Who’s Running the Show? Clarifying Delegations of Authority in Joint Ventures

Who needs to approve this? It’s a question commonly asked by corporate executives. But in joint ventures, it’s not that simple.

Fintech partnerships have become increasingly important for banks and others across the financial services sector. But are Fintech partnerships really delivering? There is growing evidence that many of these partnerships are not performing or creating value as expected. This article examines the role and nature of Fintech partnerships, challenges they typically face, and practical approaches for optimizing the value of Fintech partnerships going forward.

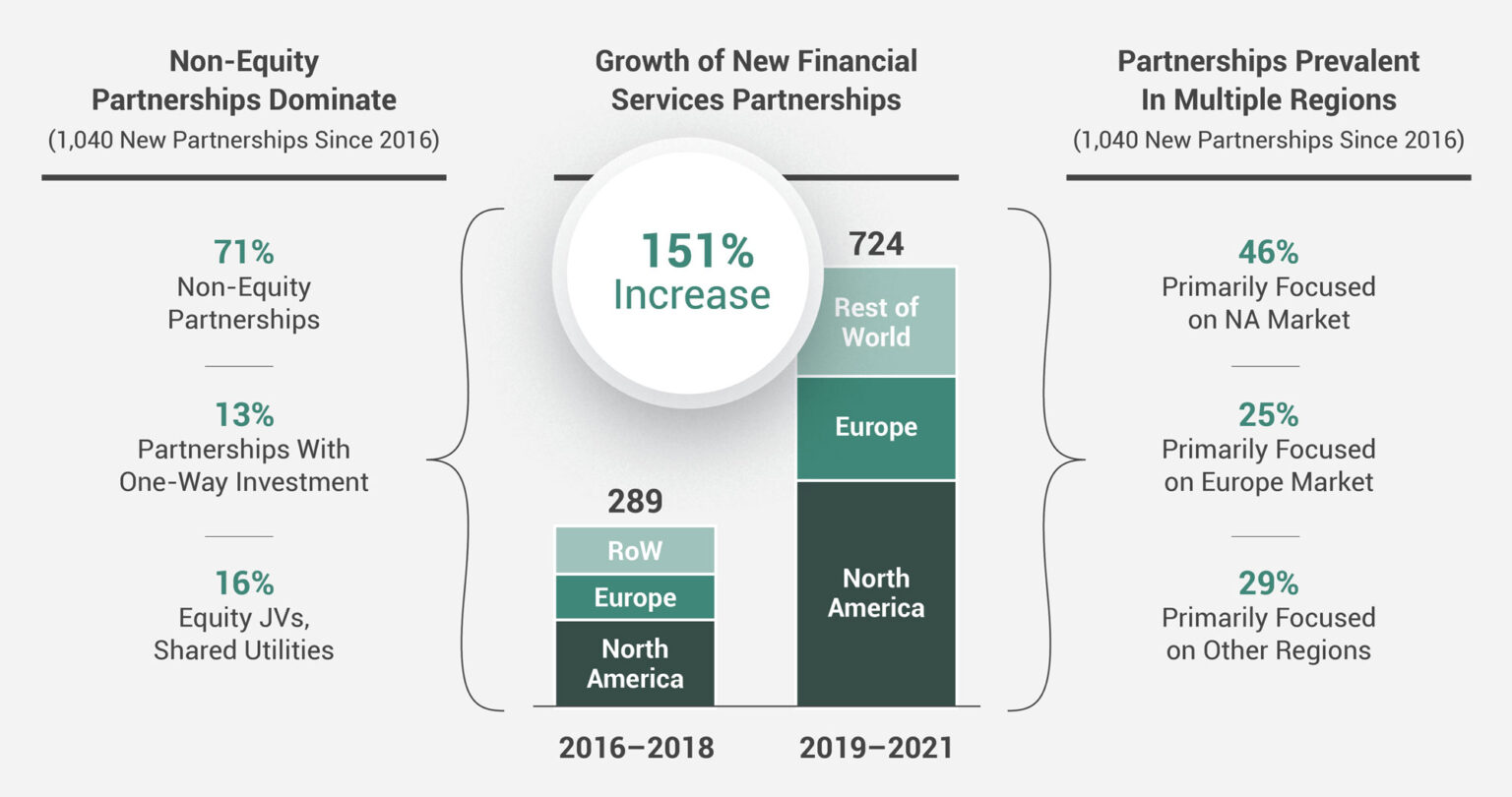

Partnerships across the financial services sector have increased dramatically since 2016, with the number of new partnerships announced globally more than doubling in the past three years (Exhibit 1). While some of these have involved equity-based joint ventures, our analysis of 1,040 new financial services partnerships during this period shows that the large majority have been non-equity partnerships, with 70 percent involving one or more Fintech. Fintech partnership growth has been accelerated by the shift toward online activity and related e-commerce growth throughout the pandemic, with Fintech partnership activity increasing across all regions.

Note: 1013 partnerships analyzed 2016-2021, plus another 27 analyzed in early 2022

© Ankura. All Rights Reserved.

