JUNE 2022 — HYDROGEN IS THE MOST abundant element in the universe, comprising roughly 75% of all matter. It burns cleanly and could help decarbonize steel, cement, fertilizers, shipping, and other fossil-fuel intensive industries. As a green fuel, it’s possible to produce without generating CO2 emissions. And it’s a mobile form of large-scale energy storage, offering an alternative to lithium batteries that could allow renewable energy to be used far from where it’s produced.

More than 30 countries have announced strategies to promote the adoption of hydrogen, pairing $40 billion in potential subsidies with promised regulatory shifts to promote, encourage, and cajole adoption. Companies have responded with more than $300 billion in promised investments across all the “colors” of hydrogen, but green hydrogen is the holy grail.[1]Different forms of hydrogen production are referred to by different colors. Gray hydrogen is the traditional method used by industry and releases CO2, while blue hydrogen takes the gray process and … Continue reading

Green hydrogen is also a technology and market in its infancy. Like the early days of wind and solar, it’s wildly expensive – up to 16 times more expensive now than gray hydrogen.[2]Analysis from the International Energy Agency as of 2019 It faces an uncertain battle to reach cost parity and convince companies to move forward with investing that depends on a combination of technology maturity, cost reductions, and regulatory subsidies.

To realize its potential, companies will need all sorts of partnerships. This article examines the drivers and patterns behind partnering in green hydrogen and shares key questions and challenges for companies looking to succeed.

References

Enter your information to view the rest of this post.

"*" indicates required fields

PARTNERSHIP DRIVERS

Five years ago, green hydrogen barely registered, but as companies and governments seized on a 2050 target date for zero carbon emissions, green hydrogen emerged as an alluring path to cut global emissions by a third.

