October 2020 — OVER THE PAST 15 YEARS, major companies have come under fire for engaging in environmentally harmful business practices. Increasingly, investors have pushed companies – particularly in the natural resources sector – to embrace sustainability in their operations through proxy battles, PR campaigns, and restricted capital flows to firms slow to go green. As a result, many publicly traded companies have turned to investing in renewable energy and the chemicals circular economy to satisfy investors and burnish their eco-friendly credentials.

One effect of this shift has been a recent increase in the formation of partnerships in sectors focused on environmental sustainability. Over the last 10 years, the number of new renewable energy joint ventures and alliances launched annually has nearly doubled, while the number of circular economy partnerships announced annually has doubled in just 3 years.[1]Derived from SDC Platnium data and Ankura JV and Partnerships Database One example is Regenyx, a joint venture created by AmSty and Agilyx in 2019 that is dedicated to fully recycling post-consumer polystyrene materials back to new polystyrene products – and claims to be the first to do so at commercial scale.[2]As described on the Regenyx corporate website – see https://www.regenyxllc.com/, accessed August 2020

Companies are starting to take action – but is the stock market rewarding these announcements?

Previous research indicates investment decisions that integrate environmental, social, and governance (ESG) criteria result in positive returns.[3]Gunnar Friede, Timo Busch & Alexander Bassen (2015) ESG and financial performance: aggregated evidence from more than 2000 empirical studies, Journal of Sustainable Finance & Investment, 5:4, … Continue reading However, mainstream investors have been slow to embrace these criteria when making investment decisions. Moreover, little research has been conducted to determine whether the market specifically rewards companies for activities related to pro-sustainability partnerships.

To address this gap, we set out to answer the question: “How do pro-sustainability partnership announcements in the energy and chemicals industries affect stock prices?”

Methodology

To conduct our analysis, we reviewed a list of 693 prominent partnership announcements from 2005-2020 in sustainable energy and the circular economy related to the creation or consolidation of pro-sustainability JVs, equity investments and alliances, non-equity alliances, and partial acquisitions. Announcements were included in our analysis if they ¬involved significant investment and/or received press coverage in leading newspapers such as the Wall Street Journal or Financial Times. The following areas were classified as “pro-sustainability”:

- Energy from renewable sources: wind, solar, hydropower, biomass, ocean current

- Enabling technologies and processes: energy storage, energy efficiency

- Use of chemical recycling processes: transforming plastics into feedstock, processing plastic waste, circular plastics ventures

- Chemicals produced from bio-based sources (e.g. bioplastics)

Our analysis focused principally on oil & gas, chemicals, and utility companies, as those sectors had the largest volume of pro-sustainability partnership announcements; however, we also included relevant partnership announcements from the industrials and pure play renewables sectors in our analysis. Our goal was to determine whether abnormal returns for a stock were significant within a 5-day event period starting 2 days before and ending 2 days after the announcement date. We did not analyze long-term impact from partnership performance itself.

After excluding announcements with noise (i.e other material announcements were made by the company in the 2-day period before and after the announcement) and with poor fit (i.e. stock price was too volatile for our model to reliably predict expected returns)[4]If standard error was > 0.025, we considered the model to be a “poor fit” for the announcement. we reduced the sample set to 321 announcements for analysis.

To execute the analysis, we first identified the partner company to test for stock price impact based on whether: (i) the company was traded on a stock exchange 2 days prior to and after the announcement period, and (ii) if the partnership was material to the company. We assessed materiality subjectively, based on the dollar value of investments in the venture and strategic significance to the company.

We then identified the most relevant date for each announcement (i.e., either when the partnership was first publicly announced, or the announcement had relevant detail, or a definitive agreement was signed),[5]For certain partnerships, multiple dates were tested. Only the date with the highest indicator of significance (i.e. highest T statistic) was kept for that partnership. and used a +2,-2 event window for each announcement, day 0 for the announcement date, and a 90-day estimation window prior to the event window.

Stock price was measured in terms of significant abnormal returns (i.e., returns not explained by the market) during the announcement window. The share price impact was tested for the partner(s) to which the announcement was material.

We calculated abnormal returns using a risk-adjusted returns model (RAR) by subtracting expected stock price returns from actual returns. Expected stock price returns were calculated via the following formula: Intercept + Beta * Actual market returns. Intercept and Beta were estimated from a regression of stock price returns against market returns over the 90-day estimation window, with a best fit market index selected for calculating market returns. Intercept2 was a measure of irregular return on the stock compared to the market, and Beta3 was a measure of the way the stock moves in relation to the market.[6]More specifically, “Intercept” is the intercept from a regression of the stock against a market index over the 90-day estimation period prior to the event window, giving us a starting point of … Continue reading

In periods with no announcements, abnormal returns are assumed to be 0. Thus, abnormal returns were considered significant when greater than ±1.645 standard deviations from 0 (i.e at a 90% confidence level). If there were multiple announcements for the same deal over a period, we selected the announcement with the greatest deviation from the mean.

Summary Findings

Overall, we found the market does reward pro-sustainability announcements, with some interesting patterns across types of deals and companies. The results of our analysis of 321 announcements were striking:

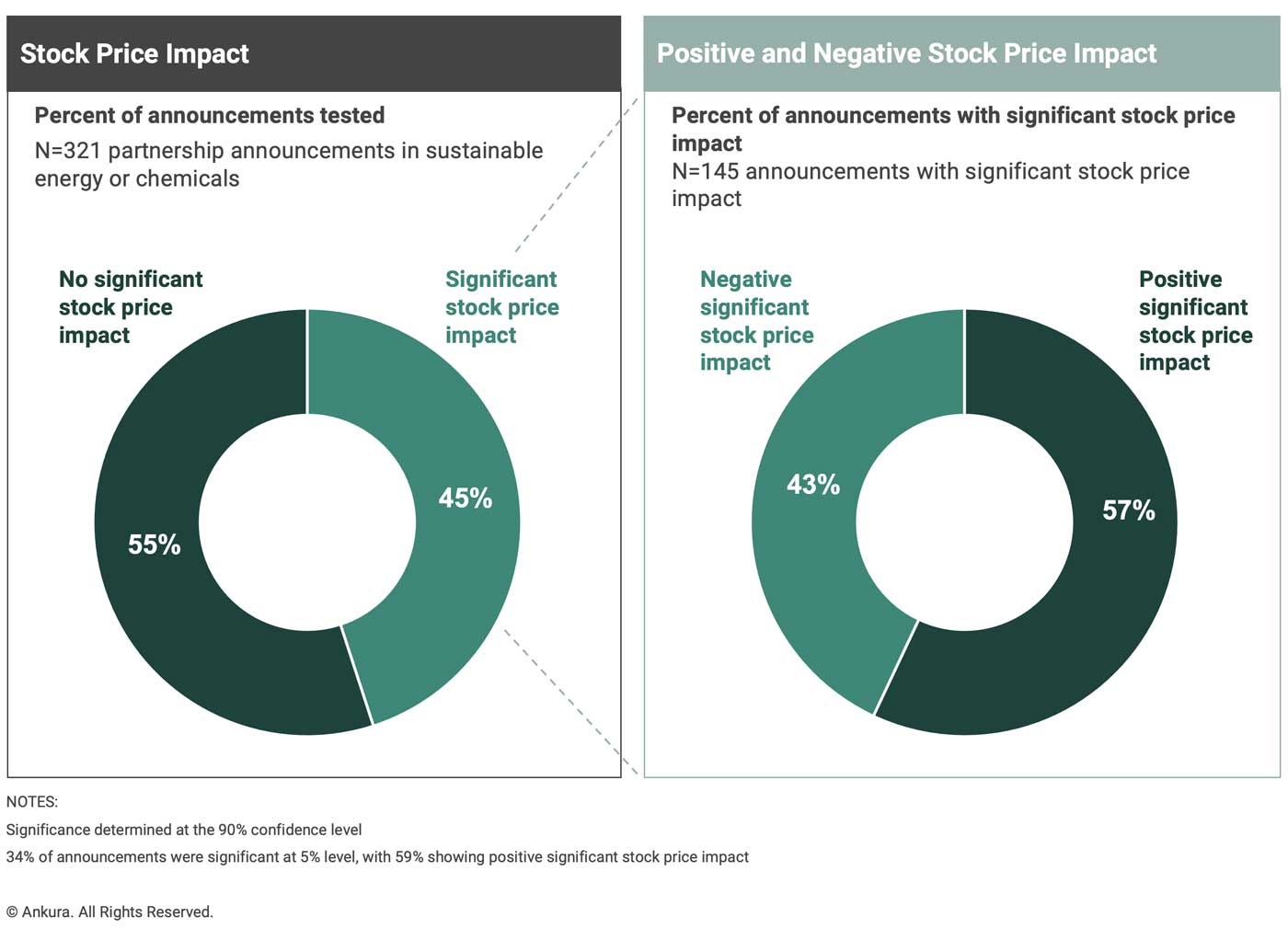

- Material partnership announcements in sustainable energy or chemicals have a significant, and mostly positive, stock price impact. 45% of announcements tested had a significant stock price impact, with 57% of significant announcements having a positive impact at the 90% confidence level. At the 95% confidence level, 34% of announcements were significant, with 59% positive.

- Partnerships to monetize or benefit from existing investments had the most positive stock price impact irrespective of the path to monetization (e.g., sell-down, asset swaps). Investors do not punish companies seeking to extract capital from successful sustainability investments, especially when the expectation is that capital will be deployed to new sustainability opportunities.

- Partial acquisitions were most likely to have negative significant stock price impact. Partial acquisitions, being material, were more likely to have a stock price impact, but this impact was mostly negative due to the dual risk of non-control and diversification. However, other types of deals such as JVs and non-equity alliances had more positive stock price impacts.

- The prevalence of significant stock price impact was highest among focused renewables companies and power companies/utilities. A potential explanation is that these partnerships are relatively more material to the focused renewables companies (which tend to have small market caps) and to the utilities (who are actively pursuing a renewables strategy).

- Oil and utilities majors with more intensive partnership activity in sustainable energy tend to have a higher stock price impact for new sustainable partnerships. Among the oil and gas majors, Shell, BP, and Total had the most intensive partnership activity, while BP was the only company with a majority of positive stock price impacts across announcements. Among the utilities, RWE and Enel had the largest and most positive stock price impacts.

Detailed Discussion

Material partnership announcements in sustainable energy or chemicals have a significant, and mostly positive, stock price impact. Our analysis shows that almost half of the 321 pro-sustainability announcements tested had a significant stock price impact on at least one partner involved, with the effect being a positive increase in stock price most of the time (Exhibit 1).

