Closing Gaps in JV Risk Management Practices

Opportunities abound for companies to elevate their risk management game in joint ventures by improving practices and raising expectations.

Ankura has developed a series of guides for developing and managing world-class influencing plans for non-controlling JV partners.

NON-CONTROLLED JOINT VENTURES are a significant asset class. Public filings show that companies like Dow Chemical, ExxonMobil, and Vodafone derive 35 to 50% of their net income from non-controlled joint ventures and other minority positions (Exhibit 1). Large mining companies such as BHP and Anglo American are less dependent on non-controlled JVs, but their portfolios often contain dozens of ventures, accounting for as much as 14% of net income. At Nestlé, non-controlled joint ventures like Cereal Partners Worldwide, Beverage Partners Worldwide, and Dairy Partners Americas form a critical component of its food and beverages business unit. Automakers like Volkswagen, Daimler, and General Motors have built a complex web of cross-holdings, alliances, and joint ventures over the last few decades – but exercise control in very few of these partnerships. Volkswagen, for example, attributes more than $700 million in income to its multiple non-controlled Chinese JVs, and a further $2 billion to other non-controlled ventures and minority investments.

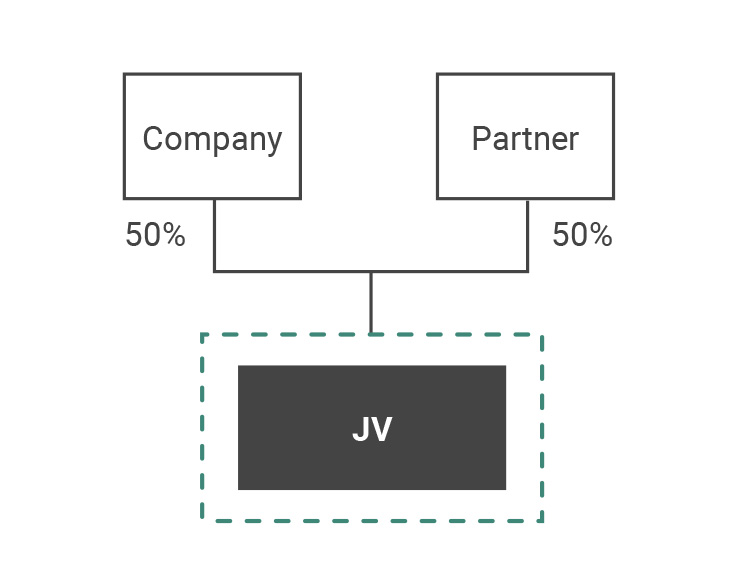

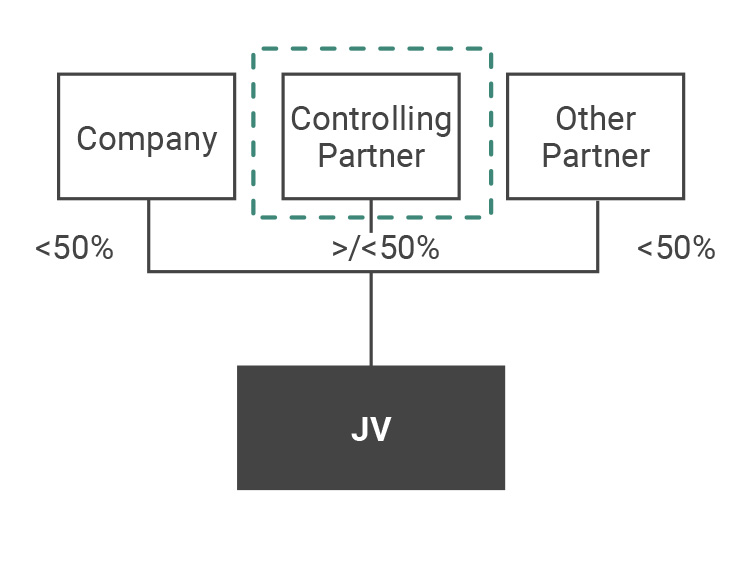

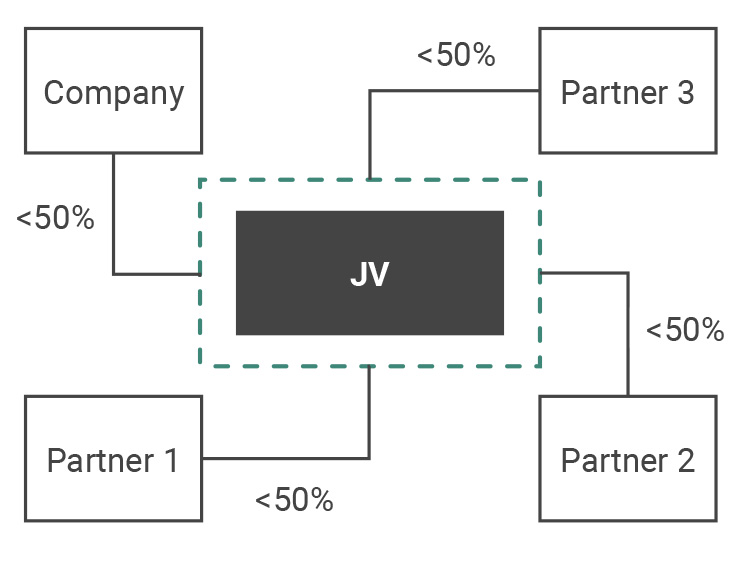

These non-controlled ventures come in many forms – including classic 50:50 style JVs, minority positions with a single controlling shareholder, or ventures with 3 to 5 other companies where all the owners are minority partners (Exhibit 2). Succeeding in such ventures is ultimately about influence – knowing how to gain influence, how to wield it, and when to use influence as a non-controlling partner.

Company and partner each hold 50% stake in venture company

Neither partner dominant; venture run by independent, CEO-led management team

Examples:

Company holds less than 50% stake in venture, operated or managed by one partner

Partner controls day-to-day workings of JV, and has dominant voice in decision making

Examples:

Company is minority shareholder in JV with multiple partners

No shareholder dominant, and venture management responsible for operations

Examples:

© Ankura. All Rights Reserved.

We believe that when a company is a non-controlling partner in a joint venture, it should consider taking a very deliberate approach to exercising influence. This deliberate approach starts with a firm understanding of what the non-controlling partner seeks to influence, and how to best influence key stakeholders (e.g., the partner, the venture management team, and its own internal organization), and then converting this into a specific annual influencing plan. We refer to this approach as the partner influencing campaign.

Over the last several years, Ankura conducted hundreds of interviews with JV Lead Directors, JV Managers and Shareholder Representatives, and members of JV management teams, including more than 100 discussions with JV CEOs about how non-controlling partners exercise influence. What we have found is many companies now appreciate both the importance and risks of their non-controlled joint ventures.