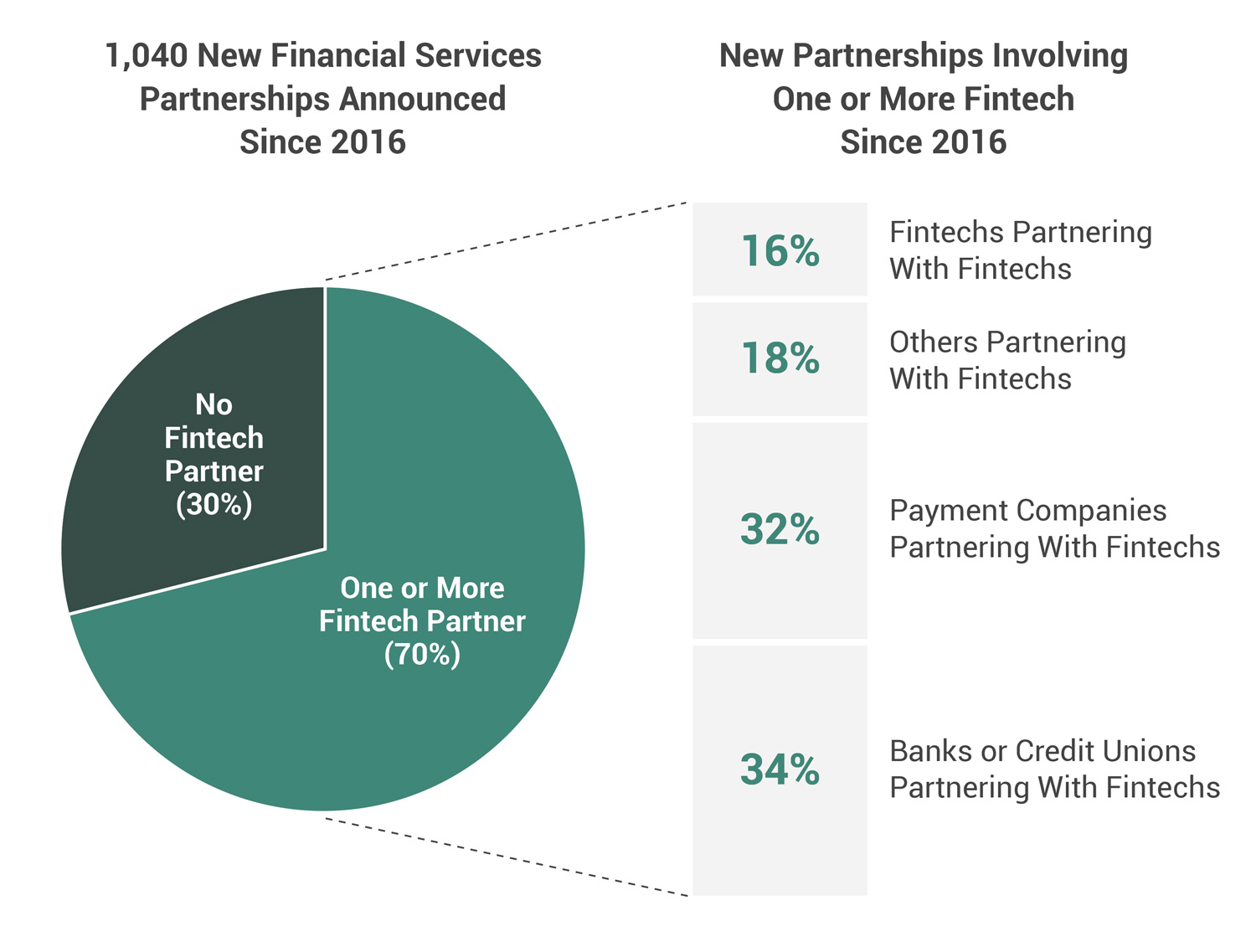

Partnering with a Fintech – to access innovative technology and keep up with the evolving digital, mobile, and other needs of customers – has become particularly important for banks, credit unions, payment companies, and other traditional players across the sector. Banks and credit unions count for about a third of all Fintech partnerships, while payment companies and networks count for another third (Exhibit 2). Others partnering with Fintechs include insurance companies, securities firms, wealth managers, technology providers and, not surprisingly, other Fintechs.

Note: Partnerships with no Fintech partner include combinations of banks, payment companies, insurers, securities firms, wealth managers, or others

© Ankura. All Rights Reserved.

Historically, partnerships within the financial services sector tended to take the form of collaborative associations such as Visa and Mastercard, shared utilities such as SWIFT and DTCC, trading exchanges such as the London Metal Exchange and Euroclear, or joint ventures for meeting cross-border market entry requirements such as in China and Latin America.

The nature and purposes of financial services partnerships have evolved over time. Today they are one of several useful means of creating mutual synergies and driving incremental partner value – along a spectrum ranging from simple sales and distribution arrangements, to strategic or marketing alliances, to more structured partnerships (with or without one-way investment), to equity joint ventures, to mergers and acquisitions.

