Joint Ventures in a Down Market

Using JVs to drive financial objectives in the current economic environment.

JUNE 2022 — Companies have been making, shaking, and breaking JVs and other partnerships at unprecedented rates [1]See: “Ankura JV Index: 2021 Year in Review,” Shishir Bhargava and James Bamford, and “Partnership Makers and Shakers,” Ankura Whitepaper, June 1, 2022.. But what do stock markets think? Are investors reacting consistently well to announcements – or do certain venture types, deal structures, or industries tend to garner a more positive reaction than others? Has the market’s reaction been steady over time, or has it been changing in the last few years? Most important, are markets good predictors of success, and what can companies practically do to generate a dependably better stock market response?

To find out, we analyzed investor reactions to more than 2,200 partnership announcements. Our analysis spanned multiple industries, geographies, and transaction structures, including joint ventures, strategic minority equity investments, and non-equity alliances. Our methodology calculated the abnormal return in the days surrounding each announcement – that is, the change in share price not attributable to other market movements (See Box: About Our Methodology).

Below we share insights from this analysis and perspectives on what companies can do to enhance how investors respond to partnership announcements.

"*" indicates required fields

Roughly one-third of all material partnership announcements involving public companies triggered a statistically significant stock price impact for at least one partner. In nearly 60% of the cases, the impact was positive, with an average share price increase of almost 6%.

Below the headline, we found other interesting patterns.