These risks come in many forms, including the risk of IP loss (a major concern in China JVs); the risk of financial and reputational damage from health, safety or environmental incidents (an intense concern in the oil and gas industry, especially following the BP Macondo oil spill); and the risk of regulatory fines and other damage from bribery and corruption allegations (such as the FCPA investigations against companies like Wal-Mart and Airbus Group related to their non-controlled JVs).

Second, while companies appreciate the need to excel at influencing, few are very focused on partner influencing as a corporate capability. The one exception is upstream oil and gas, where almost all major international oil companies are working to refine the art of influence and are developing or refining their approach to annual influencing plans, strategies, and tactics in their non-controlled ventures. We believe that companies in other industries need – and will benefit immensely from – a similar effort on influencing.

Third, even where JV Directors, JV Managers, or Shareholder Representatives do develop influencing plans, most struggle to create or execute plans with adequate focus and depth, lack sufficient creativity in thinking about influencing tactics, and fail to fully link the influencing plans to tangible metrics and individual accountabilities.

The purpose of this insight is to outline what a world-class partner influencing campaign looks like.

Typically, a company’s influencing approach takes one of two forms: Benign neglect or disorganized activism

Typically, when a company is a non-controlling partner in a joint venture, its influencing approach takes one of two forms: Benign neglect or disorganized activism. Both are usually problematic.

Benign neglect is an attractive approach. It saves non-controlling partners time and resources that would be expended chasing issues in ventures where they own a small percentage. But this approach also has its dark side: Ignoring a sub-optimal situation in the venture – or worse still, being unaware of its existence – exposes a non-controlling partner to risks, may leave value-creating opportunities untouched, and does not allow for the partner to provide needed support to the venture, which may ultimately undermine performance.

The second approach, disorganized activism, may be more common – but is often more painful. Our experience serving clients has shown that some of the most difficult non-controlling partners are highly demanding of information from the venture, misaligned internally on what matters, and bring no insight or assistance to the JV to improve performance. Consider the candid comments of one senior executive about one of his company’s largest non-controlled positions:

“There are probably 15 or 20 moderately senior – and extraordinarily opinionated – people in our company with direct exposure to the venture. Each is focused on 2 to 3 specific but different things to improve performance or reduce risk. Each is highly demanding of information. Most are highly critical by nature. And many revel in a game of ‘gotcha’ with the JV management. While these people are focused on similar issues, none is quite coming at it the same way – and so the result is that we are collectively pushing on 20 different items at any one time. And we wonder why we are not well-liked, or why we are not making any real progress.”

