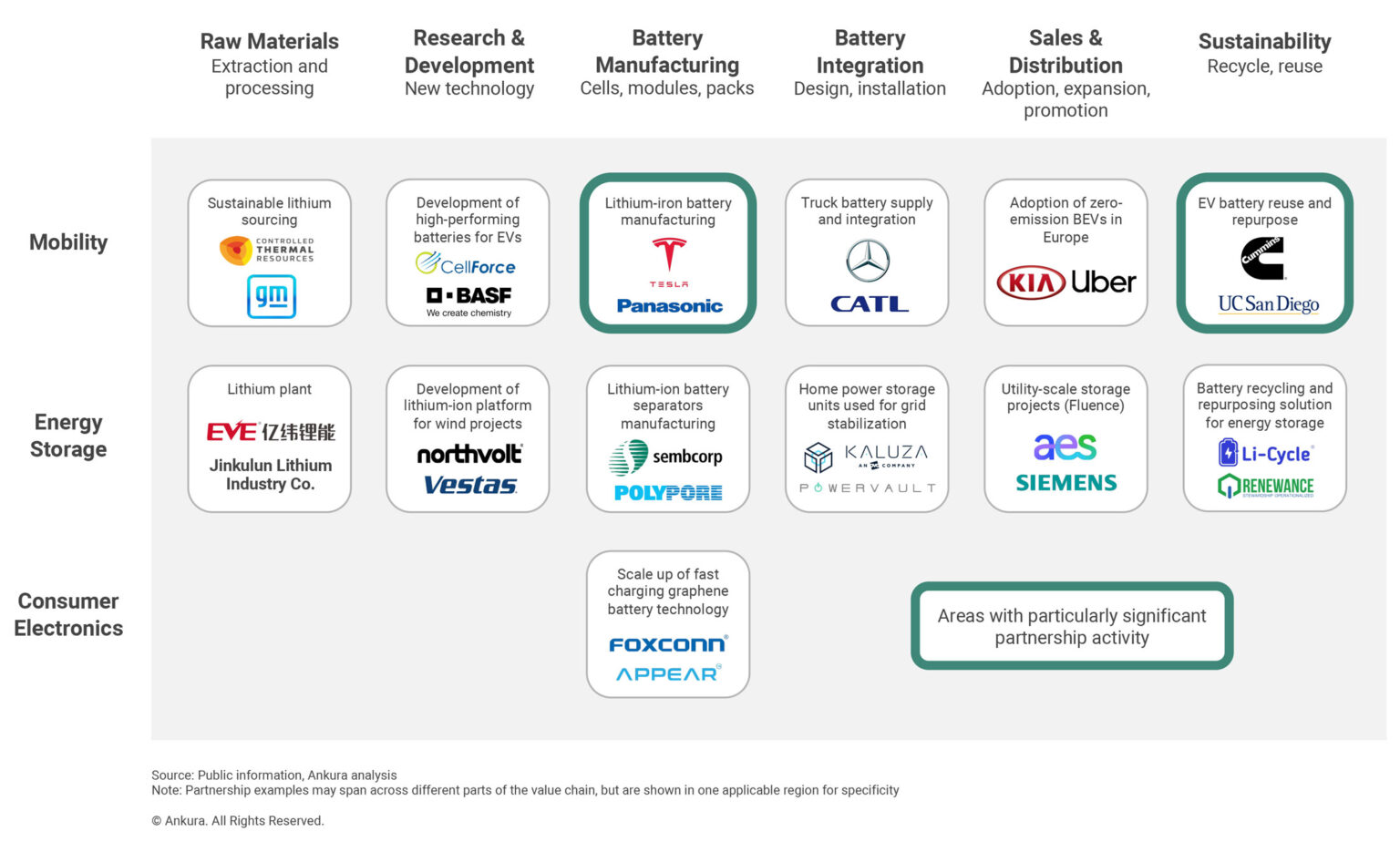

December 2021 – Batteries and other forms of electric storage are becoming more powerful every day. They are now used in our electric grids with the rise of utility-scale battery systems and in electric vehicles, including in hybrid electric vehicles (HEVs) and battery electric vehicles (BEVs). The creation and improvement of these new energy storage types and applications has caused a flurry of deal activity and, in particular, many joint ventures and partnerships (Exhibit 1). In the last three years alone, our JV Index, which tracks the largest, most material JV announcements globally, included 43 material partnership announcements specifically related to batteries and energy storage, not including partnerships related to electric vehicles or renewable energy more broadly.