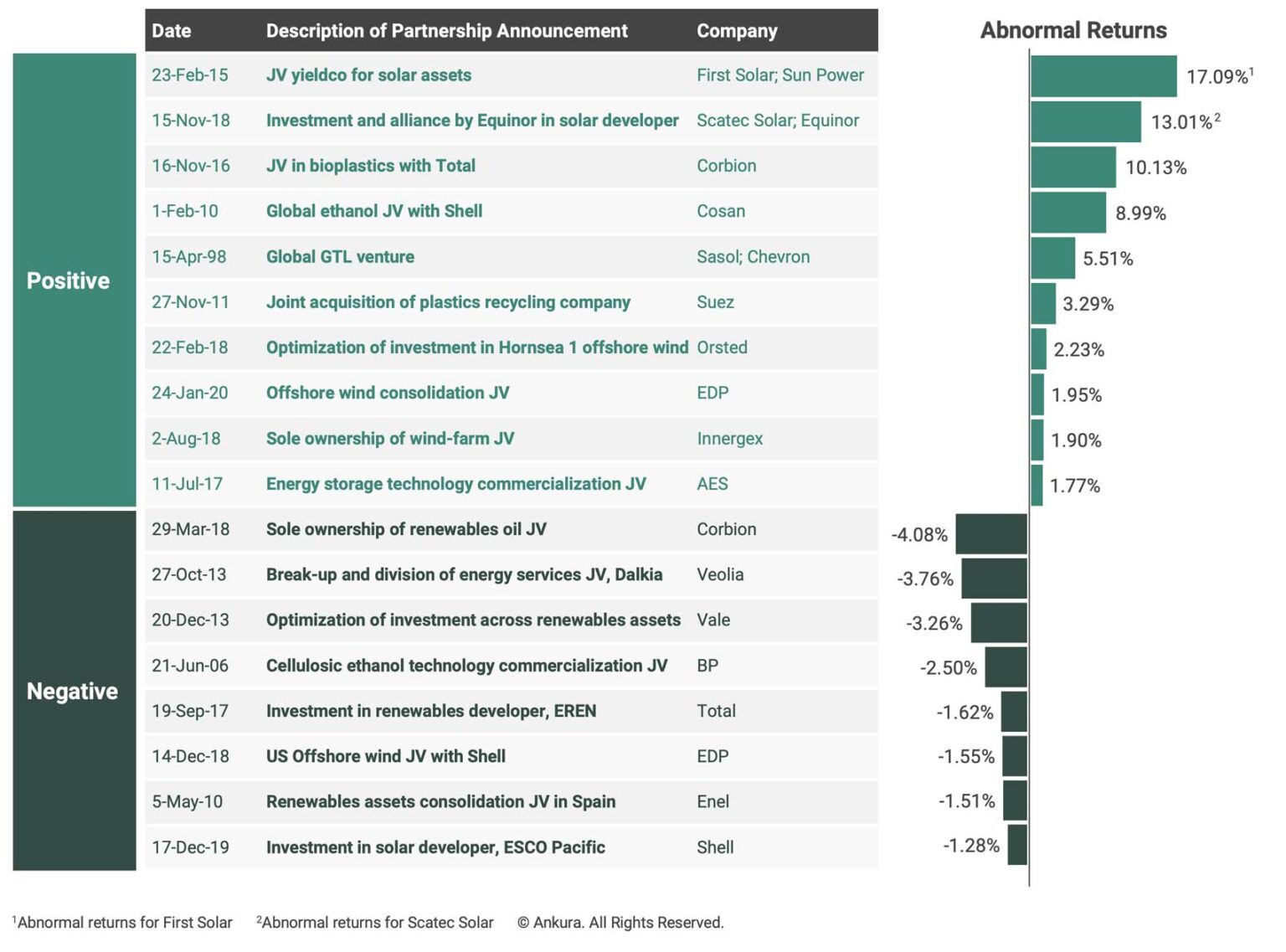

Examples of sustainable partnerships with a positive impact on stock price include DSM-POET’s ethanol joint venture, LyondellBasell and Suez’s joint acquisition of Quality Circular Polymers, and Fluence, a JV between AES and Siemens (Exhibit 2). Fluence is an interesting example of a successful partnership: Siemens brought broad commercial and geographic reach, as well as technology, complementing AES’s grid-scale battery technology. The market recognized this and rewarded AES, with one analyst commenting, “It certainly would help AES to have a big industrial on the level of Siemens to compete with GE and Schneider Electric.”[7]See “Siemens, AES Join in $2.5 Billion Storage Market Opportunity,” (2017, July 11) Bloomberg New Energy Finance … Continue reading

Exhibit 2: Examples of Announcements with Significant Stock Price Impact

© Ankura. All Rights Reserved.

Out of the partnerships tested that were significant for both partners, over half resulted in “win-win” scenarios: both partners experienced significant positive increases in stock price. 8point3, an innovative JV between First Solar and SunPower announced in 2015, illustrates the benefits partners can accrue by entering into a pro-sustainability partnership. Through 8point3, both partners could contribute solar generation assets into a yieldco. This freed up cash and attracted more investors to the yieldco due to its more diverse asset base. After announcing the partnership, First Solar and SunPower’s stock prices skyrocketed with significant abnormal returns of +9.25% and +17.09%, respectively.

More importantly, “lose-lose” situations are rare: no partnerships in our sample observed negative significant stock price impacts for both partners. This indicates the market is generally favorable towards entering a pro-sustainability partnership.

Although the prevalence of significant announcements in the data set was high, the affect was not necessarily the same across partners. 81% of partnerships (where we had public stock price data for both partners) resulted in a significant stock price impact for at least one partner, while only 30% of partnerships had a significant effect on both partners. For example, announcement of the Raízen JV by Shell and Cosan in 2010, aimed at ethanol production from sugarcane, resulted in a positive significant abnormal return of +8.99% for Cosan, but Shell experienced insignificant abnormal returns of -0.62%. Although analysts reacted positively to Raízen, Shell had had a negative earnings announcement within the same time period, which may explain its lack of significant results.[8]Testing of Shell for the Raizen announcement was eliminated from the sample as the negative earnings announcements introduced “noise” Cosan, however, benefitted immensely from the opportunity to partner with a major oil company and grow its ethanol business globally.

We also observed interesting patterns in analyst behavior regarding the types of deals that generated sufficient market buzz to raise stock price. Analysts tended to comment most on deals with the following attributes:

- Large-scale and material (i.e., were large or strategically significant) – deals like Brookfield investing $750 million in TransAlta. Our data also shows that greater materiality is associated with a greater likelihood of the announcement having a significant impact on stock price.

- Creation of an industry leader and/or vote of confidence in an emerging industry – e.g. the Ocean Winds JV announced by EDPR and Engie Offshore, which was was predicted to become the world’s #2 player in offshore wind development after Orsted.[9]N. Chestney and G. De Clerq, “French Engie, Portugal’s EDP aim be second-biggest offshore wind developer with joint venture.” (21 May 2019) Reuters. … Continue reading Another example is Raizen, which created the world’s largest sugarcane ethanol producer.

- Access to specialized expertise or technology from another partner – e.g., Acciona gained access to Solargenix’s unique advanced solar thermal technology[10]See “Spain’s Acciona To Buy 55% OF US Solargenix,” (2006, February 2), Dow Jones International News

