At-Will Exit in JV Agreements: Eject Buttons Often Come with Strings Attached

Practical guidance on structuring a critical provision in a JV agreement

Edgar Elliott is a Senior Associate at Ankura based in New York. He works across the joint venture and partnerships landscape, from advising on joint venture transactions, through to performing governance reviews of joint ventures and reviews of companies’ JV portfolios. He has worked with companies in various geographies, including in the Middle East, Europe, and the Americas, and across different industries, including the oil and gas, healthcare, aerospace and defense, and semiconductor sectors. Edgar holds degrees from Columbia University in Chemistry and in Classics.

Practical guidance on structuring a critical provision in a JV agreement

The hidden logic for holistically structuring exit terms in joint ventures.

Joint ventures are a critical tool for companies to access or commercialize new technologies and capabilities, share risk, meet local regulatory requirements, gain scale, and pursue capital-light growth.

Sustainability partnerships often are wrapped in a twine of financial, commercial, and operational flows and interactions • They may be a lifeline or a noose.

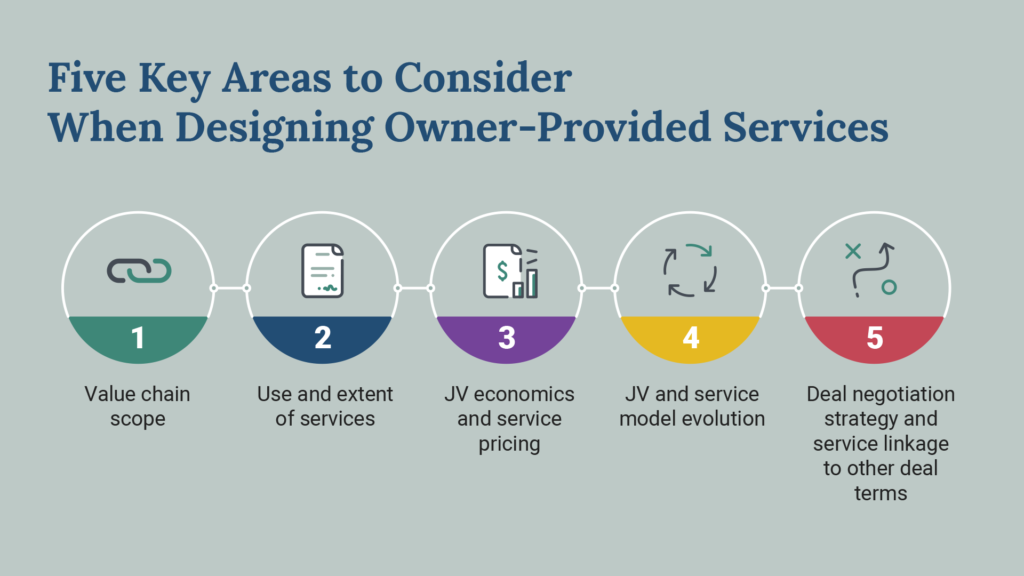

Most JVs can and should lean on their owner companies for a variety of support – but the benefits may come with costs, risks, and potential conflicts. Here’s our advice on managing these complex commercial relationships.