OCTOBER 2022 – Joint ventures and partnerships are driving the auto industry’s transition to electric and autonomous vehicles and materially contributing to the market valuation of most industry players – with industry leaders partnering at rates outstripped only by a handful of other corporate sectors.[1]See, “Partnership Makers & Shakers, Ankura’s 2022 Scoreboard of Corporate Partnering Activity,” James Bamford, Shishir Bhargava, and Peter Daniel

Our analysis of more than 300 automotive industry joint ventures and partnerships shows a steady increase in deal volumes, with a 198% surge in the 18 months from January 2021 to June 2022, compared to prior years. Exits and other restructurings of existing automotive joint ventures and partnerships rose by 92% in the same period.

Exhibit 1: JV and Partnership Activity Across the Automotive Industry

© Ankura. All Rights Reserved.

Partnering Hotspots

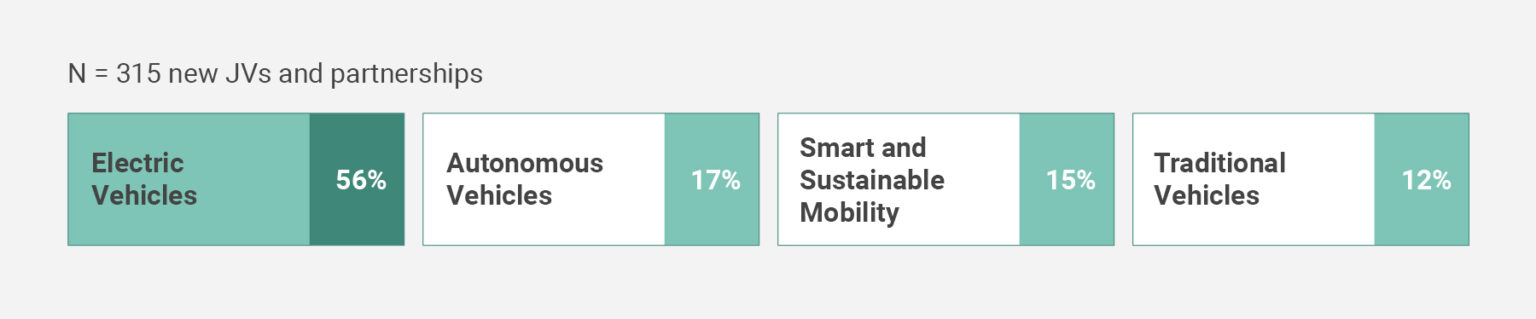

Partnering activity is concentrated in several hotspots (Exhibit 1).

Electric vehicles (EVs) have driven 56% of the new JV and partnership activity since 2016, led primarily by deals scoped around the battery – the most important, expensive, and complex component of an EV. Companies like GM, Ford, and Volkswagen are partnering at blistering rates to secure supplies of critical battery materials, speed the commercialization of solid-state battery technology, build out networks of charging stations, recycle used batteries, and most importantly, lock in guaranteed access to battery volumes by sharing the multi-billion-dollar capex requirements of large-scale production plants. For General Motors, this means a joint venture with LG, Ultium Cells, to build 3 battery plants in the U.S., each with more than $2 billion in investments, while Ford is pursuing a similar path with SK Industries, including multiple JV plants in the U.S. and Turkey.

Fuel cells featured in only 20% of the new automotive JV and partnership deals, with partnerships like Cellcentric, the JV between Daimler Truck and Volvo that is developing fuel cell systems for use in heavy-duty trucks. Automotive companies are increasingly placing their bets on this green technology alternative to batteries through partnerships – and typically for commercial vehicles, which require a greater range and shorter refueling times that hydrogen fuel cells can provide.

Autonomous vehicles (AVs) made up just 13% of new deal volumes in 2021, down from nearly 30% in 2016. The enthusiasm and frenzied deal activity around AVs from a few years ago is waning as companies struggle to refine the technology and build business models around it. Companies are also increasingly unwilling to stay invested in existing partnerships with uncertain returns on potentially heavy investment commitments – which triggered a wave of restructurings. Magna and Lyft ended their collaboration in self-driving vehicle technology, as did Volvo Cars and Veoneer. But the growing demand for trucking services, a tight supply of human drivers, and an easier-to-master non-urban operating environment has made self-driving technology attractive to truck manufacturers. Many are lining up technology companies as partners to develop self-driving systems – like Volkswagen’s Traton, which is collaborating with TuSimple, and Isuzu with Gatik, to develop self-driving trucks.

