JANUARY 2022 — When a company pursues a large merger or acquisition, it typically relies on multiple advisors – including an investment bank to run the deal process, identify potential targets, and build financial models; a law firm to draft legal agreements and secure regulatory approvals; and consultants to quantify synergies and manage the integration process.

But when it comes to joint ventures, companies often drive the deal process without the help of an investment bank. Most investment banks stay away from joint ventures, in part because they have a hard time applying their percent-of-deal-value fee structures to joint ventures, where contributions are often non-cash, phased over time, and contingent on business performance. JVs have much lower close rates than sell side M&A, which also makes banks wary. And investment banks are not well positioned to provide needed advice on many aspects critical to JV transactions, which are much more likely to be related to scope, governance, and organizational issues than complex financial engineering.

This void creates issues. Without an investment bank, a potential JV is likely to lack the tightly-managed and competitive deal process found in M&A. And while companies certainly rely on legal counsel for valuable advice on contractual terms, tax, and regulatory matters, JVs typically introduce material business issues that are intertwined with legal matters and challenging for a law firm to address alone. Internal corporate development teams may be able to fill the void, but in most companies, joint venture deal teams are under-resourced and lacking significant JV experience, as most firms only undertake such transaction structures episodically.

Enter your information to view the rest of this post.

"*" indicates required fields

A JV Advisor is the solution. Ankura helps companies manage the JV deal process, perform and link key strategy and financial analyses into negotiations and legal terms, design governance and organization, and stand up the new joint venture company post-close. Whether brought into a transaction by a company looking to do a JV or by an attorney looking to make sure their client succeeds on a JV deal, we blend the skills and deep background of both an investment bank and strategy consultant with practical experience translating business considerations into deal terms, all in the specific context of a complex equity partnership.

JV Transactions: Complex in Unique Ways

Negotiating, structuring, and launching a joint venture is inherently more complex than a merger or acquisition. For starters, JV transactions require the parties to jointly negotiate and pre-agree on a set of plans and contractual terms that, in M&A, either do not exist or can be imposed by one party (Exhibit 1).

Exhibit 1: Terms Jointly Negotiated in JVs but not in Full Acquisitions*

| Term or Action | 100% Acquisition | Joint Venture |

|---|---|---|

| Definition of Business and Scope | ||

| Exclusivity and Non-Competition | ||

| Business Plan | ||

| Term of Business | ||

| Post-Close Capital Structure | ||

| Post-Close Governance Structure and Rights | ||

| Post-Close Organization Structure and Rights (appointment rights, org design) | ||

| Post-Close Staffing Construct (JV employees or secondees) | ||

| Post-Close Business Plan | ||

| Post-Close Audit and Assurance Rights | ||

| Post-Close Information Rights | ||

| Post-Close Exit Rights | ||

| Ancillary Agreements | ||

| Launch Plan |

*Some items listed still apply in M&A but can be unilaterally decided by the acquiror

© Ankura. All Rights Reserved.

By extension, JVs introduce a much more intense and fluid interplay between business and legal issues. And JVs face other hurdles not found in M&A, including those related to team resourcing and process management. Below are some of the key ways in which JV transactions are different, more complex, or harder to manage than M&A transactions:

Range and Complexity of Potential JV Concepts

The choice to use the JV structure is itself a complex question, as is determining what type of JV the parties may form. When considering a joint venture, firms not only face the typical structuring considerations like tax and accounting needs and whether a new or existing entity should be used for the transaction, but also wrestle with foundational relationship choices within the JV (e.g., whether the JV will be 50:50 or majority-minority; whether it will be independent or operated by one of the partners) that lead to varying degrees of interaction and risk sharing among the parties.

Such decisions go beyond purely legal and tax considerations and should be based on wider strategic, economic, and other business consequences – yet few internal deal teams have the experience and examples at hand to understand and illustrate the range of JV deal concepts available and their potential benefits and drawbacks. But failure to inventory and analyze deal constructs can lead partners down a path – say of a 50:50 incorporated JV – when another creative arrangement may be preferable.

Definition of JV Scope

Typically in an M&A transaction, the “perimeter” of the deal – i.e., what products, assets, liabilities, revenues, technology rights, people, etc. are included in the scope of the transaction – is determined by the seller. In joint venture transactions, however, these are not pre-determined, but instead lie at the heart of structuring and negotiations.