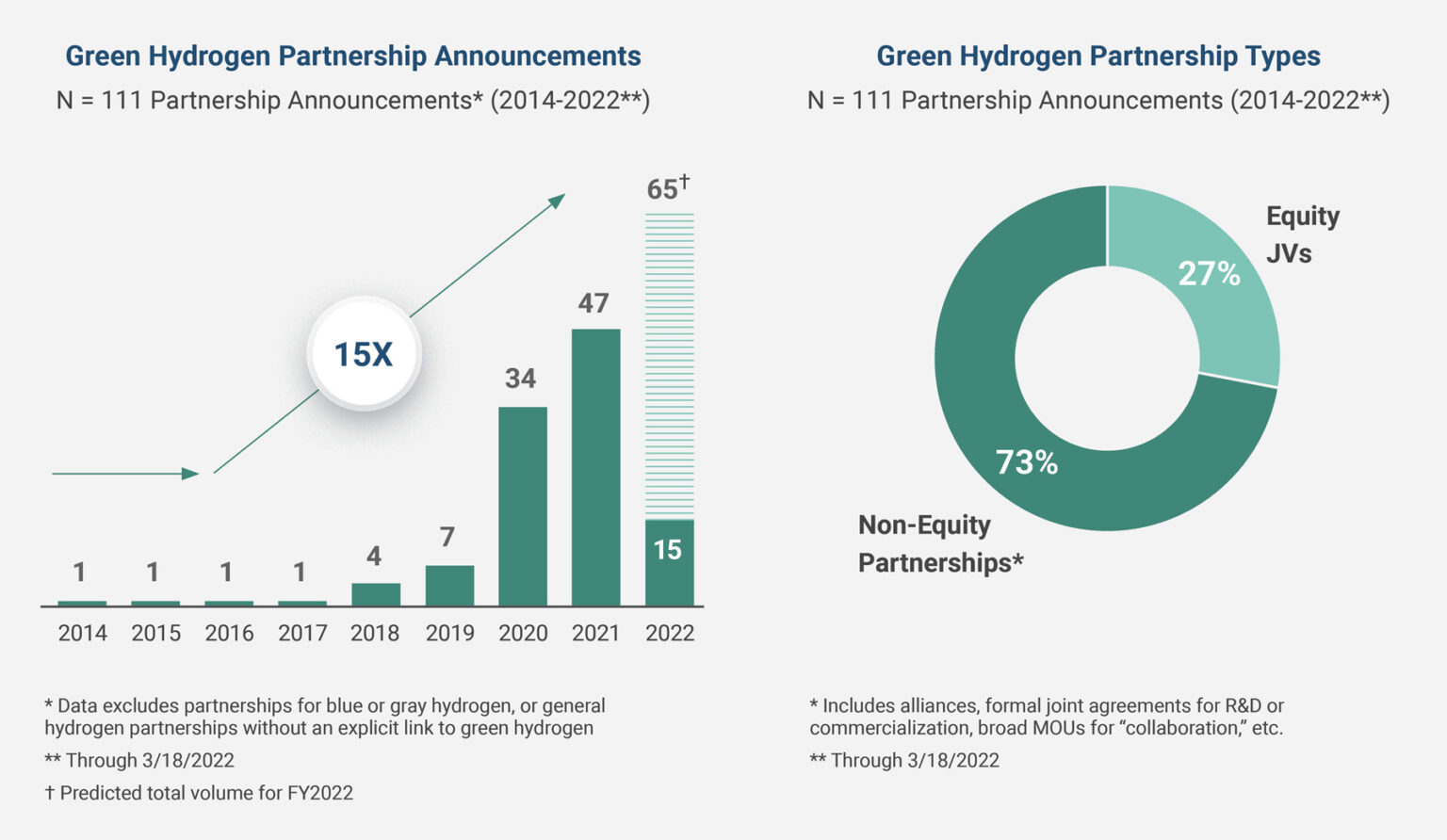

Given the uncertain economics in the face of billions of investment capital needed to build out the green hydrogen value chain – including developing renewable energy, creating factories for electrolyzers (which split water into hydrogen and oxygen), constructing hydrogen production facilities, developing transportation infrastructure, and converting end users to utilize hydrogen – companies immediately turned to partnerships to share costs and risks. And with promises growing of investment dollars into green hydrogen, annual new partnership announcements tied to green hydrogen also grew – to 47 in 2021, with announcements for 2022 in Ankura’s database set to exceed that pace (Exhibit 1).

Exhibit 1: Green Hydrogen Partnerships

© Ankura. All Rights Reserved.

Risk and cost-sharing aren’t the only things driving partnering. Other reasons to collaborate in green hydrogen include:

- Demand Stimulation: By partnering with industry (e.g., steel, fertilizer, fuel cell providers, etc.), companies can lock in guaranteed offtake for green hydrogen production, reducing the economic uncertainty of capital investment.

- Scale and Cost Improvement: Partnerships can help to grow the business, scale green hydrogen technology, and reduce overall costs – especially in renewable energy, since green hydrogen’s success requires access to low-cost clean energy.

- Access to Delivery Infrastructure: If not utilized where produced, green hydrogen needs to be transported. Partnerships allow producers to leverage existing infrastructure with some modification, at costs significantly less than building from scratch.

- Policy Coordination: With green hydrogen emerging as a value chain all at once, partnerships are a way to encourage deliberate coordination among partners, investors, policymakers, and other stakeholders to favorably shape the market and its regulatory framework.

- Optionality: Given the uncertainty around green hydrogen, partnerships allow companies to place multiple bets on different geographies, technologies, and use cases, raising the probability of access to a market-winning solution. The value of optionality likely explains why many partnerships in Exhibit 1 are looser collaborations that can evolve into JVs as markets crystalize.