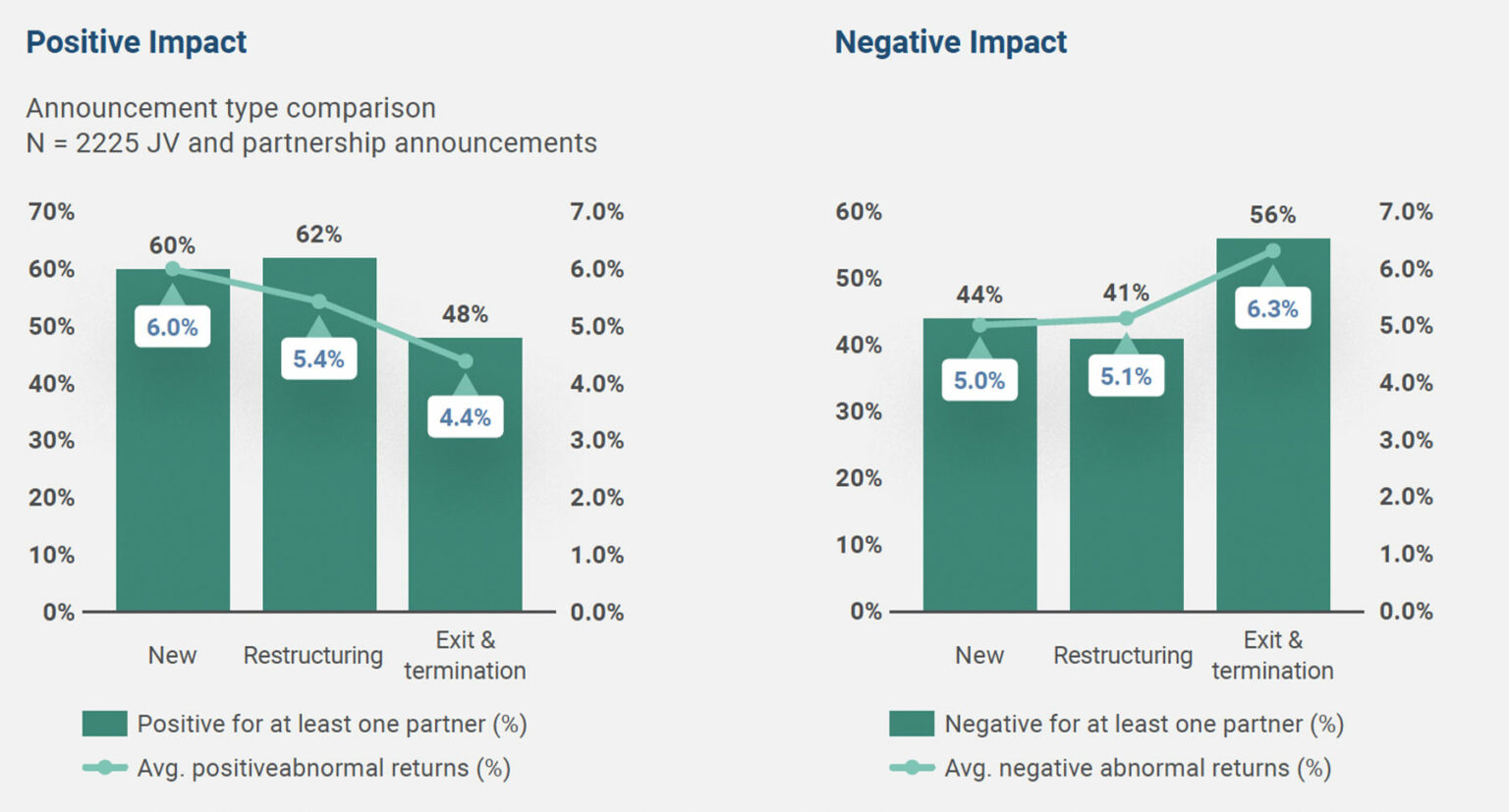

Overall, investors reacted more positively to announcements of new venture formations and to restructurings than to exits and terminations (Exhibit 1). For example, the markets cheered when General Motors announced new partnerships with General Electric in rare earth material supply chains, POSCO in electric vehicle battery materials, and Pure Watercraft in electric boats – all of which generated abnormal share price returns greater than 4%. Similarly, Walgreens Boots’ expansion of an existing partnership with VillageMD, through an additional investment to accelerate the opening of primary care practices co-located within Walgreens’ pharmacies, bumped its share price up by 7%.

Source: Ankura JV & Partnership Transactions Database

© Ankura. All Rights Reserved

Investors were fickler with full venture exits and terminations. Of the exit and termination events that showed abnormal returns, some 56% recorded negative returns, with the average negative return causing a share price drop of 6.3%. Our analysis showed that not every exit event was treated equally by the markets. Partner buyouts and third-party sales were more likely to receive a positive reaction from the markets. But liquidations/dissolutions and sales to partners were more likely to be viewed negatively as these types of exits likely signal failure or the foreclosure of an opportunity.