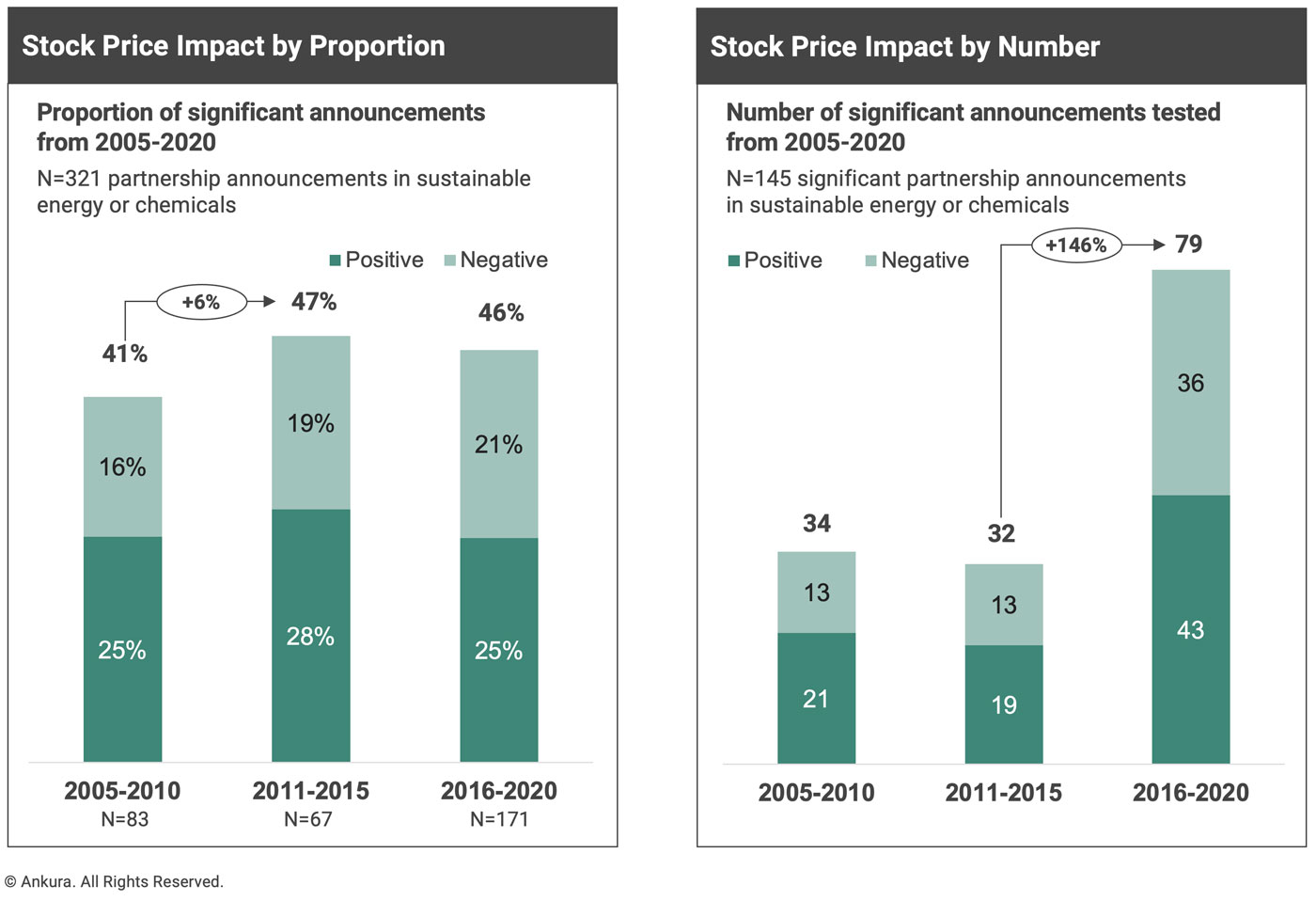

Both the number and proportion of significant announcements relative to total announcements in our data set grew over time. After segmenting data into 3 five-year periods from 2005 to 2020, we found that the number of significant announcements grew by 146% between 2005-2010 and 2011-2015, and the percentage of total announcements that were significant grew from 41% in 2005-2010 to 47% in 2011-2015 (Exhibit 3). These findings imply participation in sustainable partnerships has sharply increased, but engagement in the right types of deals that actually move stock price has been slower to progress.

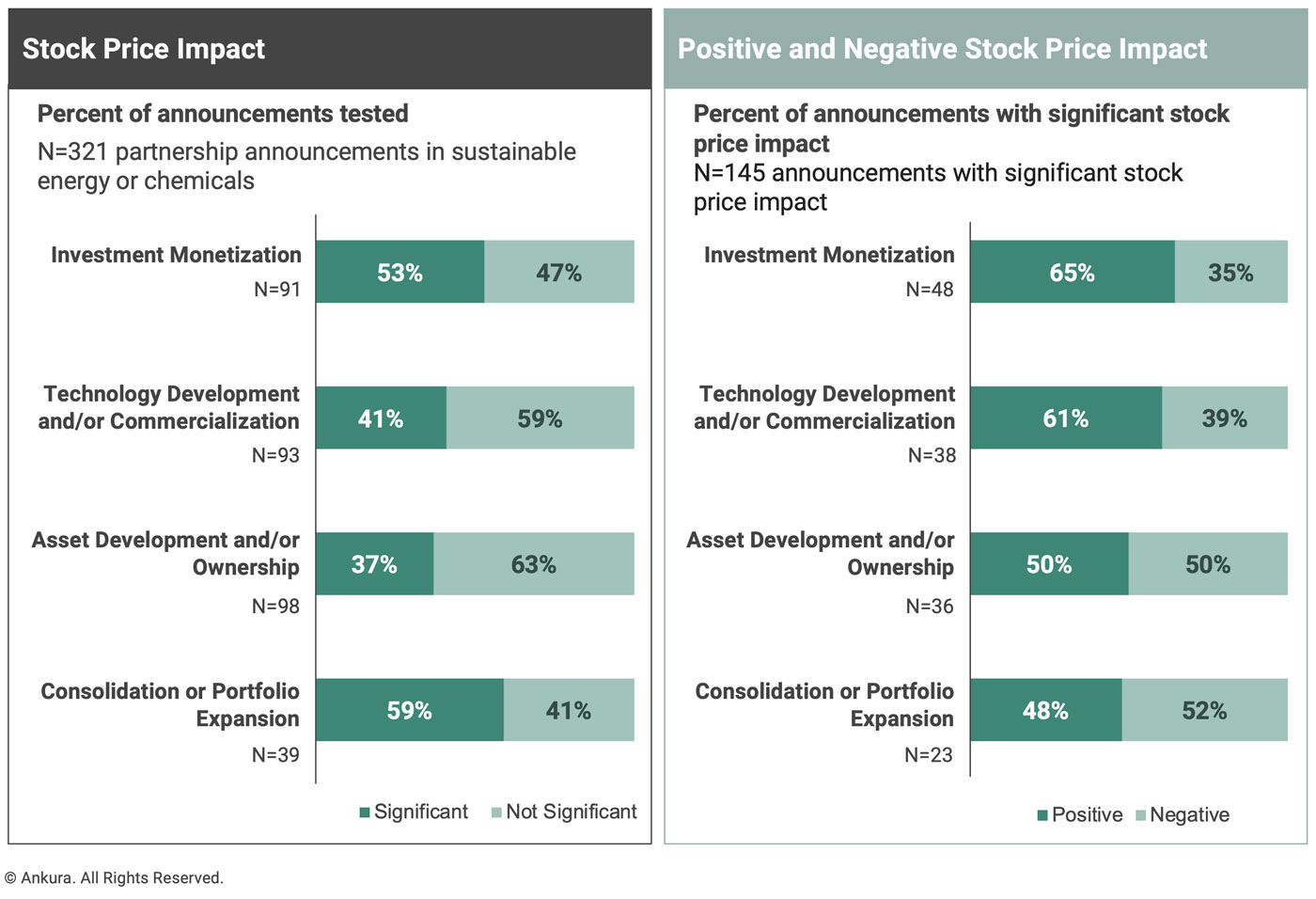

Partnerships to monetize existing investments had the most positive stock price impact irrespective of the path to monetization (e.g., sell-down, asset swaps).

We examined four types of primary deal objectives:

- Consolidation or portfolio expansion deals, in which partners consolidated their assets or bought into their partner’s portfolio (e.g., EDPR and Engie combining their offshore wind businesses into a JV)

- Investment monetization deals where partners freed up capital through asset swaps, sell-downs, buy-outs of partners’ interests, or equity sales/partial IPOs, but did not fully exit (e.g., RWE selling its majority stake in Innogy to E.ON in exchange for obtaining the renewables businesses of both firms)[11]See “RWE to create green utility via major asset swap deal with E.on,” (2018, March 12), Renewables Now … Continue reading

- Technology development and/or commercialization deals where partners collaborated on development and/or commercialization of specific technology or technological processes (e.g., BP and DuPont developing biofuels technology through Butamax)[12]See “Ahead of the Bell: BP, DuPont,” Associated Press Newswires (2006, June 21)

- Asset development and/or ownership partnerships focused on developing individual assets (e.g., Shell and EDPR developing offshore wind farms through Mayflower Wind).[13]See “EDP, Shell Win Mass. Offshore Wind,” Power, Finance, and Risk (2019, November 1) http://www.powerfinancerisk.com/Article/3902156/PPA-Pulse-EDP-Shell-Win-Mass-Offshore-Wind.html

Investment monetization deals tended to deliver more significant and positive stock price impacts than other types of deals irrespective of the path to monetization, which supports the effectiveness of the “develop, build, sell” strategy some companies tend to the employ through the lifecycle of a partnership (Exhibit 4).

