What’s the Best Way to Structure a Joint Venture?

The advantages JVs offer can come with challenges that make joint venture agreements more difficult to negotiate.

How owner-provided marketing services play a critical role in defining the scope and economics of the venture

December 2021 — “If you want to go fast, go alone,” the African proverb tells us. “But if you want to go far, go together.” Joint ventures, a transaction structure based on a decision to go together, take this statement to another level. The design and contractual structure of a venture will need to establish whether the JV will leverage the services, capabilities, and scale of its owners in key functions, or go alone within the venture’s authorized scope.

That is especially important when it comes to marketing the JV’s products. Specifically, the JV’s marketing model – i.e., how and where a JV sells its products or services and the extent to which it leverages the services of its owners – can have a significant impact on the strategy, scope, and economics of the JV. Getting the model right sets up the JV for success. Getting it wrong leads to an underpowered or fractious partnership with a shortened lifespan. Take, for example, Libyan Norwegian Fertiliser Company (LifeCo), a 50:25:25 JV in Libya between Yara, a Norway-based global crop nutrition company, and two state-owned Libyan firms, National Oil Corporation and Libyan Investment Authority. According to public reports, the marketing model of the JV was a constant source of friction –the local partners accused Yara of extracting asymmetric economic benefits from the JV because it was marketing the products internationally.[1]See“NOC suspends natural gas supply to Libyan-Norwegian Fertilizer Company, 218TV,” Jan 2019 One of the local partners claimed that “Yara’s refusal to assume repayment responsibility, expecting the NOC to solely finance LifeCo’s operations while continuing to market its products internationally, leads to an unequal relationship; profit-making for Yara, but loss-inflicting for NOC.” The JV was dissolved earlier this year due to operational challenges and a shortage of gas supply.[2]See “Norway’s Yara sells stake in Libyan ammonia and urea producer LifeCo,” ICIS, Jan 2021