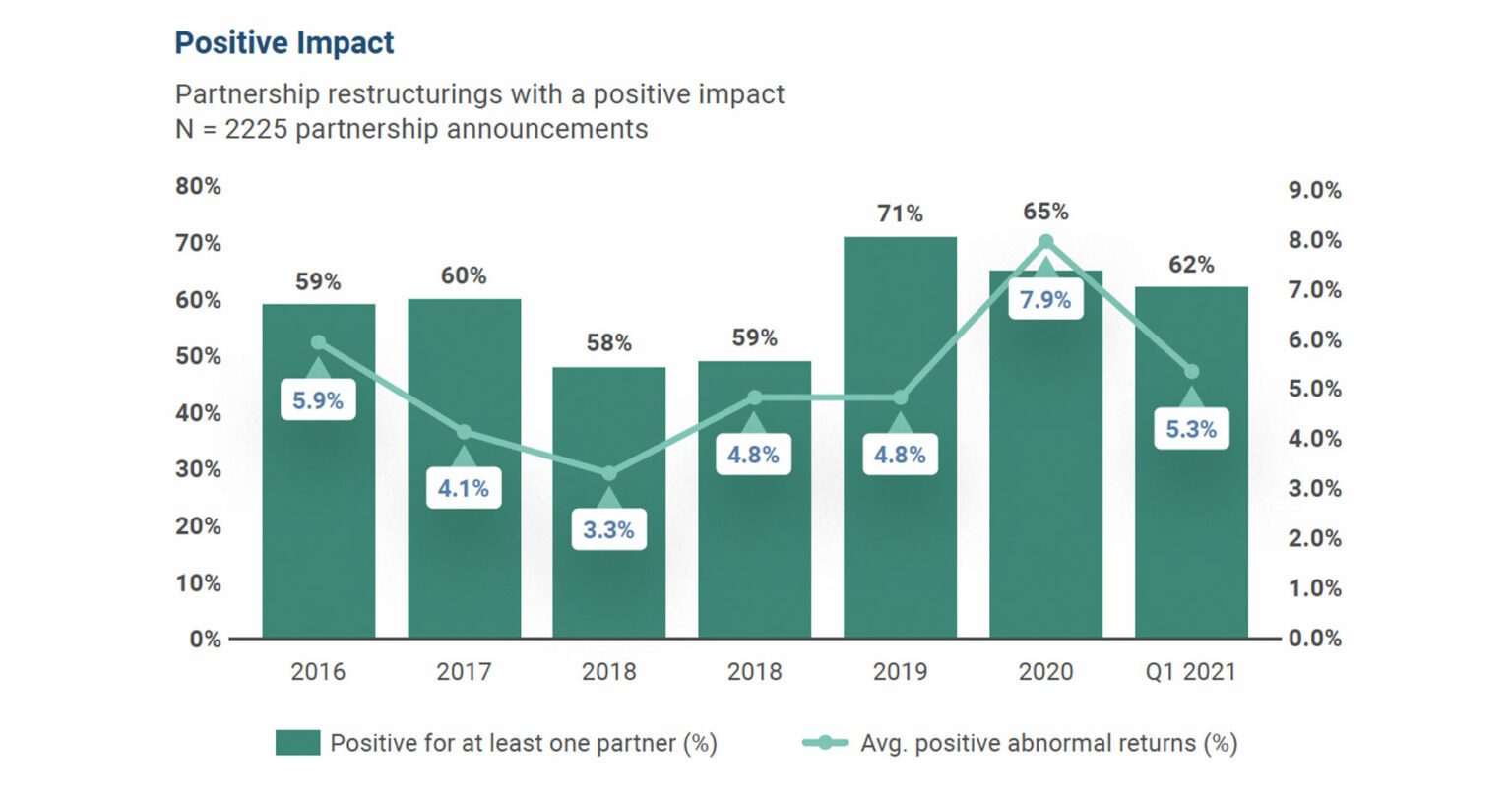

Overall, markets have not fundamentally changed how they react to partnerships over the last six years – though there have been some notable spikes, dips, and sub-plots based on transaction types. For instance, the percent of new deals that received positive abnormal returns has remained consistent but the magnitude of abnormal returns has been trending downward – and is now around 4.0% compared to the highs of 10.1% in 2019.

Conversely, the markets have become increasingly enthusiastic about restructurings – that is, material changes to a venture’s scope, ownership, governance, or operating model (Exhibit 2).

Source: Ankura JV & Partnership Transactions Database; S&P Capital IQ; Factiva; Ankura Analysis

© Ankura. All Rights Reserved

In the last few years, we have seen a sharp rise in the number of JVs that have IPO-ed.[1]For additional examples, please see, “The Ankura JV Index: 2021 Year in Review.” For an earlier analysis of how to position a JV to IPO, please see, “When and How to Take a JV Public: The IPO … Continue reading As expected, markets have loved this type of restructuring. For example, the share price of US electric power company AES jumped 4% when the company’s industrial-scale energy storage JV, Fluence, publicly listed on Nasdaq. But markets have reacted positively to other types of restructurings. For instance, the share price of German automaker Daimler climbed 4% when it announced the expansion of its battery supply partnership with China’s Contemporary Amperex Technology (CATL) into the joint design and development of sophisticated batteries for trucks. This trend has drawn back slightly in the first quarter of this year, though it is too early to see this as a real trend.

Meanwhile, the markets have recently turned negative on exits and terminations. For example, GSK’s share price declined by 6% in 2021 when its partner in China, Clover Biopharmaceuticals, ended their COVID-19 vaccine partnership. Similarly, General Mills’ share price fell 4% last year in response to the stake-swap termination of its Yoplait yogurt JVs in Europe and Canada with dairy cooperative Sodiaal. In general, exits and terminations have had less frequent and lower positive returns and more frequent and larger negative returns in 2020 and 2021 compared to historical norms.

