmental reporting and targets typically only cover a company’s operated assets.[2]Emission Omission: A Shareholder Engagement Guide to Uncovering Climate Risks from Non-Operated Assets in the Oil and Gas Industry, Rockefeller Asset Management and EDF, October 2020. Other external groups that focus on human rights, openness, governance, diversity, and community engagement, including the Equality and Human Rights Commission and Oxfam, have started to set their sights on joint ventures, and demanding better performance from firms.

Restructuring Pressures. Adding fuel to the fire, the current economic downturn and low commodity price environment are forcing companies to restructure their businesses, including their joint ventures, to reduce operating costs and capital spend. And yet joint ventures can be challenging to revamp quickly due to multiple owners with divergent strategies and financial profiles, and a shared voting construct which requires unanimous or supermajority approval for significant changes. Meanwhile, for many of the largest state-owned oil and chemical companies, joint ventures remain the core platform for international growth and a key to generate greater synergies domestically, where assets are often held in siloed joint ventures with different international partners. Our analysis shows the median JV takes 39 months longer to restructure than what would be expected for a wholly-owned business – but that JVs that undergo at least one major restructuring were more than twice as likely (79% vs. 33%) to meet their owners’ strategic and financial objectives compared to JVs that remained largely unchanged.[3]“Your Alliances are Too Stable,” David Ernst and James Bamford, Harvard Business Review, June 2005.

Increasing Partnership Complexity. The complexity of partnerships is increasing. For example, in renewable energy and oil and gas, leading companies are under pressure to provide access to technology and operations to local partners who control access to valuable reserves or licenses and who possess a desire to learn and build capabilities. As a result, firms are being driven to consider “mixed operator” joint venture models – which require fundamentally different, and often more complex, ways of working and strategies to protect IP and other secret sauce.[4]“Mixed Operator Models,” James Bamford, Gerard Baynham, Joshua Kwicinski, and Geoff Walker, The Joint Venture Exchange, January 2014.

Meanwhile, many oil and gas, chemical, and mining firms are evaluating and entering into a high volume of new technology- and sustainability- driven joint ventures, investments, and other partnerships as a way to accelerate the transition to a lower carbon economy. For instance, Rio Tinto and Alcoa teamed up with Apple and the Canadian government to form Elysis, a joint venture to develop and commercialize the first carbon- free aluminum smelting technology. In the chemicals industry, our analysis shows a three-fold increase in circular economy partnerships in the last three years, including ventures like the Alliance to End Plastic Waste and Regenyx. Such ventures are often with much smaller, more entrepreneurial partners with promising but often unproven technology. Deal structures can be highly complex – including with direct equity investments, warrants, contingent valuations, and scope carveouts. And these partnerships, often competing in the same space, are often originated and managed in disparate parts of the business. All this creates challenges related to sharing and protecting intellectual property ownership, maintaining unconstrained commercialization pathways in the face of exclusivity and other commitments, and integrating a series of partially- controlled bets into a cohesive whole.

Embedded Hurdles in Legal Agreements and Practices. Dealing with these pressures will not be easy – and, unfortunately, gaps in underlying joint venture contractual agreements and governance practices will make it even harder to respond quickly and effectively. Our work continues to show significant flaws and exposures in joint venture legal agreements, including in provisions related to exit and transfer rights, scope and non-compete, dividends and distributions, and environmental policies. For instance, as companies seek to transform the sustainability profile of existing assets, many are coming to realize that the underlying contractual agreements provide perilously few environmental rights and protections in ventures they do not operate.[5]For more see: “Fixing Flawed Environmental Clauses in Joint Venture Legal Agreements,” Shishir Bhargava, James Bamford, Noah Joseph, and Josh Kwicinski, Oil, Gas & Energy Law, October 2020.

