Powering the Energy Transition Through Joint Ventures and Partnerships

The energy transition is facing headwinds at a crucial time for maintaining momentum – but the explosion of new joint ventures and partnerships in clean energy is a bright spot.

Joshua Kwicinski is a Managing Director based in Washington, DC. He has more than a decade of experience in advising on all aspects of the partnership lifecycle, including deal strategy, transaction structuring, ongoing governance, and restructuring/exit. He has advised senior executives and dealmakers at both a corporate and individual JV level across a range of industries, including oil and gas, metals and mining, aerospace and defense, financial services, biotechnology, and others.

View Full Profile

The energy transition is facing headwinds at a crucial time for maintaining momentum – but the explosion of new joint ventures and partnerships in clean energy is a bright spot.

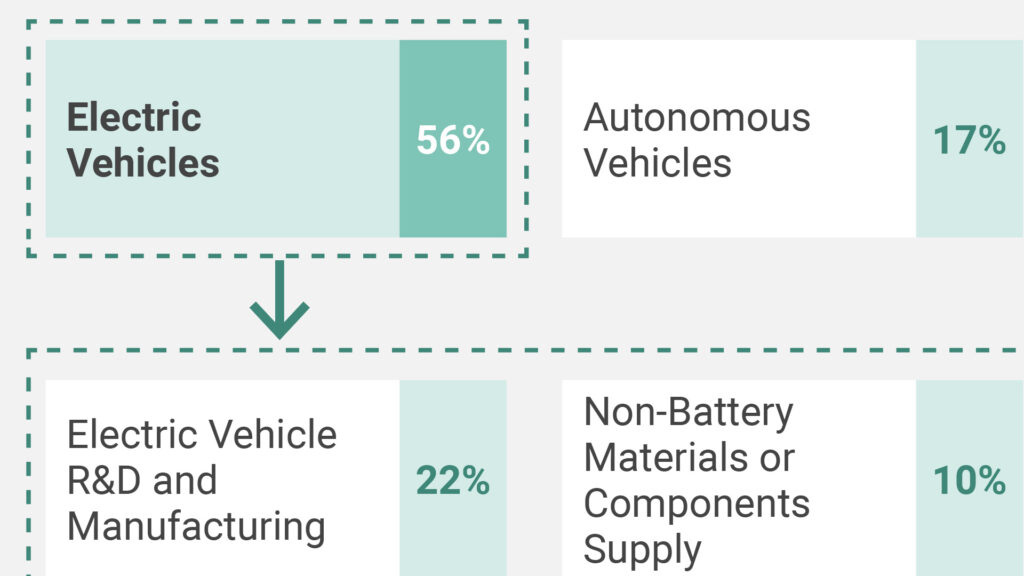

The majority of new auto partnerships revolve around electric vehicles.

Joint ventures and partnerships are driving the auto industry’s transition to electric and autonomous vehicles and materially contributing to the market valuation of most industry players.

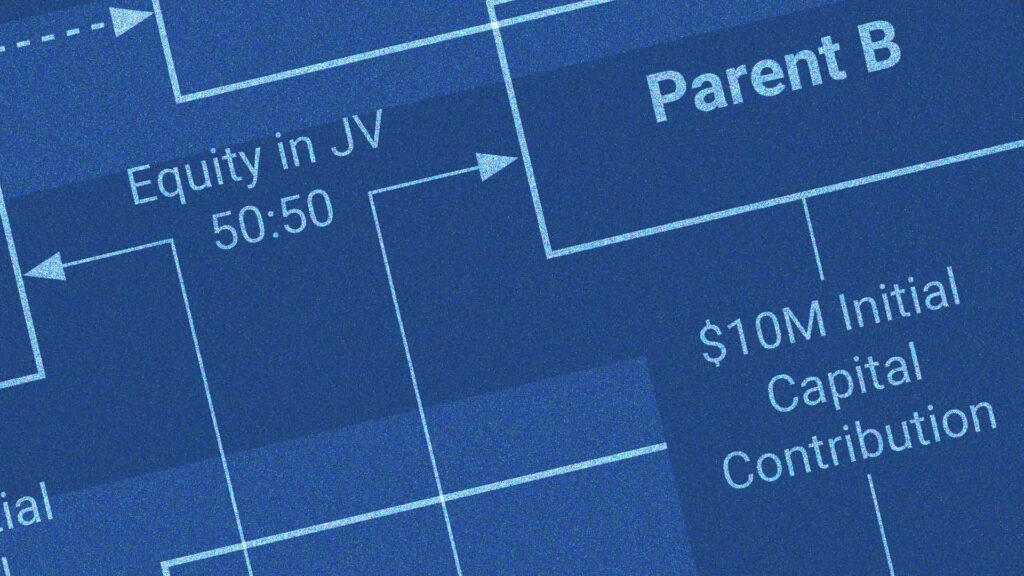

Businesses are increasingly partnering to meet their strategic objectives — but neglecting governance puts JVs and their shareholders at risk.

Companies are under intense pressure to improve their environmental, social, and governance (ESG) performance.

Companies in the oil and gas, chemicals, and mining sectors are among those with the highest environmental, social, and governance (ESG) risk profile.

Due diligence for joint ventures is more important than due diligence in an M&A context and requires an approach that exceeds traditional M&A due diligence.