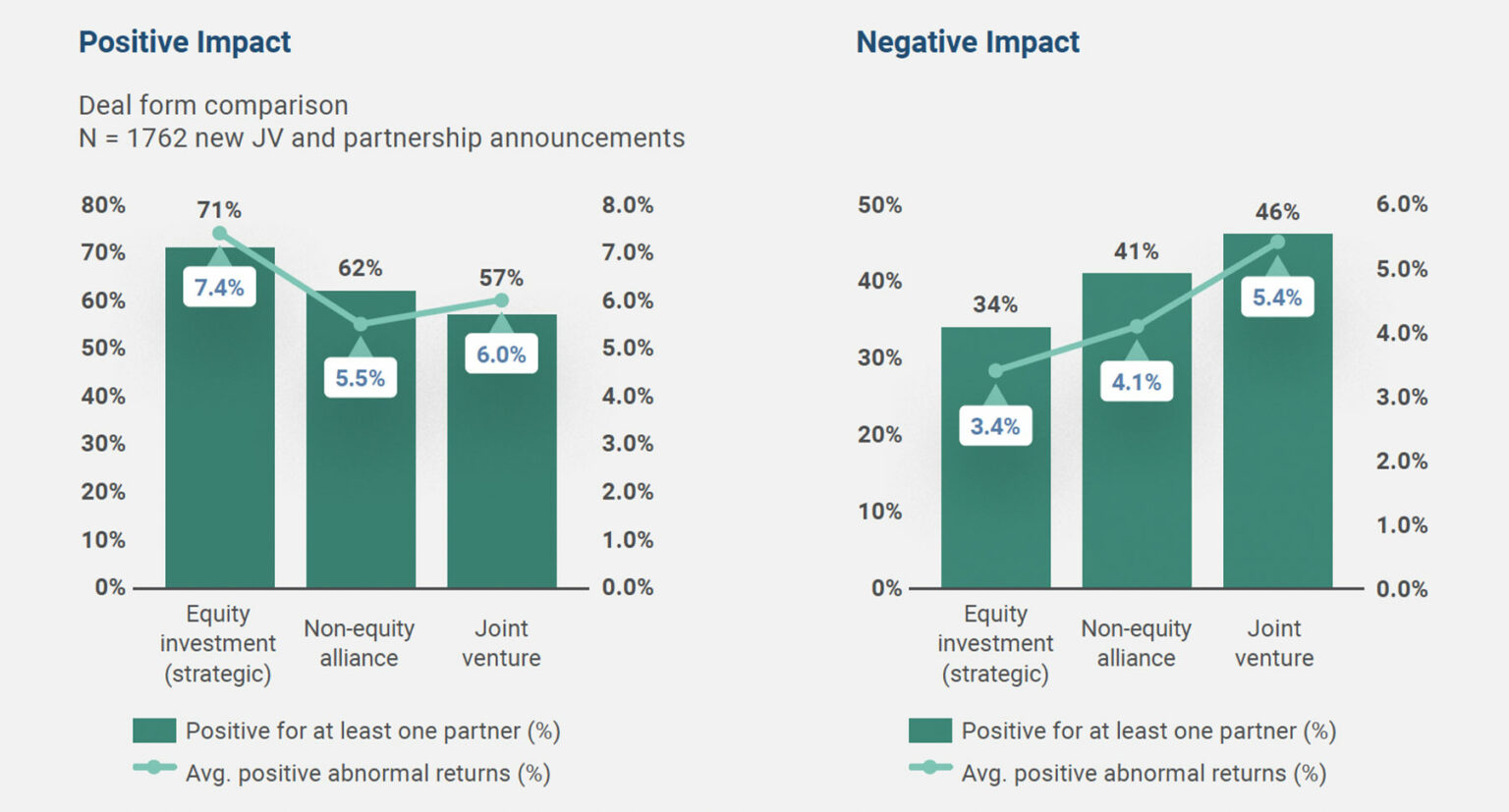

The stock market reacted more positively to strategic equity investments (i.e., a minority stake backed by a contractual alliance) and non-equity alliances – and less well to joint ventures in which the partners established a separate legal entity (Exhibit 3).

Source: Ankura JV & Partnership Transactions Database; S&P Capital IQ; Factiva; Ankura Analysis

© Ankura. All Rights Reserved

For example, tire manufacturer Goodyear’s direct equity investment in autonomous technology company Gatik, and partnership to develop mobility solutions for the autonomous B2B short-haul logistics industry, gave Goodyear a 4% jump in its share price. Similarly, Ford’s non-equity alliance with chip maker GlobalFoundries to bolster its supply of semiconductors gave its share price a 6% boost. And Apple’s buy now, pay later partnership with Goldman Sachs pushed its share price 2% higher.