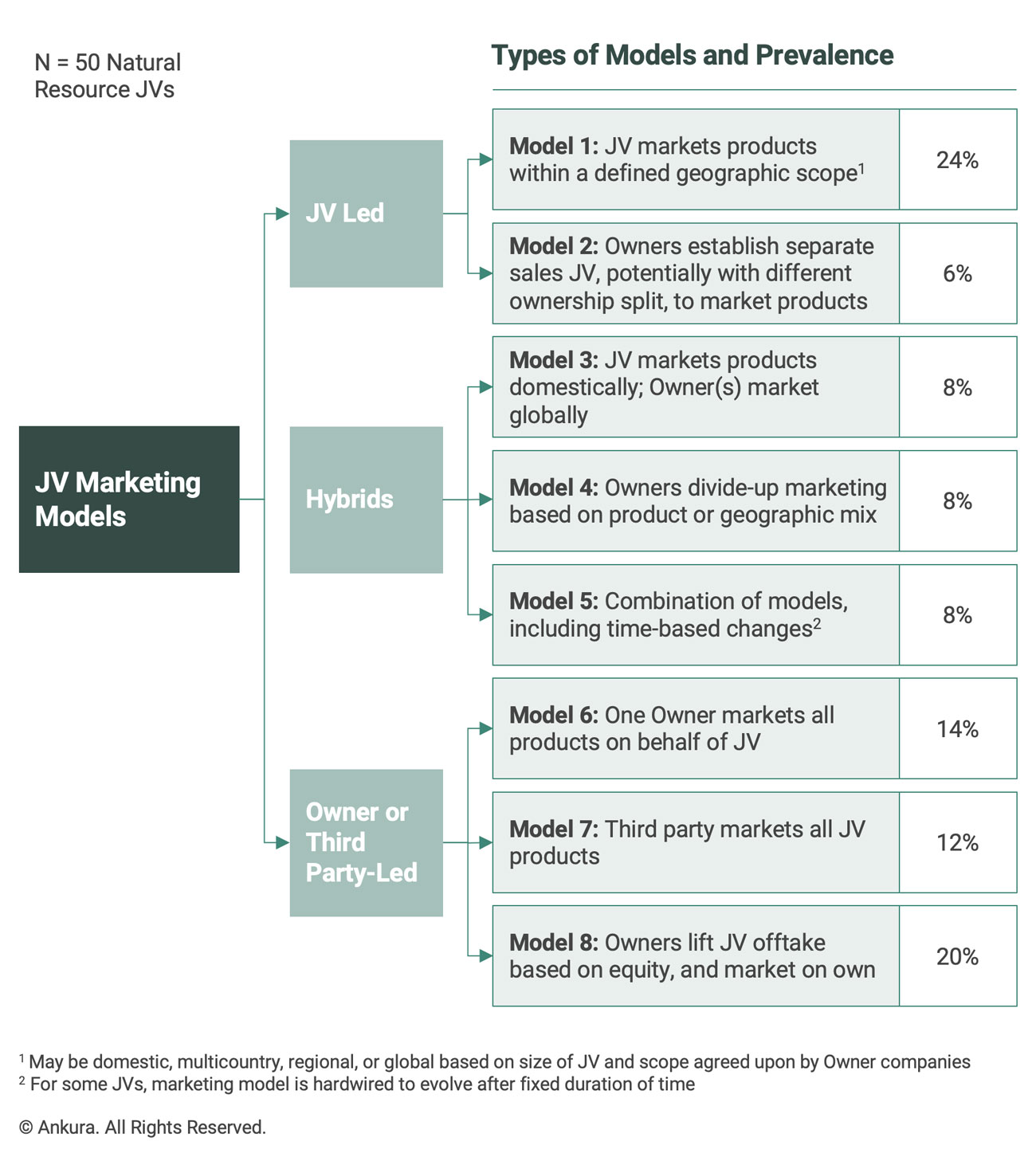

While owner companies can structure the marketing model in multiple ways, our recent benchmarking of 50 natural resource JVs from oil and gas, chemicals, and mining sectors suggests more than a third of JVs rely on their owner companies to provide marketing as a service to the JV – i.e., a model where owner companies sell all or part of the JV’s product in a defined geography on behalf of the JV or the other owners (Exhibit 1). An example, beyond our dataset, is the recently dissolved John Deere-Hitachi JV, which produced Deere- and Hitachi-branded excavators. For nearly two decades, Deere was responsible for marketing, selling, and providing after-sales support within the Americas for Hitachi-branded equipment produced by the JV.[3]See “John Deere and Hitachi Construction Machinery to End Joint Venture Manufacturing and Marketing Agreements,” PR Newswire, Aug 2021

s – Prevalence" loading="lazy" >

s – Prevalence" loading="lazy" >

Using marketing services from one or more of the owner companies to sell the JV’s products can often create multiple benefits. It helps the JV access capabilities from the owner(s), promotes skill and knowledge sharing, helps manage health safety and environment, anti-bribery and corruption, and reputational risks for the owners, and acts as a means for the owners to avoid competing in the same geography. However, owner-provided marketing services also have their fair share of pitfalls. They create opacity for owners who are not providing marketing services, make the JV “captive” to the owners who provide marketing services, and may create natural barriers to the JV’s growth.

In addition to aligning the high-level marketing construct and who markets or sells the JV’s product, owner companies need to make other choices that shape the JV’s marketing model. Such choices include agreeing on the geographic scope of the marketing support provided by the owner, the role played by the owner and whether it acts as a sales agent or a distributor,[4]Sales agents act as intermediaries between the final customer and the JV, whereas distributors buy the JV’s products and then sell them to the open market. the fee charged by the owner for the marketing services (e.g., fixed, % of sales, other), the brand of the JV’s product (e.g., JV, owner, geography-based), the time duration of the marketing agreement between the JV and the owner (e.g., perpetual, time-bound, performance based), and whether such services are on an exclusive basis.

In certain cases, dealmakers often etch-out creative deal terms that help further their respective company’s strategic intent. Take, for example Sadara, a 65:35 petrochemical JV based in Saudi Arabia between Saudi Aramco and Dow. Sadara is the exclusive marketer of its products in the Middle East. Sadara is allowed to market under Dow’s brand, but only when the products conform to Dow’s specifications; otherwise, the JV must use its own generic brand. Outside of the Middle East, Dow provides marketing services to the JV in exchange for a fee, based on a percentage of sales proceeds. Dow is the exclusive marketer of the JV’s products outside the region and is obligated to lift a minimum volume. If it does not, it is penalized by the JV. An interesting term the dealmakers negotiated in the model was to allow an option for Saudi Aramco to market 50% of the products allocated to Dow outside the Middle East if Aramco is able to satisfy certain conditions such as development of marketing capabilities.

Using marketing services from one owner or a subset of the owners has multiple benefits and enables owners to quickly get the JV off the ground. However, far too often, owner companies consider the marketing model of a JV to be static, fail to timely recalibrate it, and step into some of the pitfalls listed in this article. To talk about how you might model and structure a JV, including contractual terms associated with different marketing models, please contact Jim Bamford at james.bamford@ankura.com or Shishir Bhargava shishir.bhargava@ankura.com.

A complimentary 30-minute online briefing

Thursday, December 9, 2021

10 a.m. – 10:30 a.m. EST

This online briefing will boost your understanding of:

Shishir Bhargava

Senior Director

© Copyright 2021. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals. Ankura is not a law firm and cannot provide legal advice.

We understand that succeeding in joint ventures and partnerships requires a blend of hard facts and analysis, with an ability to align partners around a common vision and practical solutions that reflect their different interests and constraints. Our team is composed of strategy consultants, transaction attorneys, and investment bankers with significant experience on joint ventures and partnerships – reflecting the unique skillset required to design and evolve these ventures. We also bring an unrivaled database of deal terms and governance practices in joint ventures and partnerships, as well as proprietary standards, which allow us to benchmark transaction structures and existing ventures, and thus better identify and build alignment around gaps and potential solutions. Contact us to learn more about how we can help you.

Comments