JVs and Partnerships Continued on a Tear in the Second Quarter

Ankura Joint Venture Index®: Second Quarter 2022

Tracy Branding Pyle is a Managing Director at Ankura who specializes in helping organizations navigate complex transactions, and, in particular, joint venture-related transactions. She works with a wide array of U.S. and international companies across industries to help them structure, negotiate, approve, and launch joint ventures to set these ventures up for success. She additionally advises on governance of individual joint ventures and portfolios of joint ventures to help companies to minimize risk, increase efficiencies, and find value. Prior to joining Ankura, Tracy practiced law at Hogan Lovells, where she advised clients on joint ventures, public and private mergers and acquisitions, and corporate governance matters. Tracy is based in Washington, DC.

View Full Profile

Ankura Joint Venture Index®: Second Quarter 2022

Companies are under intense pressure to improve their environmental, social, and governance (ESG) performance.

The many commercial relationships between a JV and its parents can cause JV partners to butt heads. Here’s our advice on how you can design these relationships to keep the peace.

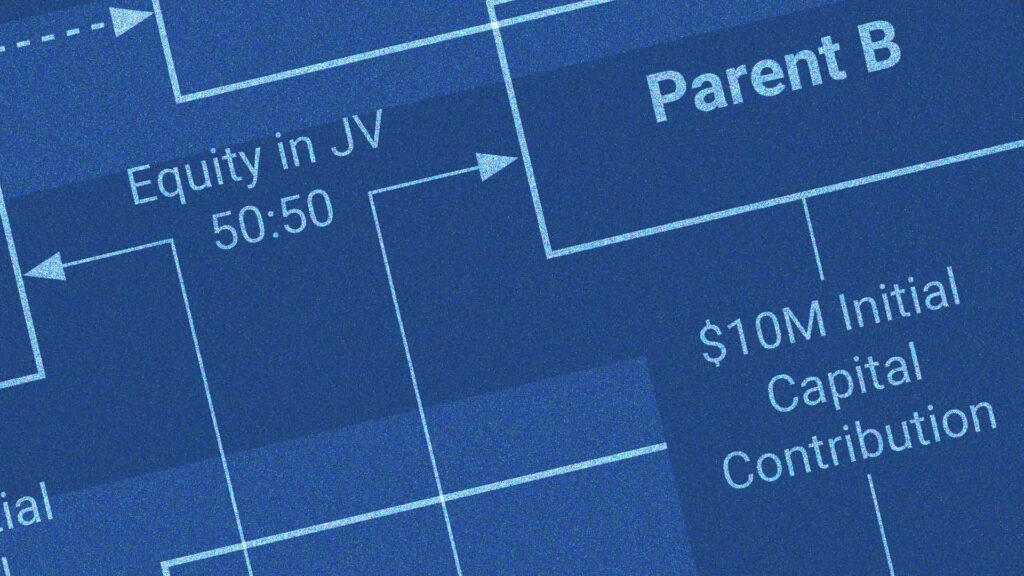

Practical guidance on structuring a critical provision in a JV agreement

Ankura analyzed how long JVs last and how JVs terminate using a sample of 537 material JVs. We benchmarked JV lifespans and how lifespans vary by industry, region, number of partners, and disposition approach.