But what explains the less favorable reaction to joint ventures? Our interpretation is that investors see joint ventures as less flexible – i.e., harder to change, more prone to disputes, and tougher to exit – than non-equity alliances or direct investments. As a result, markets are placing a premium on alternative deal structures that preserve flexibility in fast-moving and uncertain markets where partnerships are often most needed. Of course, those alternative structures may not be available in some situations, and joint ventures can be structured to include flexibility.[2]See, for instance, “Agreeing to Disagree: Structuring Future Capital Investment Provisions in Joint Ventures,” Edgar Elliott, Lois D’Costa Fernandes, and James Bamford, Journal of World Energy … Continue reading

Stock markets play favorites in other ways. Larger deals moved the markets more than smaller ones. Consolidation-style JVs that combined existing partner businesses were viewed more positively than partnerships that brought together complementary capabilities to build a new business. Meanwhile, markets viewed bilateral deals more positively than multi-partner ones, with higher average share price increases and lower decreases. In our experience, if multilateral ventures get off the ground, they tend to have longer lifespans but confront disproportionately greater struggles to successfully evolve and grow compared to two-partner deals.

The markets also reacted more enthusiastically to controlling positions. Controlling shareholders (by ownership and voting interest) were more likely to experience a share price lift than those either sharing control with their partners or holding noncontrolling interests. The market’s enthusiasm for control is understandable. Shared control situations are prone to deadlocked decisions. And while non-controlling interests could hold important levers to exert influence and soft control, these are not always apparent from the outside.