Companies are also stepping up their JV and partnership activity in a range of smart and sustainable mobility technologies – i.e., technologies that make vehicles (whether internal combustion engine (ICE), EV or AV) more connected and sustainable, including technologies for car-sharing, ride-hailing, connectivity, sustainable manufacturing, and smart urban mobility management. Fifteen percent of new JV and partnership activity focused on smart and sustainable mobility. For example, Polestar, a stand-alone premium EV company co-owned by Volvo Cars and its Chinese parent Geely, is developing the world’s first carbon-neutral car in partnership with key suppliers, including SSAB, Hydro, Autoliv and ZF.

Partnership activity in traditional ICE vehicles is dominated by partial divestments, consolidations, and restructurings, set off by the twin pressures that are weighing down the global OEMs: the pressure to invest billions on innovations that are likely years from reaching scale or returning profits, while balancing the need to promote traditional vehicles that generate investment capital against the stated objective of managing their future decline. Restructurings of JVs and partnerships in traditional vehicles have been responsible for 42% of all restructurings in the industry since 2016. The easing of regulatory restrictions in China – where many of the world’s automotive JVs are concentrated – is also contributing to the restructuring of underperforming ventures in the country. Renault alone, for instance, initiated the financial restructuring of its JV with Chinese automaker Brilliance, cancelled its JV with Chinese automaker Dongfeng, sold over a third of its Korean unit to China’s Geely, and pledged to pool more resources into its long-standing alliance with Nissan.

Industry Makers and Shakers

Which automotive companies were the most active partnership makers and shakers, and which companies the least?

Exhibit 2: Automotive Industry Makers and Shakers

Source: Ankura Partnership Makers and Shakers Analysis; 2022

© Ankura. All Rights Reserved.