PARTNERSHIP PATTERNS AND TRENDS

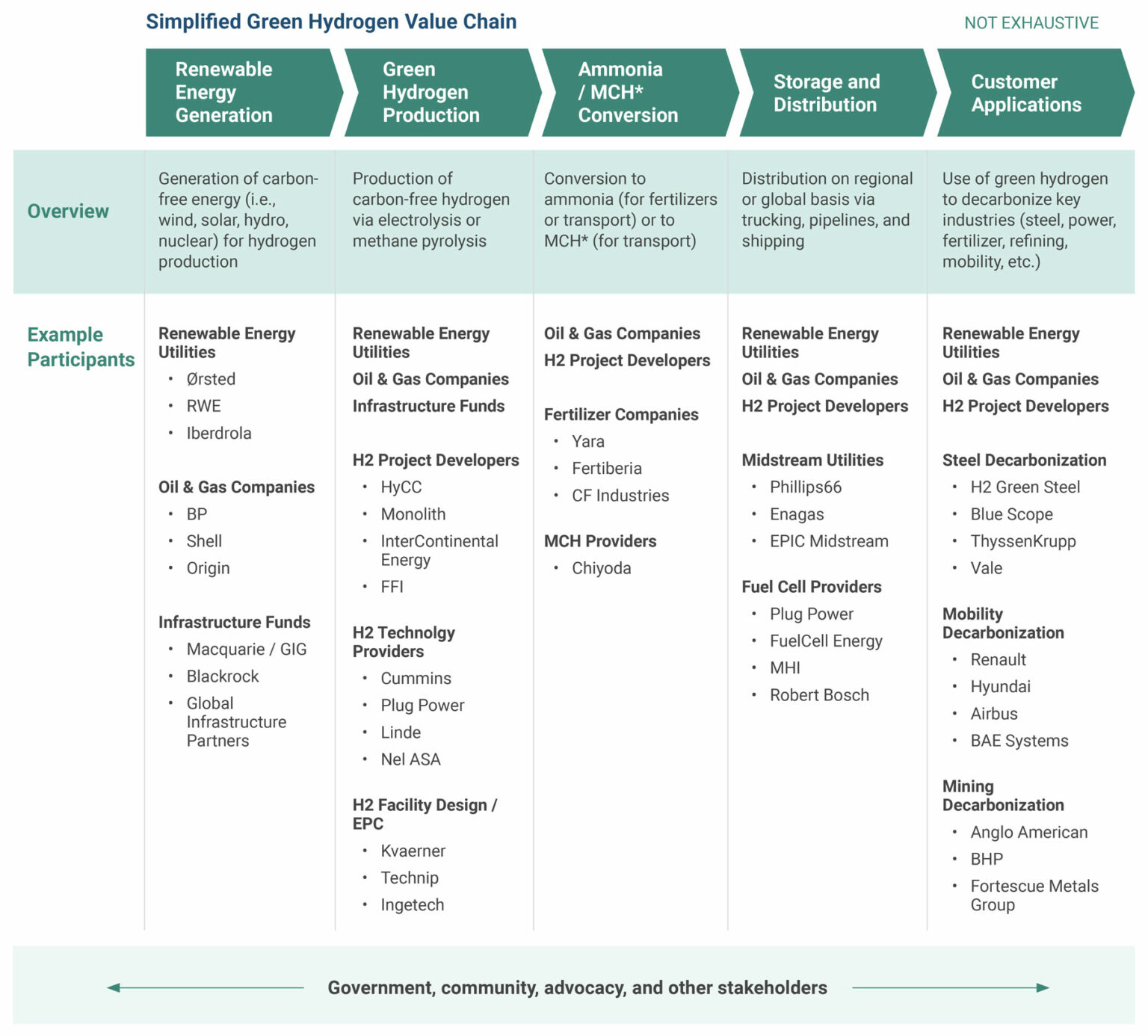

As the volume of green hydrogen partnerships grows, a common set of participants are emerging (Exhibit 2). Renewable energy utilities, oil and gas companies (who are seeking to diversify into “energy companies”), and pure-play green hydrogen project developers find themselves partnering at essentially every step of the value chain, seeking to bring the entire industry into existence in parallel. They’re joined by technology providers, who offer the engineering and equipment to generate green hydrogen and use it as a fuel; infrastructure partners, who enable it to be shipped; and customers, who can apply it to decarbonize their own business, from steel to mining to mobility (including aircraft, locomotives, and vehicles).

Exhibit 2: Emerging Value Chain Collaborators

*Methlycyclohexane

Source: Ankura

© Ankura. All Rights Reserved.

Despite common participants, the partnering looks very different depending on where companies primarily reside in the value chain. Those that view industrial-scale green hydrogen production as a core strategic objective are partnering differently than players who view green hydrogen as an enabler for their broader business.