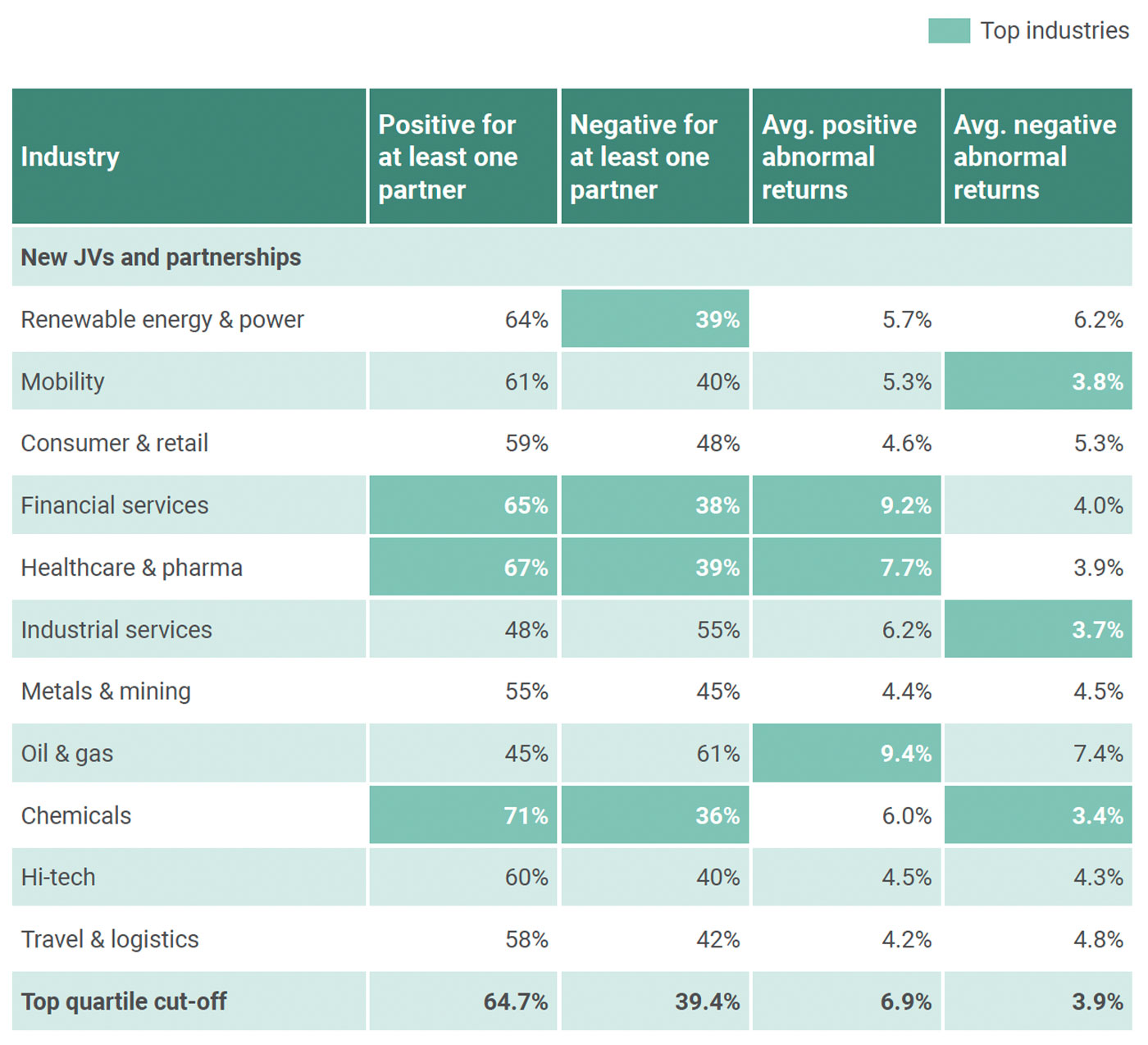

From an industry standpoint, the chemicals industry was the top performer among the industries we looked at – and performed well in new deal formations (Exhibit 4), as well as in restructurings and exits. Healthcare and pharmaceuticals and financial services were also fairly strong, although less consistently so than chemicals. The oil and gas sector was the poorest performer – and especially bad on new venture formations and restructurings.

Source: Ankura JV & Partnership Transactions Database; S&P Capital IQ; Factiva; Ankura Analysis

© Ankura. All Rights Reserved

We also wanted to know whether stock markets are good at predicting medium-term partnership success. To directionally gauge this, we looked at a sampling of 22 new partnership announcements that received either notably positive or notably negative market reactions, and conducted a qualitative analysis on how these ventures evolved and, to the extent discernible from public information, performed in the years following formation.

Our analysis suggests that stock markets appear to be fairly good predictors of medium-term partnership performance.

60% of the partnerships that received a positive market reaction also performed at or above expectations. Pfizer’s 2018 alliance with BioNTech for an influenza vaccine was applauded by the market, and it also became the foundation for the companies’ exceptionally successful COVID-19 vaccine partnership. Similarly, Total’s joint venture with Corbion in bioplastics that the markets cheered, is now expanding by constructing new production plants globally. On the other hand, 56% of the partnerships that triggered a negative market reaction went on to experience medium-term performance issues, and in some cases, outright failure. Facebook’s ill-fated cryptocurrency partnership with industry heavy weights including Visa and PayPal, which it recently abandoned, did receive a thumbs-down from the markets when it was announced. Similarly, Siemens’ electric car parts joint venture with Valeo received a negative reaction, and subsequently underperformed – with analysts at Citi, reacting to the venture’s takeover by Valeo, remarking on “the significant deterioration in expectations for the JV.”[3]See, “Valeo’s Takeover of Siemens Joint-Venture Seen Revealing Lower Expectations – Market Talk,” Dow Jones Institutional News, February 10, 2022

Partnership announcements move company share prices and, when they do, a majority move it positively.

But can companies do better? Given the stakes, companies may want to consider making changes to their partnership-related investor engagement and communications strategy. Based on our experience, a program typically entails three steps (Exhibit 5):

A natural starting point is to understand how the market is reacting to – and potentially undervaluing – the company’s partnerships. This begins with cataloguing deals: how many JVs, minority equity investments, and non-equity alliances the company has, in what businesses and geographies, and of what financial and strategic materiality. In our experience, few companies have an integrated and up-to-date picture of the partnership portfolio. Armed with this data, it is then possible to conduct a stock market announcement effect event analysis to assess the market’s reaction when individual partnerships were formed and, where relevant, restructured or terminated. This baseline can then be further scrutinized for changes over time, differences between transaction structures, and comparisons across business segments and geographies. It can also be compared to announcement effects of industry peers and to general cross-industry data.

If the company’s partnerships are performing well but the market’s reaction is consistently neutral or negative – or if the company is underperforming relative to peers in terms of abnormal positive returns – then the market may be undervaluing the company’s partnerships.

A second step is to identify ways to enhance investor perceptions. Various analyses can be helpful here. For example, a global chemical company commissioned an “Analyst Perception Study” that included structured interviews with a dozen buy- and sell-side analysts on what they thought of the company’s partnerships generally – and reactions to specific recent announcements. These interviews uncovered what risks investors perceived, what types of information they were missing, and whether they saw a specific event as positive, negative, or neutral. Another tool is to analyze how the company’s industry peers communicate partnership announcements, including how they structured press announcements, investor calls, public filings, social media posts, and annual general meetings to communicate about their partnerships.