Take the example of a renewable JV between Falck Renewables and Eni. In March 2020, Falck Renewables sold 49% of its ownership stake in a portfolio of solar plants in the U.S to Eni to create a partnership focused on solar, wind, and energy storage projects.[14]See “Eni forms US clean power JV with Falck,” renews.biz (2019, December 23) Falck Renewables had a positive abnormal stock price increase, likely due to the freed-up cash they could use for investment in other projects.

A partnership between KKR and NextEra Energy Partners (NEP) tells a similar story. In 2019, KKR announced its intention to acquire an equity interest in a partnership with NEP consisting of a portfolio of wind and solar assets.[15]“KKR Expands Renewable Energy Portfolio through Investment with NextEra Energy Partners.” BusinessWire (2019, March 4) … Continue reading NEP’s stock price increased significantly as KKR’s investment signaled the commercial viability of NEP’s contributed portfolio. These examples support our finding that the market is supportive of active portfolio management that realizes returns on sustainability partnerships.

Technology development and commercialization deals also tended to be well received by the market, with 61% positive and 39% negative market impact. An example is DSM-POET’s 2012 ethanol joint venture, where the partners planned to invest $250 million to commercialize cellulosic bio-ethanol production. The announcement increased DSM’s stock price significantly with analysts at Rabobank applauding the deal for showing that DSM “has very strong technology in the field”[16]See “Rabobank cheers DSM’s advanced biofuels JV with Poet,” SeeNews Netherlands (2012, January 24) and “POET and DSM to Make Advanced Biofuels A Reality by 2013,” poet.com (2012, … Continue reading

Asset development partnerships tended to have the least significant stock price impact, with a 50-50 chance of a significant stock price effect being positive or negative. Typically, these types of partnerships were not material enough to move stock price unless the asset being created was of sufficient scale. Moreover, the slow pace of asset development and the negative cash flows associated with investment may have caused the market to react negatively after the initial announcement. Compared to the more immediate benefits realized from investment monetization, asset development is more speculative as benefits are further in the future, and thus results seem to be mixed for this category.

This does not mean companies should stop engaging in asset development partnerships; rather, companies should make sure their investment doesn’t stop there. The market rewards bigger and bolder partnerships that allow partners to strategically monetize assets without exiting from sustainable ventures.

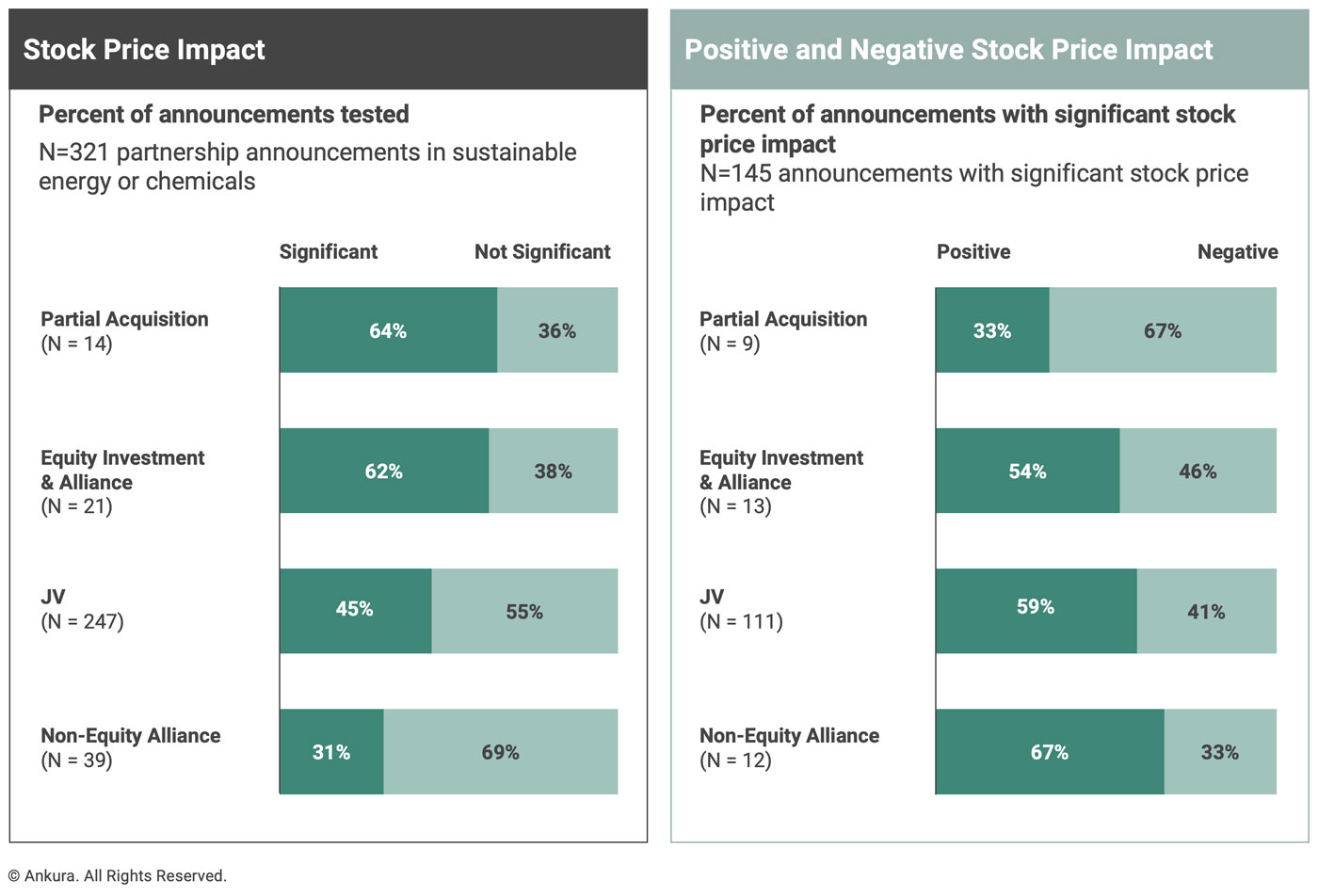

Partial acquisitions were most likely to have negative significant stock price impacts.

We assessed market impact of four types of deals: partial acquisitions, JVs, equity investments, and non-equity alliances. Across the four deal types , all except for partial acquisitions resulted in positive significant stock price effects. Non-equity alliances had the most positive share price impact, followed by joint ventures. Although 64% of partial acquisitions analyzed moved stock price significantly, the highest proportion within the group, only about 33% of these deals produced a positive stock price impact (Exhibit 5).