Industrial-Scale Hydrogen Production

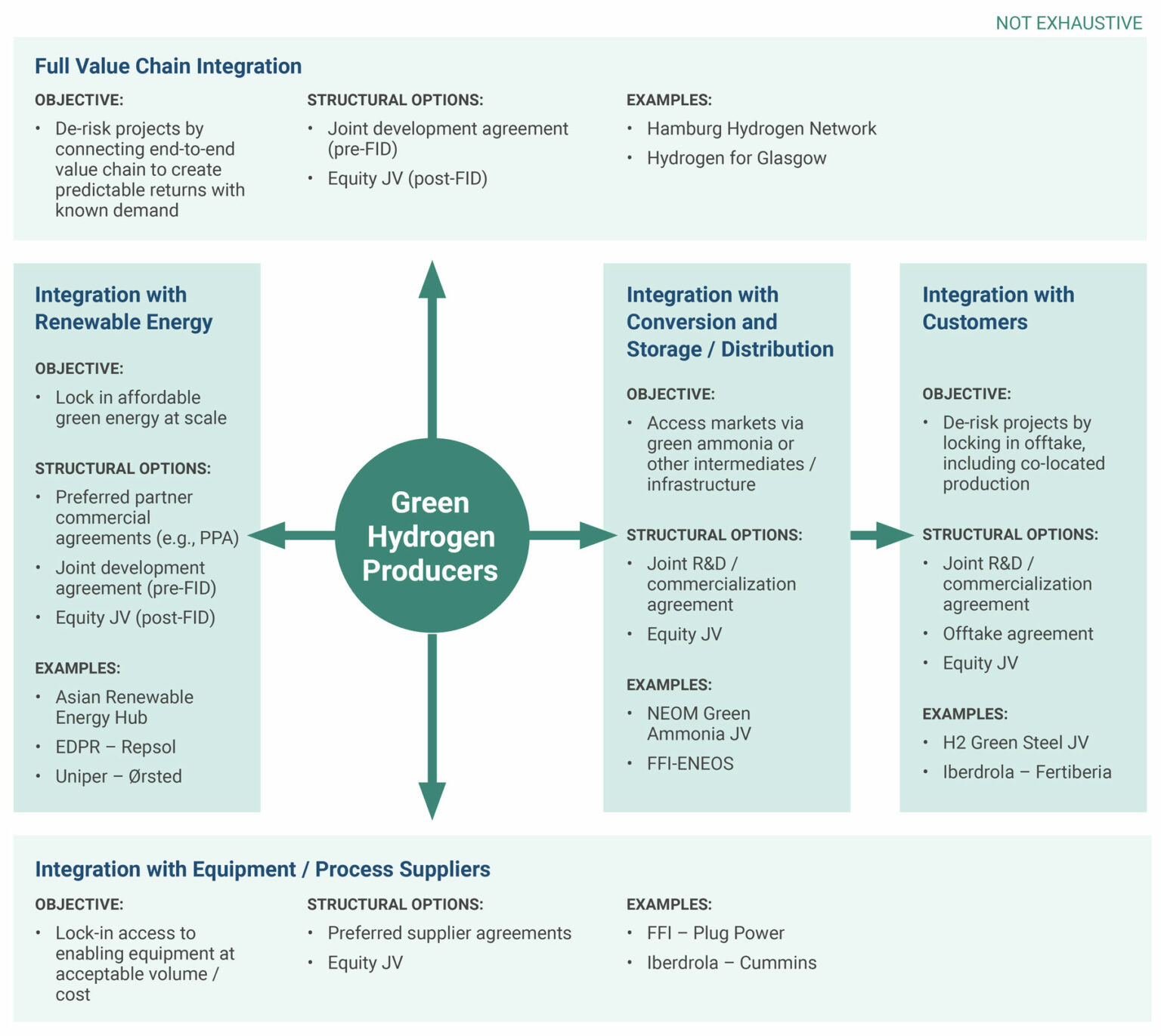

Despite a handful of partnerships focused solely on funding, building, and operating a production plant, most companies focused on industrial-scale hydrogen production are being pulled to partner across the entire value chain, driving a significant share of new green hydrogen partnerships (Exhibit 3):

Exhibit 3: Partnering Pressure on Green Hydrogen

Source: Ankura

© Ankura. All Rights Reserved

- Backward – Integrating with Renewable Energy: With renewable energy the foundational input – and cost – to green hydrogen, producers are partnering to secure affordable renewable energy at scale. This ranges from arms-length commercial arrangements locking in volumes and pricing under a PPA, to JVs where renewable providers take an equity stake in a green hydrogen production facility and provide green energy at advantaged pricing, to JVs that develop, operate, and maintain integrated renewable energy and green hydrogen production facilities.

One of the largest and most advanced examples of the latter is the Asian Renewable Energy Hub in Western Australia between BP, InterContinental Energy, CWP Global, Vestas and Pathway Investments (plus local indigenous groups and energy research institutes) to generate 26GW of renewable power for 1.8 million tons of green hydrogen and 10 million tons of green ammonia annually.

As an intermediate step before committing to a specific project, hydrogen producers are entering into joint development agreements with green energy companies to explore a slate of specific opportunities or forming broad alliances with them to investigate all future opportunities as they arise. In the UAE, renewable energy and green hydrogen producers have gone further and consolidated their activities into Masdar, turning it into a 3-way JV (43% ADNOC, 33% Mubadala, 24% TAQA) that plans to drive a single coordinated approach to UAE’s domestic hydrogen projects as well as global partnerships for green hydrogen production. - Down – Integrating with Equipment / Process Suppliers: Affordable green hydrogen production is also dependent on access to electrolyzers (or alternative technology like methane pyrolysis) at an acceptable cost and scale, leading green hydrogen producers to partner with equipment and process suppliers to guarantee access to equipment and gain cost improvement

from scale.