The final step is to pull this into a coherent program to better engage and manage investors and analysts. Often, this program operates on two levels. At a strategic level, the program will include actions to better position the company’s partnerships generally. This might include providing investors with greater transparency on what partnerships the company holds, their overall financial contribution to the firm’s financials, and how the company is managing specific issues and risks in joint ventures and other partnerships that matter to investors (e.g., safety, ESG performance, and sanctions or corruption compliance).[4]For further discussion and analysis about how companies are publicly reporting on and making public commitments regarding methane emissions and other environmental performance, community engagement … Continue reading

Other general actions might include better communicating how the company organizes itself to govern and manage its partnerships, and developing public materials and presentations that describe how the company uses partnerships to enhance its competitiveness. For example, US pharmaceutical company Eli Lilly has done an excellent job providing a steady stream of articles, conference and investor presentations, and online investor materials explaining how it uses alliances and promoting its alliance management capabilities. Dow was an early mover when it issued a public whitepaper on its JVs – discussing the rationale for entering into these ventures, summarizing the financial contribution to the company, and providing an overview of each major JV. BHP has actively and directly communicated to investors about the governance of its non-controlled joint ventures since 2016, following a major safety and environmental incident at Samarco, a 50:50 iron ore JV in Brazil.

An investor communications program might also include exposing the company’s ventures to independent scrutiny – and communicating this to investors. For example, a large US industrial company sponsored an independent assessment of the company’s material JVs against the CalPERS Joint Venture Governance Guidelines, and communicated that management was using the results to address gaps and opportunities in how it governed these assets. Another company hosted an “Analyst Day,” in which it brought together 20 or so analysts for a few hours to talk through the importance of JVs and other partnerships to its strategy and how the company thought about entering into and governing these ventures.

At a tactical level, the program may include actions to better communicate individual announcements. For instance, the company might change the way it structures press announcements, providing more and clearer information on a deal’s rationale, financial and strategic benefits, and how it will be managed.

~~~

Today, JVs and other partnerships are materially contributing to company market valuations. By elevating how companies control and articulate the overall story around their partnerships, companies stand to gain even more.

The authors would like to thank Joshua Kwicinski for his thoughtful contributions to this article.

As the basis for our analysis, we picked 2,731 partnerships events announced since 2016. These partnerships were based on the Ankura JV Index dataset and were selected based on a proprietary methodology to identify those deals that are financially or strategically material. Next, for each partnership announcement we identified the partner companies to test for the stock price impact of the announcement. In the process, we eliminated announcements with no publicly-listed partners, or with errors in the stock price or market data. This reduced the sample to 2,225 announcements.

Using a five-day event window (+2, -2 days from the announcement date), we calculated the abnormal stock price returns for each company by subtracting the expected stock price returns from the actual stock price returns. The expected stock price returns were calculated using the market model, by a regression of the stock price returns against the returns on an appropriate index over a 90-day estimation window. Announcements with a poor fit (where the standard error of the regression was greater than, or equal to, 0.025) were eliminated. We also eliminated announcements with noise (where the standard deviation of the stock price in the event window was greater than 3, suggesting that information unrelated to the JV or partnership announcement became public during the event window).

We then tested the calculated abnormal returns for statistical significance at 90% confidence level. The abnormal returns were considered statistically significant if the |T Value| was greater than 1.645 on any day of the event window, with a positive T Value being indicative of a positive impact, while a negative T Value that of a negative impact.

Download the PDF version of this article.

We understand that succeeding in joint ventures and partnerships requires a blend of hard facts and analysis, with an ability to align partners around a common vision and practical solutions that reflect their different interests and constraints. Our team is composed of strategy consultants, transaction attorneys, and investment bankers with significant experience on joint ventures and partnerships – reflecting the unique skillset required to design and evolve these ventures. We also bring an unrivaled database of deal terms and governance practices in joint ventures and partnerships, as well as proprietary standards, which allow us to benchmark transaction structures and existing ventures, and thus better identify and build alignment around gaps and potential solutions. Contact us to learn more about how we can help you.