Often highly interdependent, decisions on the JV’s product, market, and business system scope are shaped by the partners’ strategic priorities and relative capabilities – which may not be fully revealed or agreed upon – and may confer asymmetric returns or influence to one partner. As such, they can be hard to pin down.

Consider one common scope question: Should the JV market its products or services directly, or outsource marketing to one or more shareholders? Answering this requires multiple inputs (e.g., voice of the market; understanding of shareholder capabilities; structural options with pricing and other terms; economic impact and risk analyses; etc.), significant coordination across deal workstreams and internal functions, and focused negotiation (Exhibit 2).

Multiply this by the large number of scope decisions, and there is a need for an organized, capable, and well-staffed project management team to drive internal alignment and support the negotiating team.

Exhibit 2: Negotiating JV Scope – Marketing Example

* In some cases, partners will develop a joint economic or financial model or engage in other work jointly. Even if these activities are conducted jointly, each partner should have its independent view on the direction for such workstream and engage in some level of independent analysis to develop its own view of a target outcome.

** Negotiating team typically involves key executives and legal counsel who drive decisions into deal documents.

© Ankura. All Rights Reserved.

Enhanced Partner Due Diligence

M&A due diligence typically focuses on the buyer’s financial wherewithal and the good standing – financial, legal, and regulatory – of the seller’s assets, in addition to various market and product assessments and synergy analyses tied to valuation. Culture issues may also be explored, but mostly one-way: can the target acquisition’s culture be made to fit with the buyer? In a JV, however, diligence is as much about both parent companies’ cultural fit and operating style – and the ability of each side to be flexible – as it is about their financial profile and the assets they might contribute (which companies shortchange in a JV context at their peril).[1]See “Giving Diligence its Due,” James Bamford and Piers Fennell, The JV Deal Exchange, April 2015. Companies should also understand their potential partners’ experience in other JVs – not only for what JV-specific terms the partner has signed up to in the past, but also for how they behave as a partner post-close. This information can be beneficial in negotiations and can even influence whether to collaborate with the potential partner at all. But companies often fail to do this work, leaving them without highly valuable information in their arsenal as they think about specific terms or even the deal itself.

Joint Control, Governance, and Assurance Provisions

Unlike M&A, JVs involve ongoing shared control post-closing, which requires all parties to negotiate and be comfortable with provisions regarding Board composition, voting, management appointment rights, delegations to management, information rights, audit rights, and other terms absent from a full acquisition.[2]While some of these terms might also be negotiated in some M&A scenarios – like board composition and post-transaction management structure with a merger of equals, or limited near-term … Continue reading Companies often try to negotiate these terms without information on what has worked (or not worked) for others, without clarity on their internal boundary conditions and governance needs, and without playing out how negotiated provisions could impact them in different future scenarios. Few companies themselves, or even the best law firms, have an integrated database of benchmarks and best practices on these terms across industries and different deal structures – and this information gap, paired with competing priorities, means companies often fail to do the work required to clarify objectives, understand their range of options, and conduct a structured analysis of future scenarios. This leads many companies to sign up unknowingly to terms that seem reasonable, but end up disfavoring them at a critical moment in the venture’s lifecycle.

JV Staffing Construct

The lack of unilateral control post-close also requires partners to address and agree on how to staff the venture. A JV can be staffed with direct employees, but it may rely heavily – especially at launch – on secondees (i.e., individuals “loaned” to the venture from a parent company for a period of time, typically one to three years, before returning). Having secondees creates its own set of complexities. Who do secondees report to – their parent company or their line manager in the JV organization? Who leads and defends secondee reviews and ratings, and decides on their bonuses? These and other questions require an HR-related workstream in JV negotiations (1) that is not required in many other types of transactions and (2) for which deal teams are often ill-prepared due to lack of experience with secondees and lack of data on other JVs’ experiences with various staffing constructs.[3]In some joint ventures, a company (typically one of the partners), as opposed to an independent management team, operates the business as an “operator,” such as in many upstream oil and gas … Continue reading

Long-Term Ancillary Agreements

In most JVs, there are multiple ancillary relationships between parents and the venture, like a long-term supply agreement under which a parent provides key components to the venture, or a license agreement under which a parent provides critical IP to the JV. These commercial relationships need to be negotiated up front, as they can have profound impacts on both JV and parent company economics. But these related-party transactions are inherently mired in conflicts of interest and are often quite complex, multiplying the number of issues to be negotiated. Having dedicated technical teams for these ancillary agreements can help facilitate negotiations – but even more critically, there needs to be connectivity between these teams and the core deal team to ensure that they are working on the same deal timeline, that economic impacts from ancillary agreement negotiations are carried into the economic model for the JV, and that overall transaction risks are appropriately mitigated in the ancillary agreements themselves as well as across terms impacted by them.