Make no mistake: It is not easy to run an effective partner influencing campaign. In some cases, the company lacks a single point of accountability for the JV. Even when this position exists (often in the form of a designated Lead Director – the senior Board Director appointed by the company to act as its primary representative to the JV), it is often not an explicit expectation for this individual to develop and deliver on an influencing plan. Similarly, companies provide limited guidance to Lead Directors and JV Managers on how to develop and run effective influencing campaigns. Influencing is neither a linear nor a data-driven game – which places it outside the comfort zone of the financially or technically trained individuals who must do this work. And, of course, JV legal agreements often do not make it easy – with limitations on the company’s information and voting rights, and other mechanisms of formal influence.

Still, it doesn’t have to be this way.

Ankura has developed a series of tools to help companies overcome these barriers, and better exercise influence in non-controlled joint ventures. One of these tools is the Developing a JV/Partner Engagement and Influencing Plan (Guide). This Guide is intended to help JV Lead Directors, Shareholder Representatives, JV Managers, and others bring greater coherence to the seminal task of influencing JV management teams and other partners, to mitigate risks and generate more value from the joint venture.

This Guide is intended to help companies bring greater coherence to the seminal task of influencing JV management teams and other partners, to mitigate risks and generate more value from the JV

The Guide is structured around a three-step process (Exhibit 3). Step 1 involves a series of analyses and working sessions designed to generate a list of potential key focus areas (KFAs). The list is ultimately narrowed down to 2 to 4 KFAs based on potential impact and feasibility (i.e., the likelihood of influencing the JV and partner).

© Ankura. All Rights Reserved.

The Guide profiles a series of discrete analyses and inputs used by non-controlling partners to identify and refine potential KFAs (Exhibit 4).

Some of these are analyses that are very specific to a given industry (e.g., Utilization Profile, Margin and Yield Impact Analysis in the chemical industry; Subscriber Base Analysis in the telecom industry; Conversion Analysis in the retail industry; Field Cash-Flow Model in the oil and gas industry), and that have traditionally been used by non-controlling partners but are nonetheless critical to informing potential KFAs. Other analyses and inputs (e.g., Open Audit Items) likely already exist – but are often not included in the thinking to generate KFAs (although we believe they should be). A final group of analyses (e.g., JV/Partner Capabilities Assessment, JV/Partner Wants and Needs Analysis) are often highly underdeveloped or absent but are critical to selecting KFAs.

1) Production Profile – Base and Alternate Case

2) Field Cash-Flow Model

3) JV Asset Risk Assessment and Matrix

4) Operator Capabilities Assessment

5) Issue Tree and Root Cause Analysis

6) Cost Gap Analysis (e.g., opex, capex)

7) Operational Performance Benchmarking

8) Transport Tariff and Third-Party Processing Profile

9) Proposed Annual Work Program and Budget

10) Partner Wants and Needs Analysis

11) List of Operator KFAs for the Year

12) Open Audit Items and Prior Year Audit Findings

13) Assessment of the Operator’s Internal Controls

14) Company’s Learning Roadmap

15) Corporate Performance Initiatives

16) Operator “Rapid Exposure” Day

17) List of Other Non-Operating Partners’ KFAs

18) Restructuring Upside Analysis

19) Company Asset Team Resourcing Benchmarks

20) Total Venture Economics Assessment

PRIMARY ANALYSIS

SECONDARY ANALYSIS

© Ankura. All Rights Reserved.

Step 2 is to understand the influencing environment. In our experience, many non-controlling partners skip or underinvest in this step. Done well, this step includes inventorying the company’s formal contractual rights and informal sources of leverage; understanding the JV’s and partner’s context (e.g., strategy constraints, decision-making culture); and mapping the company’s relationships with key stakeholders in the joint venture, in the partner, and beyond.

The work of Step 3 is generating a concrete JV engagement and influencing plan, which includes specific influencing tactics, metrics, and messages. To this end, an Influencing Tactics and Positioning Sheet is developed for each KFA – a one-page table that outlines the influencing tactics (e.g., challenge assumptions and performance, share benchmarking data to demonstrate risk or upside, invite JV/partner to the company’s internal training sessions on the topic, work back-channels in the government to create indirect pressure on JV/partner), fallback positions, and alternative strategies for the KFA. These details are then rolled up into an integrated workplan – with key dates and milestones to track the company’s progress.

Ideally, these inputs and the integrated workplan are organized in a single document (Exhibit 5), which serves as the roadmap for managing the non-controlling partner’s work, as the basis for tracking performance, and as a guide to communicating with the JV/partner and aligning internally within the company.