Our results indicate companies seeking to maximize stock returns should target participating in pro-sustainability JVs, and equity investments with associated alliances, to increase the chances that investment will move stock price upwards. The stock price impact was less significant for non-equity alliances because they do not tend to be material for the larger companies tested. However, the impact is typically positive for this category when it is significant.

Partners should exercise caution when engaging in partial acquisitions as there is increased risk associated with a lack of control and diversification. This finding is analogous to research in mergers and acquisitions which finds that the stock price of the acquirer typically declines more than that of the company being acquired after an acquisition.[17]Adnan, Atm & Hossain, Alamgir. (2016). Impact of M&A Announcement on Acquiring and Target Firm’s Stock Price: An Event Analysis Approach. International Journal of Finance and … Continue reading

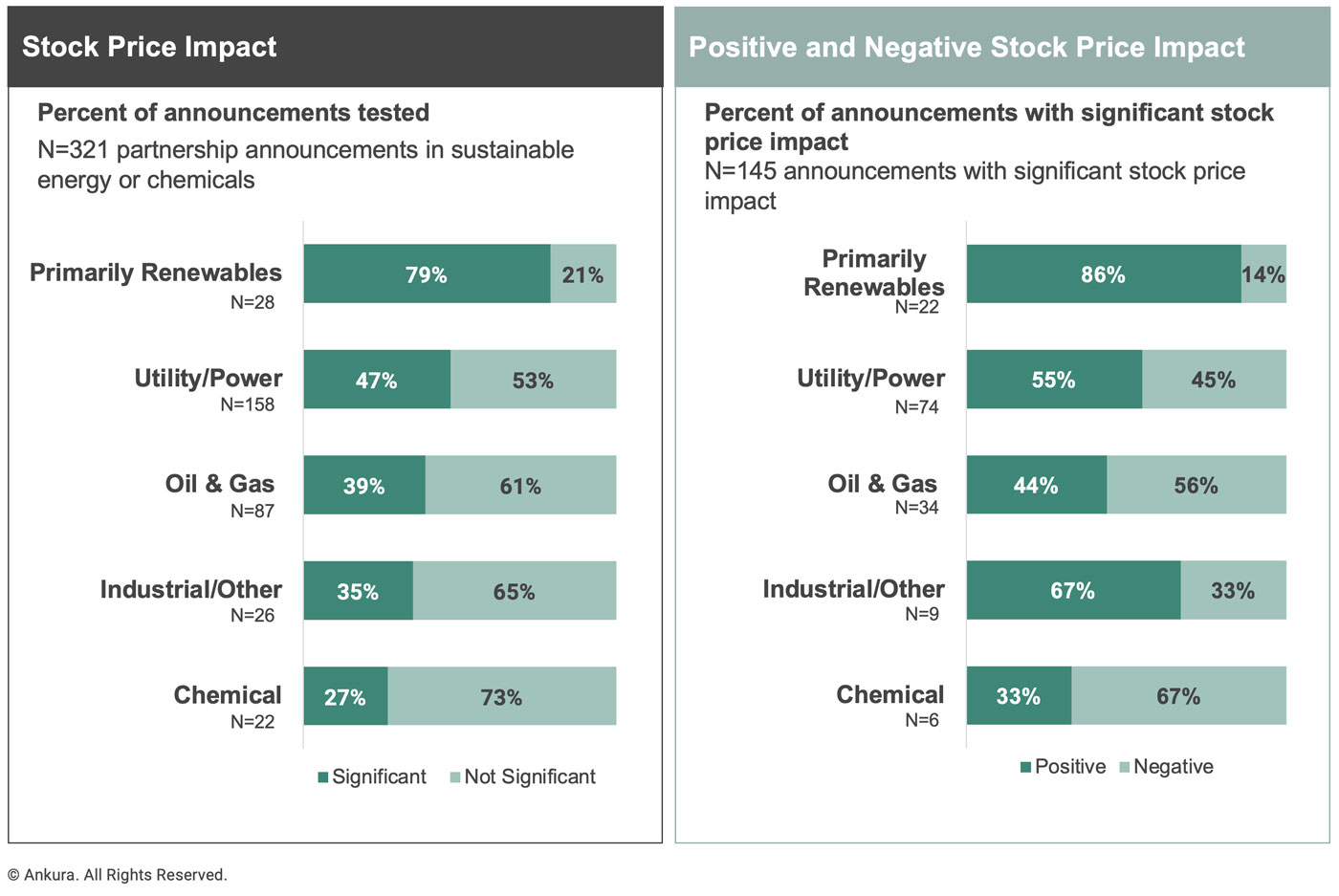

Stock price impact was highest among focused renewables companies and power companies/utilities, with oil and gas lagging behind.

Companies that primarily operated in the renewables sector benefitted the most from positive increases in stock price after announcing pro-sustainability partnerships compared to other types of companies tested (Exhibit 6).

This is not surprising considering these companies’ core competencies were already related to sustainability. However, the data does confirm that entering into partnerships is attractive for pure play renewables companies since most partnerships are material relative to their low market caps and provide access to cash and commercialization opportunities. Utility/power companies also had positive stock price effects, showing that the market has rewarded the utility industry’s overall trend toward increasing investment in sustainable energy.

Stock price effects for oil and gas companies, however, were mediocre as most oil and gas investments in pro-sustainability partnerships were small bets and not typically large enough relative to market cap to meaningfully sway stock price. Interestingly, although industrial companies had fewer significant pro-sustainability partnerships, the partnerships that did affect stock price frequently did so in a positive manner.

Utilities and oil majors with intensive partnership activity in sustainable energy tend to see higher significant returns for new sustainable partnerships.