We also see widespread evidence that many individual joint ventures are not well-governed, with JV Boards lacking diversity or suffering from high turnover, poor agenda discipline and meeting management, and disconnects between Boards, committees, and management. The median JV Board Director (or equivalent) has a tenure of just 30 months and spends only 15 days per year fulfilling their governance duties – a material difference from corporate Boards and clear deviation from accepted norms of good governance. Meanwhile, a mere 5% of natural resource industry JV Board Directors are women – a significant gap from what those same companies’ owner corporate Boards and leadership teams look like.[6]“Research: Only 10% of Joint Venture Board Members are Women,” Molly Farber, James Bamford, and David Ernst, Harvard Business Review, July 10, 2020. At the same time, talent in joint ventures is not well-managed. Too often, key JV talent populations – including JV Board Directors, asset managers, and secondees – are poorly selected, under-prepared, poorly rewarded, exposed to personal liability, and feel like second-class citizens in companies focused on wholly-owned or operated businesses. Our data shows that many JV asset teams are not properly sized or structured, with significant variation in resource levels not linked to materiality, risk, capabilities, or ability to influence the operator.[7]For further details on these gaps; “Joint Venture Governance Index: Calibrating the Strength of Governance in Joint Ventures,” James Bamford, Shishir Bhargava, Martin Mogstad, and Geoff Walker, … Continue reading

Responding to all of these pressures and embedded hurdles is not a job to be solely undertaken at the individual venture level. Rather, companies must also act at the corporate and business unit level to drive the quality, consistency, and scale of response. But they must do so in a way that helps – not distracts or burdens – the intense fire- fighting demands at the asset level.

In calibrating companies against our Standards of JV Portfolio Governance, our goal was to understand what corporate and business unit level practices and organizational structures they have put in place to drive improved financial and environmental performance, better risk understanding and mitigation, and enhanced transparency internally and externally across their joint venture portfolios, as well as to understand what companies are doing to select, prepare, and support their people working in or overseeing joint ventures. These Standards are based on 25-plus years of experience helping companies enhance their JV capabilities.

Here’s what we found at the 45 companies in our latest benchmarking:

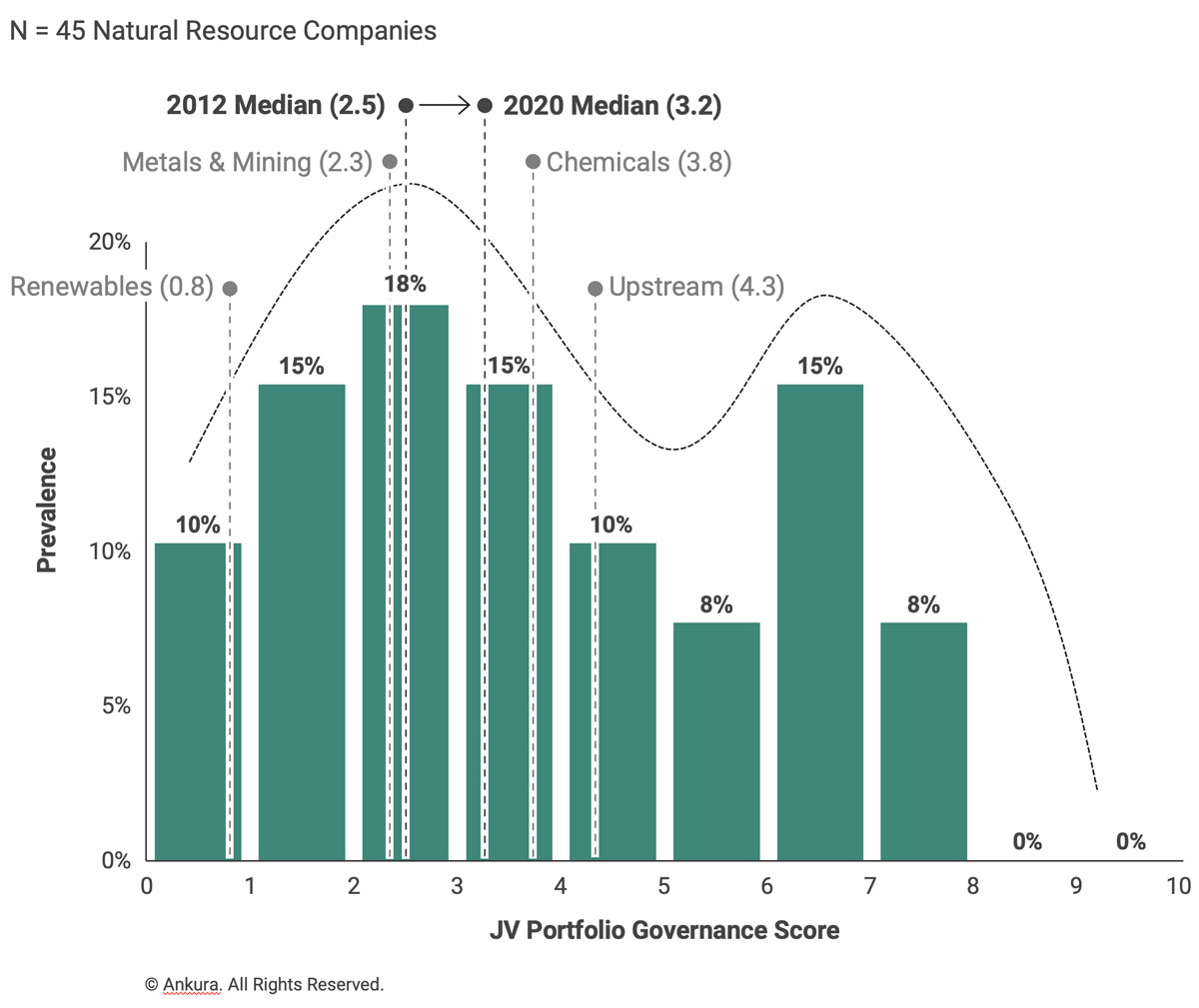

Overall Scores: We assessed companies against 20 Standards of JV Portfolio Governance Excellence (Exhibit 2). Our Standards are organized into six categories – starting with corporate accountability for JV excellence, which is at the heart of an integrated approach. Within each Standard, we tested for the presence and strength of specific practices that are hallmarks of world-class joint venture portfolio governance. All told, there are 40 practices embedded within the 20 Standards. For each Standard, we gave a company one of four ratings: fully meeting, mostly meeting, somewhat meeting, or not meeting. These scores were then rolled up into a 10-point scale. The median company in our dataset scored 3.2 on our 10-point scale (Exhibit 3). Highest scores were found among international oil and gas companies, with a median score of 4.3, followed by upstream oil and gas, chemicals, and mining. Renewable energy companies scored the lowest, with a median score of 0.8. These scores are consistent with these industries’ relative experience with JVs – with oil and gas having a century of experience compared to a decade or less for many renewable energy companies. Top public companies had somewhat higher scores than state-owned companies, and materially higher scores than independents and mid-tier players.

© Ankura. All Rights Reserved.

Notable Leaders: A number of companies – including BHP and SABIC – stand out as leaders in our benchmark for their robust and innovative approaches to JV portfolio governance.[8]For a discussion on Dow, one of the companies that first adopted strong JV portfolio governance and corporate capabilities, please see: “Dow’s Systems of Corporate Controls for JVs,” Randy … Continue reading

Consider BHP, one of the world’s leading resource companies. In its mining business, BHP has taken a series of aggressive actions over the last four years to better manage risk and value in non-operated ventures following a major HSE incident at Samarco, a 50:50 JV in Brazil in which a tailings dam collapse resulted in 19 fatalities, extensive environmental damage, and multi-billion dollar fines. In 2016, the company created a new executive role – Asset President of Non-Operated Joint Ventures – with a dedicated team to manage its non-operated mining assets.

Under this structure, BHP established a set of JV governance standards which define minimum expectations for how it organizes and conducts itself in non-operated ventures, and it now audits its non-operated teams against those standards. BHP significantly upgraded the training and ongoing education of its JV Board and committee members, including legal and compliance training as well as influencing, negotiation, and effectiveness training. It established new performance management processes for non-operated assets – processes built around annual influencing plans and key focus areas to drive prioritization. It provides regular updates to the company’s executive leadership team and Board on the non-operated ventures, and regularly engages with its institutional investors on how it is managing non-operated assets. Every three years, it sponsors an independent review of the governance of its joint ventures in both minerals and petroleum. BHP has also taken a leadership role in the mining industry, catalyzing an industry conversation and sponsoring forums on joint venture governance. BHP has also started to provide greater public transparency on its non-operated ventures, with separate reporting on non-operated asset emissions and community spend.

Another standout is SABIC, the world’s fourth-largest chemical company. In 2015, the company created a new corporate function, Joint Venture Affairs, with the goal of bringing added focus and greater internal integration to the company’s 40-plus joint ventures and affiliates. The Joint Venture Affairs unit is led by a corporate vice president – a role that initially reported directly to the CEO, and now reports to the CFO.