At the simplest level, green hydrogen producers are forming “preferred supplier” alliances with electrolyzer providers to lock in volumes and pricing and influence technical design specifications, and pairing up with preferred EPC partners to standardize a scalable approach to plant design. Some green hydrogen producers are extending this to include taking equity stakes in the equipment supply chain in return for guaranteed electrolyzer access, including Fortescue Future Industries’ electrolyzer gigafactory JV in Australia with Plug Power, and Sinopec’s with Cummins in China. At the most integrated, green hydrogen producers are bringing equipment suppliers in as equity partners, giving them a stake in production volumes to incentivize the performance and delivery of their electrolyzers (and spreading the capital risk as well). - Forward – Integrating with Conversion and Storage / Distribution: A major challenge for green hydrogen is that the lowest cost locations for generating green energy (i.e., places like Morocco, Oman, Western Australia, etc.) and co-locating production plants tend to be far from eventual hydrogen users, requiring a shipping solution. One option is to expand the lens of being a green hydrogen producer to mean being a green ammonia producer, allowing companies to leverage the existing ammonia supply chain, as Air Products, ACWA Power, and NEOM did with their $5b green ammonia JV in Saudi Arabia and Norwegian energy company Scatec did with its $5b green ammonia partnership with the Egyptian government.

Alternately, green hydrogen producers are partnering to stimulate development of a transportation infrastructure for green hydrogen, like converting it to methylcyclohexane (MCH) for long-distance transport. They’re also de-risking the path to market by bringing in storage and transportation providers as partners in production plants to drive development of green hydrogen pipelines, as is the case with EPIC Midstream in the Corpus Christi green hydrogen hub (alongside Apex Clean Energy and Ares Management). - Further Forward – Integrating with Customers: As an alternative to developing transportation infrastructure, some green hydrogen producers are partnering with customers to integrate production plants on their sites. For example, Iberdrola has formed a 50:50 JV with H2 Green Steel to build a $2.6b green hydrogen production plant co-located with a steel plant, while TotalEnergies and Engie are partnering on a green hydrogen production plant to feed a co-located biorefinery.

Green hydrogen producers are also partnering broadly with potential end users to stimulate market demand and de-risk projects. This ranges from joint research and development on the potential to decarbonize industries to broader sector collaborations like the H2Accelerate partnership between Shell, Linde, Daimler, Iveco, OMV, Volvo, and TotalEnergies that brings together hydrogen producers, infrastructure operators, and vehicle manufacturers to drive and coordinate development of a European market for green hydrogen-fueled long-haul trucking. - Full Value Chain Integration: In some cases, green hydrogen producers are forming an end-to-end collaboration that solves for the entire value chain. Multiple regional green hydrogen hubs are emerging to minimize infrastructure costs by consolidating renewable energy generation, green hydrogen production, and offtake at commercial scale amongst many local industrial partners. Many of these hubs also pair with local, regional, and national governments to promote cross-industry coordination, cut through bureaucratic red tape, and tap into government subsidies.

Other Players

Other players in the value chain see the partnering landscape differently:

- Electrolyzer and fuel cell manufacturers are also partnering across the value chain, not because they want to be green hydrogen producers, but to sell equipment. Companies like Plug Power and Cummins are building a global ecosystem of partnerships (1) with peers, to improve R&D, create scalable solutions, and consolidate activities, and (2) with their customers, to lock in demand, including through selective equity stakes in hydrogen production projects – not to supplant pure-play green hydrogen developers, but to creatively stimulate and benefit from greater volumes of electrolyzer or fuel cell production.

- Users of green hydrogen are partnering in a more limited fashion across the value chain. Industrial-scale users in steel, cement, mining, and fertilizers are looking for guaranteed access to green hydrogen before committing to decarbonize their business, and are willing to take equity stakes in co-located projects that exclusively benefit their business – but are more likely to be an arms-length offtaker, and not equity partner, in global megaprojects that serve multiple customers. Similarly, mobility partners – especially automotive companies like Renault and Hyundai – are willing to join partnerships to access fuel cells and promote the creation of regional hydrogen fueling networks but are not (yet) pairing up with industrial-scale production projects and their associated infrastructure.