Trying to negotiate a material JV with an under-resourced, inexperienced, and process-lite team is a recipe for a long, painful experience with no guarantee of success. But creating a JV need not be so treacherous. By bringing in a JV Advisor for added support, experience, and an abundance of relevant analogs, data and benchmarks, companies can smooth out the process of forming and launching a JV.

Lack of Adequate Deal Team Resources and Expertise

Internal deal teams often lack the resources and expertise required to effectively negotiate and launch a JV, and are often smaller than a team working on an acquisition, despite the added complexity of JV negotiations. The frequent result: a failure to prioritize and link issues in the right way; a slow-moving negotiation process prone to momentum loss; and an underappreciation of JV-specific deal issues and terms, including those related to scope and exclusivity, governance, intellectual property, and exit. The resourcing model for JV deals is a leading cause of “deal fatigue” seen in many joint venture transactions, as executives simply find that joint ventures introduce such a high volume of material business issues to negotiate and translate into the legal agreements.

Undefined Deal Process and Lack of Hard Deadlines

JV deal team fatigue is exacerbated by the lack of a competitive and tightly-managed transaction process for JVs. JV negotiations are rarely competitive, and lack hard bid deadlines and the pressure to beat others to an attractive deal. Furthermore, JV transaction processes are notoriously undisciplined, with deadlines slipping in the vast majority of deals. Without a structured and closely-managed process, companies struggle to prioritize. The ensuing delay can be costly: advisor fees mount, companies lose significant time to market, and, in many cases, potentially accretive deals fail to close as interest wanes and teams call it quits.

How Ankura Can Help

As a JV Advisor, Ankura is positioned to help companies artfully navigate, integrate, and manage the high volume of diverse analyses and negotiations that go into consummating a joint venture. We advise on joint venture transactions in five primary areas: (1) transaction process management, (2) business planning and due diligence, (3) valuation and economics, (4) deal structuring and negotiations, and (5) launch and integration management (Exhibit 3).

Exhibit 3: JV Advisor Transaction Support

* Conducted by Ankura Capital Advisors, LLC (ACA) (Member FINRA, SIPC)

© Ankura. All Rights Reserved.

We work with a deal team, alongside external counsel, to implement their company’s vision, while offering JV-specific strategy, financial, legal, governance, and negotiation expertise, additional skills and manpower, and a professionalized process honed by exposure to over 500 JV deals in the last decade. We bring experts to each part of the JV transaction process: from FINRA-licensed broker-dealers who can facilitate transaction processes and leverage our own internal investment bank, to IP experts who are some of the best in the world at valuing IP contributions or assessing IP royalty rates, to leading thinkers on JV structure and governance.

This combination gives us the skills and perspective to pull together and manage many competing inputs and objectives into a JV transaction. By leveraging Ankura in a transaction, companies can better support their deal teams, speed their time to deal closure (or to realizing that walking away is preferable), and ultimately end up with a JV that better protects their interests while positioned for success.

We can also integrate with any other advisors on a deal team, like outside counsel, to provide them the JV-specific guidance they need when they need it and to ensure all analyses supporting the legal and negotiations workstream are being synchronized. We know that strategy, economics, and risk must all be managed and woven into a thoughtful negotiation strategy for a company to create a successful JV. Ankura can use its experience with project management and JV strategy to bring these pieces together, working alongside other advisors in a complementary and fit-for-purpose way.