The SABIC JV Affairs team’s mandate is threefold: develop and oversee the implementation of corporate joint venture standards and processes, provide venture management support to all joint ventures and affiliates, and help structure and perform due diligence on potential JV transactions and restructurings. Over the last five years, the unit has created and operationalized an impressive list of joint venture practices, including JV Board Director training, regular JV Board and Director assessments, and the adoption of annual influence and engagement plans for each venture. It has put in place new corporate performance management processes, including annual strategic asset reviews that challenge each venture to look critically at long-term strategic fit, partner alignment, and relationship strength, as well as performance and risks. On the transaction side, not only does the SABIC JV Affairs team have a small team focused on supporting JV transactions and renewals, but it also has developed JV major clauses guidance that establish standard principles for key joint venture contractual provisions and terms, with any deviations requiring formal approval of the SABIC Investment Committee. SABIC also now performs joint venture post-close lookbacks to evaluate and capture learnings from each transaction.

Unlike BHP, the SABIC JV Affairs unit does not hold direct P&L for individual ventures – which resides with designated executives across the company who serve on the JV Boards. Nonetheless, the unit contains a team of about 20 who are deeply involved in supporting those accountable executives and in the day-to-day engagement with external and internal stakeholders. Recently, as testament to it success, the scope of the VP-JV Affairs role was expanded to include all of M&A, which will strengthen their application of joint venture transaction and investment practices.

Link to Performance. When we compared overall portfolio governance scores and practice adoption rates to company financial returns, we found a clear correlation between a company’s three-year Return on Capital (ROC) and good joint venture portfolio governance. Companies that are moderate or broad practice adopters were much more likely to be exceeding or significantly exceeding industry average returns. Conversely, narrow practice adopters were much more likely to have returns that trailed industry averages (Exhibit 4).

Organizational Models and Accountability: Not surprisingly, form follows function; companies that are serious about governing their portfolios of joint ventures tend to develop organizations and accountabilities to match. In our benchmarking, we observed four overall organizational models (Exhibit 5). On one end of the spectrum, 36% of companies operate as a Corporate Adhocracy – i.e., they have no deliberate organizational accountability or structures at the corporate or business unit levels. Not surprisingly, these companies had the lowest practice adoption rates and scores against our Standards. At the other extreme, 38% of companies have an Integrated Corporate Organization – that is, a structure which includes corporate-level accountability for joint venture excellence, combined with deliberate organization with JV-intensive business units.

A number of companies have pursued other models, including a Coordinated Decentralized Organization which seeks to establish structures and accountabilities within different business units while providing some non-structural mechanisms to coordinate activities and consistency. While conceptually appealing, these models have struggled to drive corporate-wide progress.[9]Below the corporate level, we also looked at how 141 JV-intensive business units, regions, or functions were organized within the 45 benchmarked companies – benchmarking organizational models … Continue reading

By benchmarking against our Standards of JV Portfolio Governance Excellence, companies are able to quickly see strengths and gaps relative to an objective yardstick and to peers, and are able to convert this structured diagnostic into a prioritized roadmap for action at the JV portfolio level.

But improving company-wide performance of joint ventures requires more. Whether a company is just starting on the excellence journey or decades into it, we have found that executive leadership teams need to be pressing the organization for updated answers to four types of questions:

(1) What is our vision for JV success?; (2) What strengths, gaps, opportunities, and risks exist at the individual venture level, what patterns do we see, and where do we need to take action at scale?; (3) Beyond the governance of non-operated joint ventures, are there other types of ventures and at different points in the lifecycle that merit added corporate and business unit level attention?; and (4) Do we have the right leaders and mindset?

What is Our Company’s Vision for JV Success? It’s hard to make sustained progress without defining what “Point B” in the journey looks like. One simple way to do this is to define a “Company Vision for Joint Venture Success” with metrics to track and communicate progress. One company defined such a vision around four categories: performance, people, partners, and external stakeholders. Within each, it articulated a simple one-sentence definition of success (Exhibit 6). For instance, under “people,” its ambition is that employees working in joint ventures had engagement scores, performance ratings, and retention levels at least as strong as employees working in other parts of its business. A great way to keep the company energized and moving forward, such a vision is can be translated into a journey book that defined the steps and milestones needed along the way to get there.