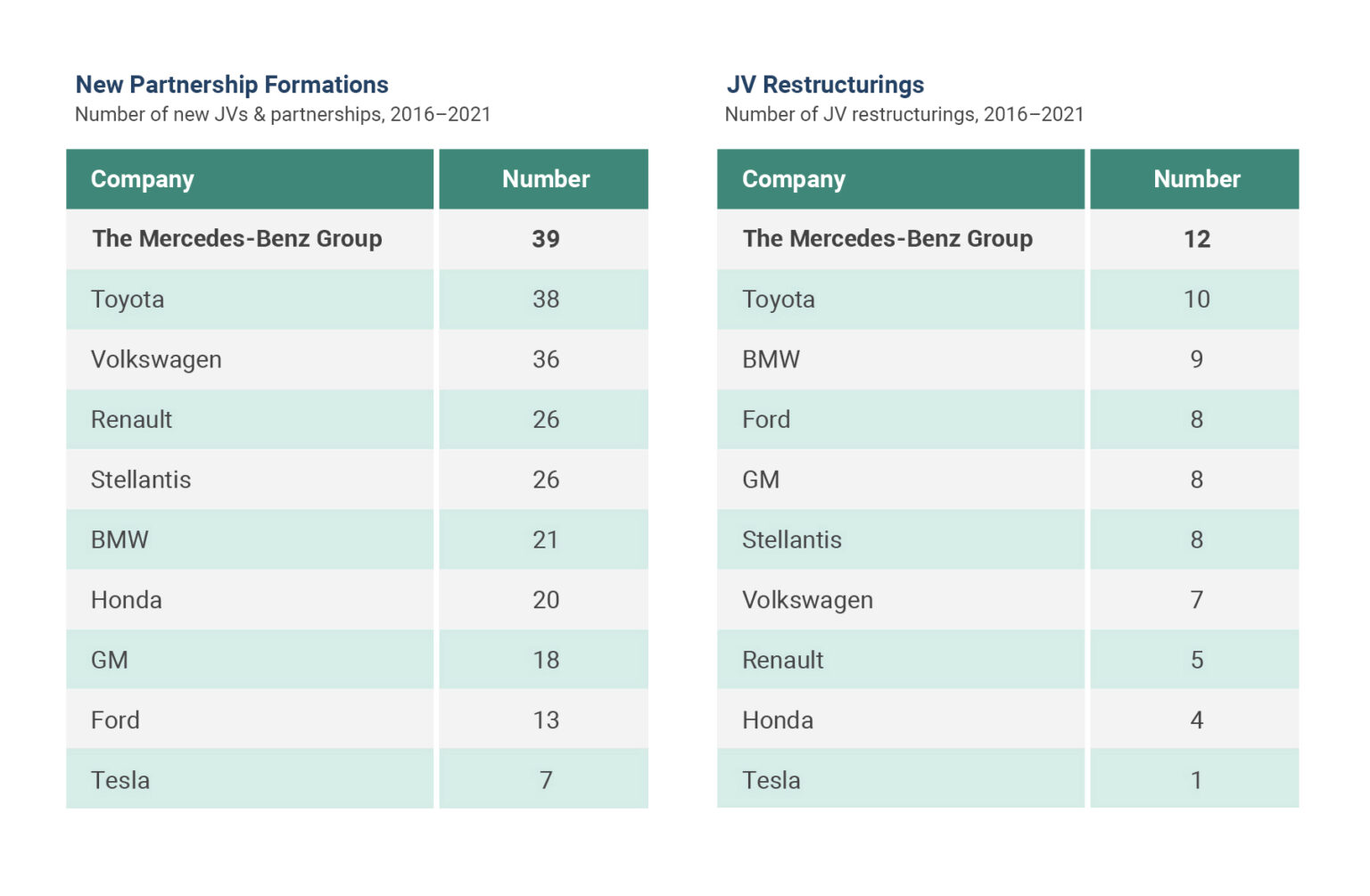

Among 10 leading automotive OEMs, Daimler (now the Mercedes-Benz Group) was the most active partnership maker by absolute volume of new JVs and partnerships in the last five years, with 39 new JVs and partnerships established (Exhibit 2). Toyota and Volkswagen followed closely behind, with 38 and 36 new JVs and partnerships, respectively. Daimler also led by absolute volumes of restructurings, with 12 of its ventures restructured over the last five years. Over the last 12 months, however, General Motors was the most active maker, and Stellantis the most active shaker.

The Stock Market’s Reaction

The stock markets reacted positively to JV and partnership activity by industry players – both for new deal announcements and restructurings.