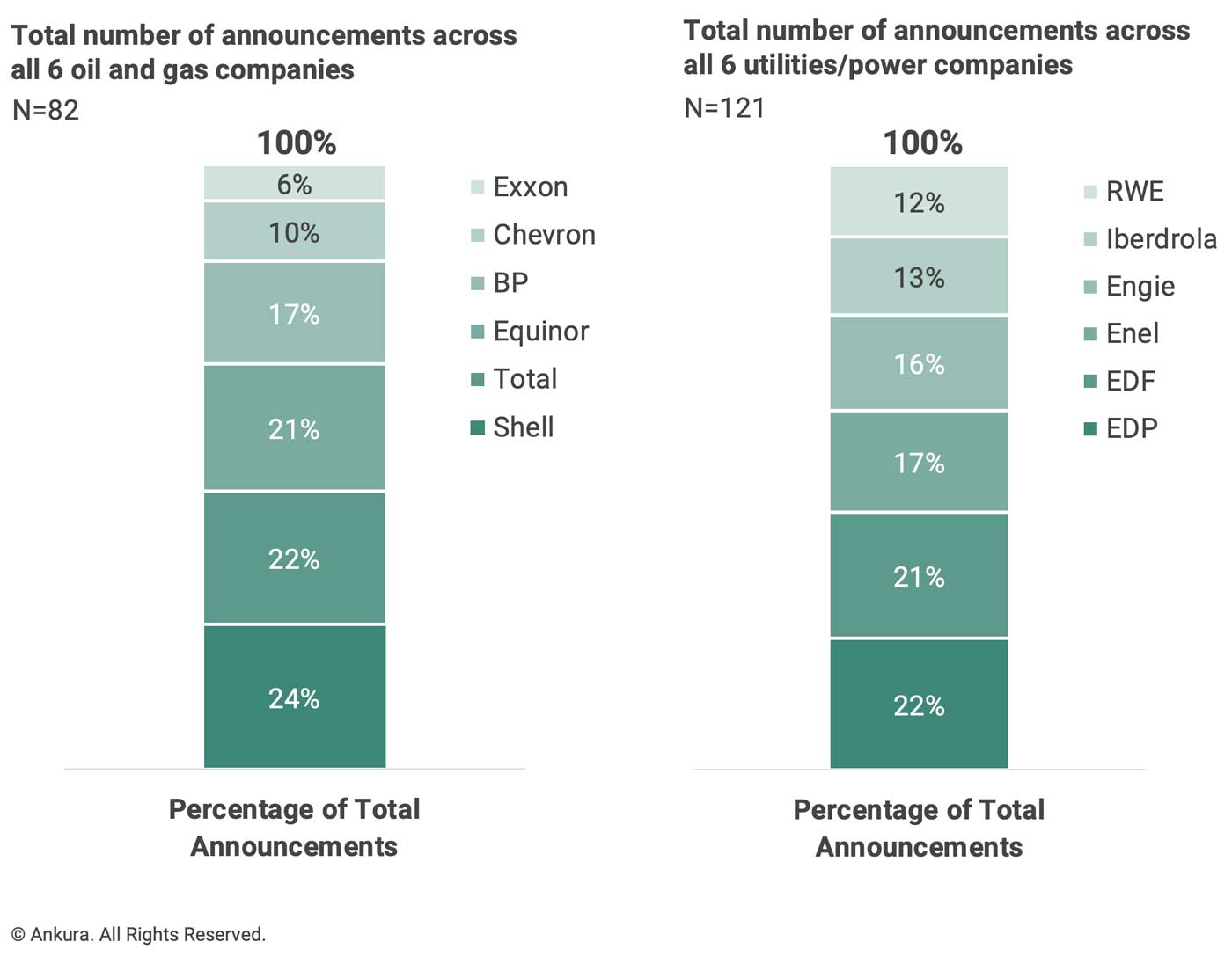

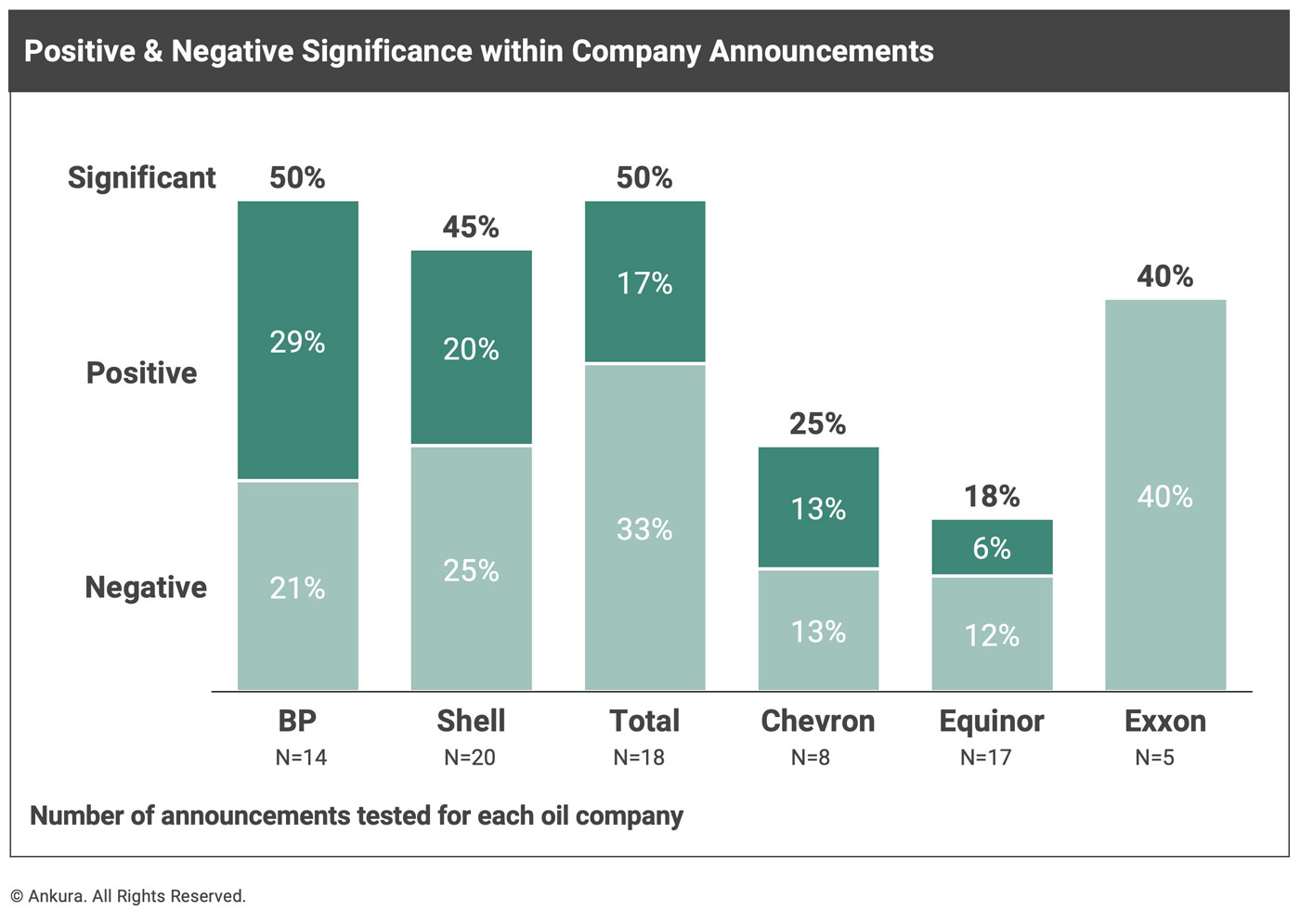

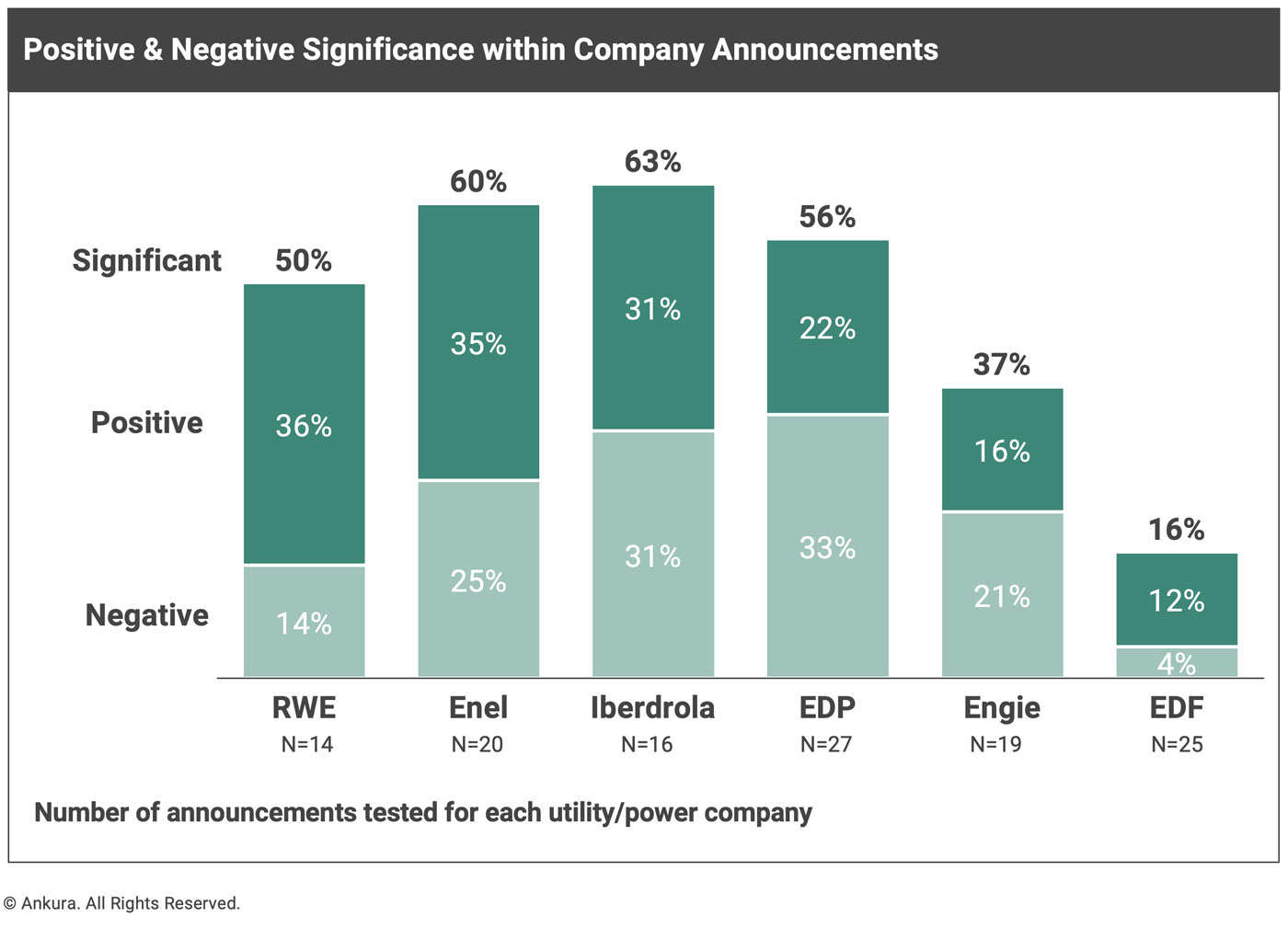

We took a closer look at 6 large utilities companies (EDF, EDP, Enel, Engie, Iberdrola, RWE) and 6 large oil and gas companies (Shell, BP, Total, Exxon, Chevron, Equinor)[18]Although Equinor is not traditionally described as an oil major, we included it in our analysis due to the firm’s increasing prominence in the oil & gas sector. to compare industry leaders against their peers.

In oil and gas, Shell, BP, and Total had the highest number of pro-sustainability partnership announcements, and BP had the most abnormal positive stock price impact. Among the utilities, RWE and Enel had the largest and most positive abnormal stock price impacts. Even though these firms were not necessarily the top investors by volume of announcements, both did have large numbers of material announcements over the last 15 years (Exhibit 7).

Exhibit 7: Stock Price Comparison Across Major Oil & Gas and Utilities Companies

© Ankura. All Rights Reserved.

Overall, large utilities companies have collectively invested in pro-sustainability partnerships to a greater extent than large oil and gas companies have. The distribution of such announcements is also more balanced among major utilities companies compared to oil and gas, where Chevron and Exxon most notably lag behind their peers.

These findings can potentially be explained by two observations: (1) renewable energy is more related to the core business of utility/power companies compared to oil and gas and (2) the utility/power industry has pushed for greater investment across the board in environmentally friendly energy, a trend that has gained more momentum among European utilities than American firms. Although this trend exists in oil & gas, it is not yet so pronounced.

The data also shows simply throwing money at pro-sustainability partnerships is not enough to observe positive stock price gains – the deals have to be strategic.

For example, Equinor was a large investor in sustainable partnerships in our data set compared to its peers – it made up about 17% of announcements in the total pool of partnerships tested across all 6 large oil companies. However, only 18% of Equinor’s announcements actually ended up being significant – the lowest proportion of the group – and the effect was mostly negative (Exhibit 8).