As context for the influencing workplan, the document should include a summary of the JV and its performance history, a crisp articulation of 2 to 4 KFAs (each with specific target outcomes), and ideally, the probability of influencing the JV/partner on each issue. Behind this, the document might provide further details on each KFA, including key stakeholders in the JV/partner and elsewhere on this issue, key decision-making bodies (e.g., Operations Advisory Committee) for the KFA, a list of company subject-matter experts on the topic, the company’s formal contractual rights, and key informal levers and potential tradables. The influencing plan document should also contain an appendix of key reference materials and analyses – items that are designed to help people in the company quickly understand the JV and the agreed-upon influencing strategy. Common appendix items include organizational charts for the JV and the company’s support team; a stakeholder relationship map with biographies of key people in the JV and partner; a list of all the potential focus areas considered; and a summary of the prior year’s plan and outcomes.

When non-controlling partners run deliberate influencing campaigns, the odds of tangible impact increase greatly. Consider the following two examples:

As part of its influencing planning process, a non-controlling partner in an emerging market integrated chemical JV identified sub-optimum utilization and availability at the venture’s refinery and chemical plants as a major risk. An initial analysis based on comparable facilities suggested that the JV could achieve a utilization of at least 89%; opportunity losses from unplanned shutdowns were conservatively estimated to be $11 million per day, and those from planned shutdowns, $4 million a day.

Discussions with the JV’s CEO, SVP Manufacturing and Engineering, and the controlling partner’s Lead Director revealed that the JV did not fully appreciate the impact of this risk, subscribed to a cavalier attitude towards maintenance, and had neither the capabilities nor the drive to push for improved maintenance and operational efficiency.

It also revealed that the controlling partner (who provided some technical services to the venture) believed that the current utilization and availability was “good enough.” Based on this analysis, the non-controlling partner made the issue a central plank of its annual influencing strategy – including obtaining comparable technical data from other plants, quantifying the potential impact of non-action, and building a compelling case and communication strategy aimed at key staff in the JV and partner. Its influencing plan included sharing its proprietary Operational Reliability Management System with the venture, inviting key personnel from the venture to maintenance-related workshops and trainings, and even initiating a series of reverse secondments. Within a year, the JV made progress towards resolving the issue. The intervention placed the venture on the path towards saving more than $200 million per year from lower unit costs and higher product sales volumes.

An LNG JV structured as a quasi-independent company was consistently delivering third- or fourth-quartile operating performance relative to comparable facilities around the world. Eager to turn around performance, the Lead Director and JV/Asset Manager in one of the international shareholders believed that the main issue was not technical, but rather that the shareholders’ mode of interaction – constant information requests and audits, excessive committees, and a failure to provide the JV with top talent or the latest proprietary data or systems – was the root cause of underperformance. That shareholder launched a highly orchestrated influencing campaign to change the JV’s governance and shareholder model. The effort led to a fundamental performance turnaround in the JV over the following two years, with production jumping by 4%, availability rising from 85 to over 90%, and operating cost dropping by 20% per MMBTU. The total value from this single key focus area was more than $2.5 billion in net income for all the shareholders.

Ankura works closely with its consulting clients and Joint Venture Advisory Group subscribers to develop world-class partner influencing plans (Exhibit 6). In some cases, especially with large JVs, our support is heavier – we work side-by-side with the non-controlling partner to conduct critical analyses, refine the list of potential KFAs, and to directly develop and refine elements of the plan (including key activities, metrics, messages, and underlying tools for tracking the team’s progress).

In other cases, especially with our subscribers, we have lighter-touch involvement, acting more as an experienced advisor than plan co-developer. Under this working model, we facilitate a process to help JV support teams and Lead Directors develop an influencing plan on their own. The light process generally starts with Ankura providing the team with our resources (including the detailed Guide) for developing an influencing plan. This introduction is followed by an hour-long video- or teleconference to walk through the process and tool at a high level. Depending on the team’s appetite, Ankura may facilitate a half-day, in-person workshop to generate the outlines of the influencing plan. We then provide on-call support to react and offer improvements to the draft plan as it is more fully developed, and to offer thoughts on influencing strategies and tactics as issues arise across the year.

Recent research by McKinsey & Company and others confirms that activist investors help public companies improve and sustain shareholder value – provided the targeted management and Board listen to these activist investors. Non-controlling shareholders in ventures can have a similar effect. The trick is getting the management team and Board to listen, rather than moving straight into confrontation. In short: It is about mastering the art of influencing.

The authors would like to thank Cody Gaffney for his contributions to a prior version of this article.

We understand that succeeding in joint ventures and partnerships requires a blend of hard facts and analysis, with an ability to align partners around a common vision and practical solutions that reflect their different interests and constraints. Our team is composed of strategy consultants, transaction attorneys, and investment bankers with significant experience on joint ventures and partnerships – reflecting the unique skillset required to design and evolve these ventures. We also bring an unrivaled database of deal terms and governance practices in joint ventures and partnerships, as well as proprietary standards, which allow us to benchmark transaction structures and existing ventures, and thus better identify and build alignment around gaps and potential solutions. Contact us to learn more about how we can help you.

Comments