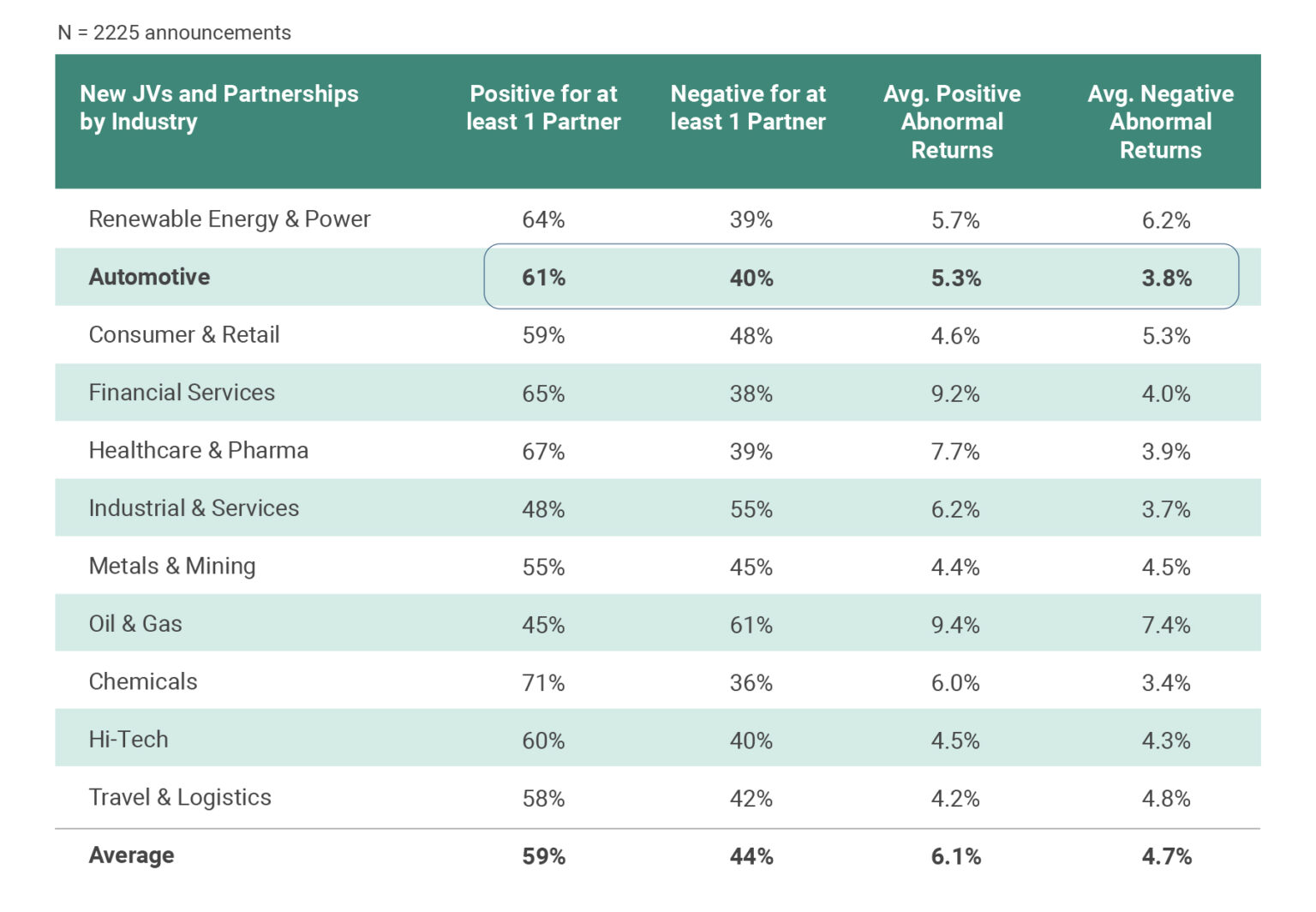

Of the announcements for new deals since 2016 with a statistically significant stock price impact in our data, 61% had a positive impact on at least one partner’s share price, and 40% had a negative impact (Exhibit 3)[2]See “How Stock Markets React to Partnership Announcements – And What to Do About It,” Lois Fernandes, Saadhika Sivakumar, and James Bamford, The Joint Venture Alchemist, June 2022. Average positive abnormal returns were 5.3%, and average negative abnormal returns -3.8%. General Motors’ new partnerships with General Electric in rare earth material supply chains, POSCO in electric vehicle battery materials, and Pure Watercraft in electric boats, for example, were all cheered by the markets – and each generated positive abnormal share price returns for GM greater than 4%.

Exhibit 3: Stock Market Impact – Industry Comparison

Source: Ankura JV and Partnership Transactions Database; S&P Capital IQ; Factiva; Ankura Analysis

© Ankura. All Rights Reserved.

Of the announcements for restructurings since 2016 with a statistically significant stock price impact, 72% had a positive impact on at least one partner’s share price, and 31% had a negative impact. Average positive abnormal returns and average negative abnormal returns were 4.5%. The stock markets, for instance, cheered multiple restructurings involving Daimler (now the Mercedes-Benz Group). The company’s expansion of its partnership with CATL for the development of truck-specific advanced batteries and unwinding of Your Now, its mobility services partnership with BMW, gave the company 3-5% in positive abnormal share price returns each.

The stock market’s reaction to JVs and partnerships in the automotive industry compared favorably to all other industries. Fifty-nine percent of announcements for new deals across all industries had a positive impact, and 44% had a negative impact. Cross-industry average positive and negative returns for new deals were, respectively, 6.1% and 4.7%.

Similarly, across all industries, 60% of restructurings had a positive impact, and 44% had a negative impact. Cross-industry average positive and negative abnormal returns for restructurings were, respectively, 5.1% and 4.6%.

Looking Ahead

New joint ventures and partnerships will continue to power the future of the automotive industry. There is no better time than now for industry players to hone their capability at the front-end of deal making to – both, creatively and efficiently – originate, screen, shape and close deals.

At the same time, a still evolving industry landscape, performance challenges, and competing priorities will continue to exert pressure on the joint ventures and partnerships that exist. There is no greater urgency than this to encourage industry players to actively govern and proactively restructure or exit their JVs and partnerships.

Comments