Joint Ventures that Keep Evolving Perform Better

Successful companies actively manage their businesses through periods of economic growth, downturn, and recovery.

Shishir Bhargava is a Managing Director at Ankura based in Washington, DC. He advises clients on transactions and their post-deal governance in the energy, natural resources, and technology sectors. His transaction experience includes developing deal strategies, screening investments, structuring and restructuring joint ventures, and minority equity investments. He also helps companies build transaction capabilities and negotiate better outcomes. Prior to Ankura, Shishir worked at IBM where he led JV and partnership deals and at Hero MotoCorp of India, the world’s largest motorcycle manufacturer, which was established as a joint venture with Honda Motorcycles of Japan.

View Full Profile

Successful companies actively manage their businesses through periods of economic growth, downturn, and recovery.

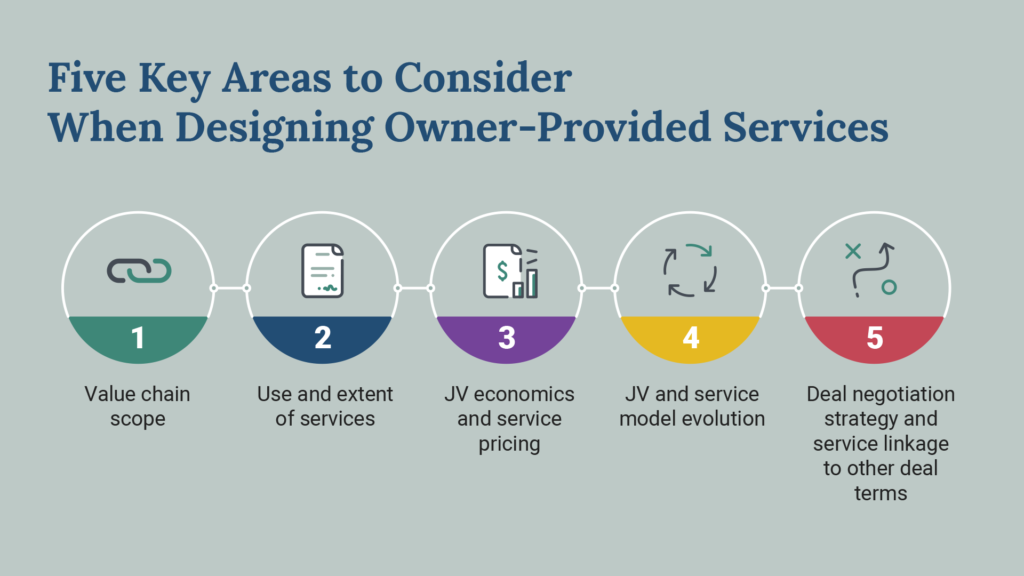

The many commercial relationships between a JV and its parents can cause JV partners to butt heads. Here’s our advice on how you can design these relationships to keep the peace.

Joint ventures are a critical tool for companies to access or commercialize new technologies and capabilities, share risk, meet local regulatory requirements, gain scale, and pursue capital-light growth.

How non-controlling partners can use owner-provided services to gain transparency and influence in joint ventures with high ESG risks

How owner-provided marketing services play a critical role in defining the scope and economics of the venture

Most JVs can and should lean on their owner companies for a variety of support – but the benefits may come with costs, risks, and potential conflicts. Here’s our advice on managing these complex commercial relationships.

Good governance matters to the performance of joint ventures. Our Joint Venture Governance Index is a rigorous, independent, data-driven way to measure governance strength.

To this day, our Standards of JV Portfolio Governance Excellence remain the only tool for companies to independent- ly calibrate themselves against peers on the journey to excellence.

TODAY, as environmental, social, and governance (ESG) issues take increased prominence and companies invest heavily to reduce their environmental footprints, natural resource companies have made only tentative steps to actively manage and shed light on the ESG performance of their non-controlled joint ventures.