ISSB Issues Global Sustainability Disclosure Standards – What Companies Need to Know

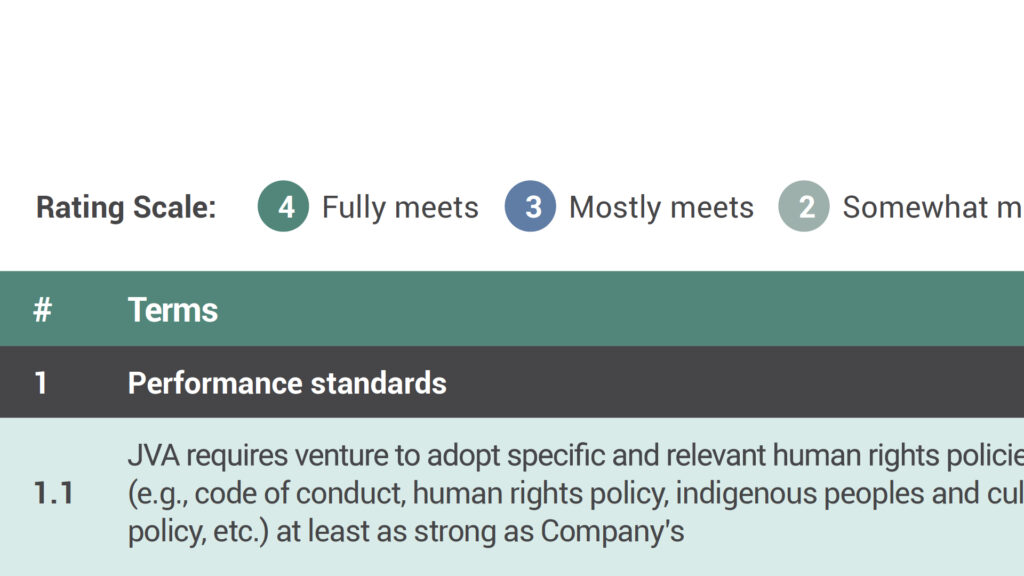

The Standards are designed to be a baseline of sustainability-related corporate disclosures and provide investors and other stakeholders with a common framework to make more informed decisions about a company’s environmental and social performance.