Indeed, in the electric vehicle (EV) space, rising demand for electric vehicles and intense competition for market share has spurred many collaborations across the entire battery value chain. On one extreme, partnerships are addressing the shortage of raw materials required for energy storage. GM, for instance, is investing in one of the U.S.’s largest lithium projects to ensure the auto maker has its own source of the critical battery material. At the other extreme, companies aim to achieve the best approach for collecting and disassembling end-of-life EV batteries, like Redwood Materials and Ford, who started working together to use Redwood’s lithium-ion battery recycling technology to build a sustainable battery supply chain in the U.S. for Ford’s electric vehicles. In between are all manner of partnerships, including research and development of new battery technology, manufacturing of battery components and fuel cells, and integration into EVs. We have seen particular activity in battery manufacturing ventures, including Tesla and Panasonic, Geely Auto and LG Chem, Volkswagen and SK Innovation, and Toyota and CATL.

The same partnering rush has been seen in the energy storage, where companies are coming together at various stages in the value chain, from extracting raw materials to recycling utility-scale energy storage systems. Sustainable energy leader Vestas and battery manufacturer Northvolt have set up an R&D partnership to develop a lithium-ion battery storage solution to be deployed in wind power projects. Canadian resource recovery Li-Cycle has partnered with U.S.-based Renewance, a battery management company, to deliver a safe, sustainable, and cost-effective lithium-ion battery recycling solution for end-of-life energy storage systems. We foresee high partnership deal flow in the energy storage sector, particularly in Europe as the continent tries to increase its battery-manufacturing capacity to reduce reliance on imports.

Regardless of their position in the battery value chain, these energy storage partnerships span across various types of proven or potential energy storage solutions, from lithium-ion and lithium polymer batteries to the nickel-metal hydride batteries used in hybrid electric vehicles and to lead-acid batteries. For example, Germany’s BASF partnered with Cellforce, itself a JV between Porsche and Customcells, this summer to develop high-performing lithium-ion batteries for electric vehicles. Around the same time, American energy storage solutions provider, ESS, and Slovakian energy equipment supplier, InoBat, partnered to grow the presence of iron-flow battery technology and to establish R&D capabilities in Central and Eastern Europe. Fuel cell partnerships are also in the mix such as the alliance between Ballard and Linamar to develop fuel cell solutions for light-duty vehicles. The uncertainty regarding which of these technologies will take off and grow in market share in the coming years makes for interesting negotiations in these partnerships, with some partners willing to bet the company on a specific technology while others negotiate to hedge their bets.

There are endless partnering possibilities: among competitors, between automakers and battery suppliers, and even with governments, non-profits, and research institutions. Competitors Piaggio, KTM, Honda, and Yamaha set up swappable batteries consortium to develop common technical specifications for two-wheeled electric vehicles. Traditional automotive companies are pairing off with battery makers. For example, Volkswagen, took a stake in battery cell maker Northvolt. Volvo similarly formed a partnership with Northvolt. And Daimler bought a 33% stake in battery cells manufacturer Automotive Cells Company (ACC). These types of automotive-battery supplier partnerships are not new. In fact, Tesla formed a joint venture with Panasonic back in 2014 to build a “gigafactory” in the U.S. to manufacture batteries for Tesla cars.

Public-private partnerships are also on the rise. The European Batteries Partnership, for example, includes a wide range of European industrial and commercial companies, universities, research institutions, and trade associations and aims to support the creation of a competitive and sustainable battery industrial value chain in Europe. In the U.S., the Department of Energy is planning to launch new public-private partnerships to drive down battery costs and decarbonize the transportation sector. University of California San Diego is partnering with American engine maker, Cummins, to establish a multi-year partnership related to the reuse and repurposing of EV batteries.

So regardless of the place in the value chain, application where the battery will be used, battery technology, or type of partner, joint ventures and partnerships are playing a critical role in the development and commercialization of energy storage solutions. Ankura’s Joint Venture & Partnership practice helps set up, improve, and trouble shoot these dynamic and vibrant partnerships. Interested in learning more? Contact us.

Comments