KEY QUESTIONS AND CHALLENGES FOR COMPANIES

With green hydrogen partnering on the rise, companies that can identify, negotiate, and structure partnerships more effectively than their peers are likely to have a competitive advantage in the green hydrogen economy. Having served companies across the emerging green hydrogen value chain, we believe they need solid answers to the following:

- What’s our overall strategy for using partnerships? If partnering in a mature, stable industry is checkers, then doing so in green hydrogen is 3-dimensional chess. Faced with essentially limitless options for partnering across the entirety of the value chain, companies need to bring order to chaos with a clear articulation of how partnerships will collectively enable their green hydrogen strategy. For companies that are just getting started, they might choose to build a gameboard that maps partner types relative to the value chain and highlights potential counterparties in the areas of greatest strategic need. This approach helps companies think holistically about their partnerships and make thoughtful trade-offs, rather than approaching them in isolation.[1]For more on thinking through where and how to collaborate, see “Alliances: Getting Non-Equity Collaboration Right,” James Bamford, Joshua Kwicinski, and David Ernst, The JV Alchemist, June 2016

- Where do we need to be in control? Related to the overall strategy question is being able to articulate as a company where in the green hydrogen value chain, and why, you seek control. This is essential guidance for deal teams as they begin to narrow down the range of potential deals, partners, transaction structures (e.g., where companies seek control to lock in a competitive advantage, they may be less inclined to choose equity JVs if non-equity collaborations could achieve similar benefits), and investment horizons (e.g., companies should be thoughtful about where they seek to be involved as a long-term owner/operator and where they want to play a developer role to realize projects before bowing out to redeploy capital).[2]For more on thinking through control rights in the context of deal structuring, see “JV Ownership and Control Blueprints,” Gerard Baynham and James Bamford, The JV Alchemist, February 2012, and … Continue reading

- How do we manage a diverse and unusual pool of partners? As companies think about where they want to be in control, they’ll need to be deliberate about partnering with an unfamiliar cast of potential competitors, with renewable energy producers, traditional oil and gas companies, technology and process providers, and others who are all seeking equity positions in green hydrogen production. One potential solution is to identify preferred strategic partners and develop a modular approach with them, including as co-project developers or in a preferred supplier model. This reduces the complexity of finding and managing multiple new partners per deal, shortens transaction times by leveraging a common starting point, and de-risks the potential for misalignment amongst strangers-turned-collaborators.[3]See “Managing Global Strategic Partners: In Isolation No More,” James Bamford and Cassandra Tillinghast, The JV Alchemist, May 2015

Notably, companies may need to find their footing in dealing with an unusual partner: regional, national, and supranational governments that are taking an increasingly active role in the green hydrogen economy, including playing matchmaker to catalyze partnerships, and offering direct funding in return for equity and governance rights (when not outright creating government-to-government joint ventures). Companies need to be aware of this increasingly aggressive posture and to think through the implications of a government having a seat on the JV Board. - Are there lessons to apply from other sectors? Wind, solar, and other forms of renewable energy have all followed a relatively similar trajectory of reducing costs over time. For green hydrogen to similarly improve, dealmakers should look for patterns to replicate. At least one study suggests that the solar industry, for example, has six factors that each accounted for more than a 10% reduction in costs, leading to an overall cost decline of 97% for solar modules from 1980 to 2012 (offering a potential roadmap for green hydrogen equipment).[4]This study showed R&D was the dominant cause of solar cost decline in early years, with economies of scale only surpassing it years later – suggesting R&D collaboration on key equipment … Continue reading

Similarly, green hydrogen’s value chain is somewhat akin to natural gas, which prefers to extract gas in areas with lower costs of operation, convert to LNG for global shipment, and then re-gasify at the destination for use. This sector is full of JVs where partners have worked through collaborating as competitors, generating scale benefits, managing marketing and distribution of molecules, and building infrastructure that serves owners directly plus third-parties on a tolling basis – all of which may offer useful lessons to the emerging green hydrogen economy.

~~~

Look into the portfolio of companies investing in green hydrogen today, and you’ll inevitably find partnerships. Given the capital involved, the technological and market uncertainty, and the inherent risks of a frontier market, partnerships have emerged as a foundational tool for dealmakers. To paraphrase an adage, if you want to go fast, go alone – but if you want to go far in green hydrogen, go together. Has your company thoughtfully planned how to do it?