Within utilities, there’s a similar story. EDF claims one of the highest proportion of total pro-sustainability announcements across all 6 utilities majors, yet only 16% of EDF’s announcements resulted in a significant effect on stock price (Exhibit 9).

So, what’s going on?

First, the size of the deal relative to market capitalization may affect significance of certain announcements. Pro-sustainability partnerships tended to be larger relative to the market capitalizations of major utilities firms, whereas sustainable deals were small compared to the market capitalizations of large oil and gas companies.

Second, the prevalence of routine, smaller scale asset development deals among pro-sustainability announcements may affect results. For Equinor and EDF, asset development deals made up a higher portion of their total announcements relative to their peers, which may explain the lower rates of significant stock price effects both firms experienced.

Third, a company’s business strategy may shape the market’s expectations of sustainable investment. Equinor and EDF have made sustainable partnerships a prominent aspect of their respective business strategies, so the market may have already come to expect these investments from them. BP, however, has recently shifted to a more focused and deliberate renewables strategy compared to earlier sustainable investments, and the market seems to have rewarded this move thus far.

As large oil and gas companies open up their own internal alternative energy divisions, pro-sustainability announcements will likely continue to increase in this sector. Whether these partnerships will be material enough to make a difference still remains to be seen.

Our analysis is encouraging: not only can pro-sustainability partnerships help mitigate the climate crisis, but they also tend to positively increase company stock price. In particular, the market rewards firms that go big and invest in ventures that can scale. Our analysis confirms what the frontrunners have always known: sustainability is just better for business.

Comments