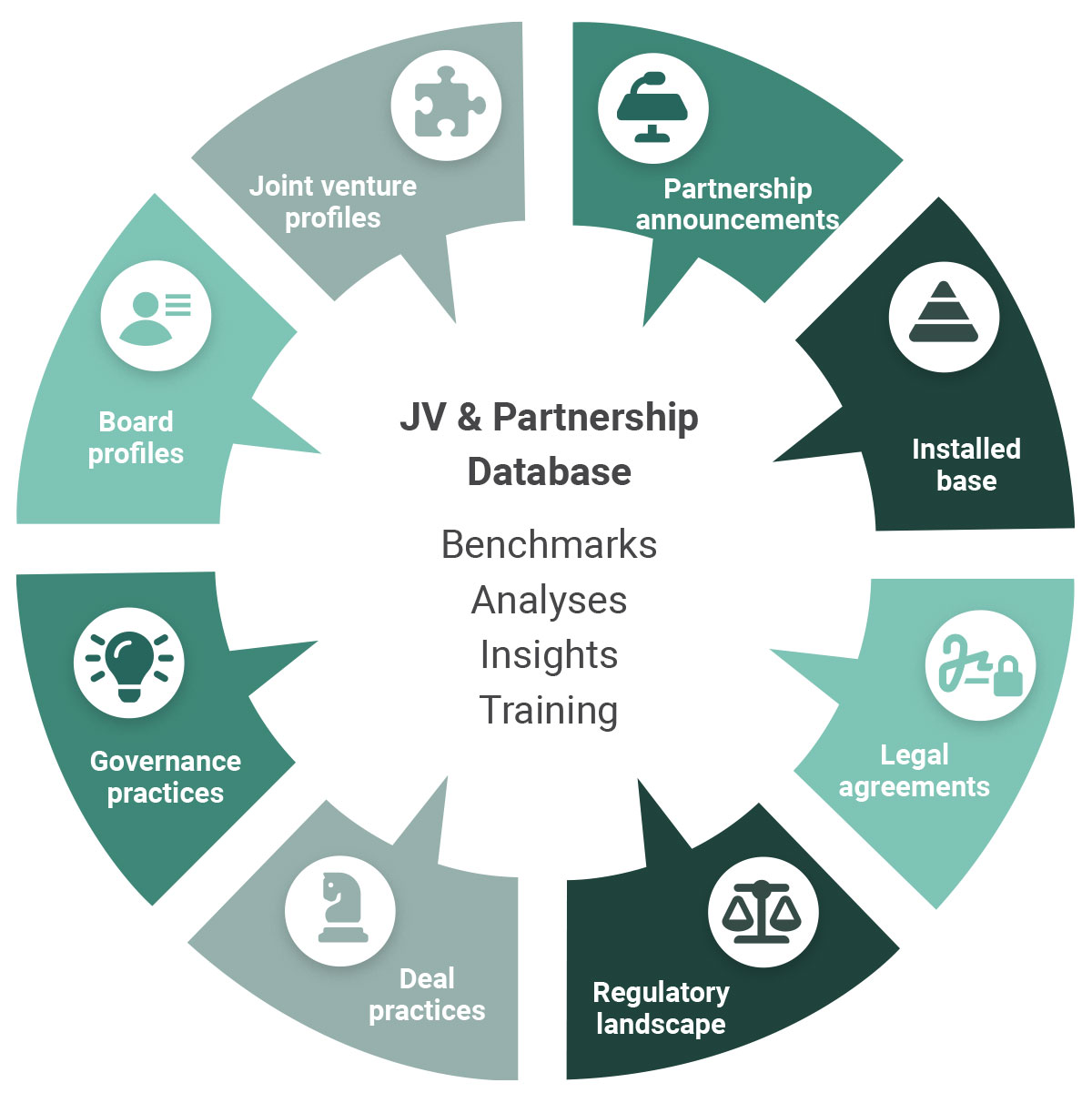

When working on JV transactions, we also leverage our unrivaled proprietary tools and data (Exhibit 4). For example, our teams have access to a proprietary database of 1,200+ joint venture-related contracts, 200+ case studies, a network of JV practitioners and experts, and other benchmarks and tools to advise on JV transactions in a more data-driven manner than in-house corporate development or legal teams could do.

In other cases, we serve both parties in a transaction as an independent expert outsider who facilitates negotiations, brings case examples/analogs, and adds an external perspective on what it will take for the JV – not an individual partner – to succeed. Ankura can play this role of the independent third party helping the collective process in a way that other advisors with duties to a single client cannot, which can be helpful for getting deals done – for instance by giving partners who are at an impasse on a key deal term a last-ditch effort to have an independent mediator try to resolve the conflict before the parties throw in the towel.

Regardless of what role we play, our combination of experience, data, independence, and cross-cutting perspectives can fill gaps in deal team manpower and capabilities and bring order and discipline to a JV transaction in much the same way as an investment bank brings experience and discipline to an M&A transaction. With Ankura as your JV Advisor, you don’t need to go it alone – you can be supported in whatever ways needed to shape your JV into a successful endeavor.