Where Do We Have Gaps and Needs at the Venture Level? Before deciding whether and where to invest in joint venture excellence at the corporate or business unit level, a company needs a fact-based and holistic view of practices, gaps, risks, and opportunities across its portfolio, and whether such patterns are cross-cutting or specific to certain venture types. Such a fact-based and holistic assessment requires different types of analyses, including:

In our experience, companies often go through the motions of conducting such analyses – but do an extremely thin job, over-relying on anecdotes that confirm existing biases, performing analyses that lack real structure or comparative data and that do not dimension the size of the prize, and failing to access any independent perspectives, including the opinions of partners and JV management teams, as well as third-party benchmarks.

What Partnership Domains Need Focus? It’s a big world out there. For any company, it is critical to ask: “What types of joint ventures and partnerships would benefit from increased corporate and business unit focus?” A company might organize its answer around a two-dimensional gameboard – with partnership types running down the side and the phases of the partnership lifecycle across the top (Exhibit 7). In our experience, most natural resource companies start in one square – namely, the governance of non-operated production assets – where the lack of understanding, risks, and untapped value are highest.

But for most, there are considerable opportunities to expand the discipline and focus devoted to non-operated production asset governance into other squares on the gameboard, potentially including:

Do We have the Right Leaders and Mindset? Making real and sustained progress on joint venture excellence starts with leadership. There’s no better – or alternative – way to do this than designating an executive to hold accountability for joint venture excellence across the company or within a major business segment such as upstream or downstream, and asking them to keep the Board and executive leadership team updated on performance, risks, and trends.

Some 38% of companies in our dataset have such a designated role – a similar number we saw in 2012. Where such accountability exists, it may either be placed in an existing executive (e.g., CFO, General Counsel, Head of Strategy, Chief Risk Officer, Chief Compliance Officer), or in a new position (e.g., VP-Joint Ventures). In terms of mandate, we found Some 38% of companies in our dataset have such a designated role – a similar number we saw in 2012. Where such accountability exists, it may either be placed in an existing executive (e.g., CFO, General Counsel, Head of Strategy, Chief Risk Officer, Chief Compliance Officer), or in a new position (e.g., VP-Joint Ventures). In terms of mandate, we found that the corporate JV executive sponsor role always includes joint venture excellence and reporting, but in 80% of companies it also includes some added responsibilities, including directly supporting asset teams; supporting JV transactions; and, in 53% of companies, P&L responsibility. The size of the teams supporting this executive varies widely – from 0.5 to more than 40 FTEs – with the size mostly a function of the breadth of the unit’s role. For instance, JV units which are focused on being a center of excellence tend to be quite small (2-4 FTEs), while those with accountability for venture management tend to be much larger.

As we look at many of the first-generation of companies that adopted JV portfolio governance practices and structures, we see that many have stagnated after a decade or less – failing to adequately embrace a spirit of continual urgency and improvement. Once the original need has been identified and early gains made, it can be hard to sustain the progress. At the beginning of the journey, company Boards and executive leadership teams often have high-levels of interest – which drives activity and progress. But over time, the principal task shifts to sustained year-on-year delivery – something much less sexy, but absolutely essential to realizing the value on the investment. Instilling the requisite operational discipline may take a different set of leaders, those who relish in making continuous improvements to processes and systems, embedding capabilities in individuals, and realizing value in the assets through sustained influencing and contributions. This is a very different mentality for those leading the early stages of the journey – where making the case for change, securing resources, and launching new processes and organization are the core work.

A decade ago, we first called on companies to improve the governance of their portfolio of joint ventures – and to “put an end to the adhocracy” that defined so many firms’ approaches. Our calls were heeded by some, but others have not taken up the challenge. With mounting pressures, including from external stakeholders, investors, and corporate Boards who are waking-up to the to the materiality of ESG issues in non-operated ventures, the need is growing. How will you respond?

We understand that succeeding in joint ventures and partnerships requires a blend of hard facts and analysis, with an ability to align partners around a common vision and practical solutions that reflect their different interests and constraints. Our team is composed of strategy consultants, transaction attorneys, and investment bankers with significant experience on joint ventures and partnerships – reflecting the unique skillset required to design and evolve these ventures. We also bring an unrivaled database of deal terms and governance practices in joint ventures and partnerships, as well as proprietary standards, which allow us to benchmark transaction structures and existing ventures, and thus better identify and build alignment around gaps and potential solutions. Contact us to learn more about how we can help you.

Comments