Fintech partnerships are in most cases non-equity partnerships that serve several important purposes, with specific objectives that vary depending on the goals and circumstances of the partners involved. Established financial services players (large and small) often enter Fintech partnerships seeking innovative solutions or technology that can help them keep up with changing customer behaviors and needs. For example, the top 10 banks in the U.S and Europe (top 5 in each region) have entered into as many as 200 new Fintech partnerships over the past three years. US Bank’s recent partnership with Plaid is one such example:

Partnership Example: US Bank and Plaid. US Bank, the fifth largest bank in the United States, partnered with Fintech Plaid in 2021 to bring ‘open banking’ to its customers, allowing them to access and sync quickly across multiple digital and mobile money management applications. It might have taken years for the bank to replicate the full range of open banking capabilities available through Plaid. The preferred option was clearly a partnership, as reinforced by US Bank’s Chief Digital Officer, “What we did together with Plaid is a huge step forward . . . helping our customers with greater transparency, control and security.”

Fintechs meanwhile (large and small), often enter partnerships looking for ways to accelerate market and customer access, or otherwise capitalize on the established technology, risk management, or regulatory capabilities of more established players. Raistone’s partnership with Mastercard announced in April of this year is a good example:

Partnership Example: Raistone and Mastercard. Raistone, a Fintech provider of finance and working capital to small and medium businesses, recently partnered with Mastercard to expedite the SMB credit review and approval process by leveraging Mastercard’s virtual card technology. Raistone’s goal is to make it easier for businesses to get paid on invoices that would otherwise take months for reimbursement. “By using existing credit card rails and infrastructure,” according to Raistone’s CEO, “we’re able to reach businesses of all types . . . saving them time and money so they can get back to doing what they do best.”

Our analysis of 1,040 new financial services partnerships over the past five years underscores three primary Fintech partnership purposes:

This is the most common focus of all financial services partnerships, shared by over two-thirds of those analyzed. Accelerating growth can, of course, be accomplished in different ways, such as through expanded indirect distribution, advanced digital and mobile channel integration, product innovation to achieve faster time-to-market, and so on. Fintechs are also going outside the financial sector to find new opportunities for market expansion, as Payoneer has done by partnering with Amazon to access online marketplace sellers, and Finastra has done by partnering with Microsoft to grow small and medium business lending.

Technology and process innovation can advance multiple partner objectives, ranging from more efficient customer onboarding and servicing, to accelerated digital transformation, to core process efficiencies and cost reduction. There are numerous examples of Fintechs partnering with banks, payment companies, and other Fintechs for this purpose, including Razer with Visa for gaming payment processing, Paysend with Mastercard for direct-to-card remittances, Form3 with Goldman Sachs for added FX functionality, and Twilio with Stripe for PCI-compliant voice-based transactions.

Finally, while Fintechs can help others with innovative tools for financial and risk management and reporting, some Fintechs also need access to the balance sheet or regulatory licenses of banks or others to engage in certain kinds of business, such as BNPL or alternative lending. Cross River Bank in the U.S. has positioned itself as a banking partner to Fintechs to help meet some of these needs, working with Affirm, PayTile, GreenBox, and over 20 other Fintechs.

Exhibit 3 summarizes the most common purposes and objectives of Fintech as well as other financial services partnerships.

| Financial Services Partnerships By Primary Focus and Objective (1,040 New Partnerships Announced Since 2016) |

|

|---|---|

| 1) Market and Revenue Growth (68%) |

|

| 2) Technology and Process Innovation (31%) |

|

| 3) Risk and Financial Management, Compliance (13%) |

|

Note: Percentages add to more than 100% due to more than one primary focus of some partnerships

© Ankura. All Rights Reserved.

‘Bank-Fintech partnerships are under-performing’

– Forbes, January 2022

As with any collaborative relationship, Fintech partnerships are not easy, and evidence is emerging that many Fintech partnerships are not meeting performance expectations or delivering the value intended. Challenges faced by Fintech partnerships can be grouped into three categories:

Common challenges include mis-aligned or unclear goals and objectives, loosely defined operating model and metrics, and imbalance in economic or other incentives. If partnership goals and objectives are not clearly defined up-front, or financial and other incentives are not fully aligned or become imbalanced over time, it is unlikely that the partnership will succeed. Simple metrics and target timeframes, and the discipline to track and report against those regularly, can go a long way toward addressing these challenges and helping to ensure ultimate partnership success. Important questions to ask include:

We often see Fintech partnerships start out with great enthusiasm, only to find that leadership attention dwindles over time or that partnership governance arrangements do not allow for effective, timely communication of issues or decisions regarding possible solutions. Lack of effective partnership governance or leadership attention is a common challenge, as well as a common cause of partnership failure. Important questions to ask include:

Finally, even where partners are fully aligned and the above challenges are being addressed, if resources or capabilities dedicated to the partnership are inadequate, partnership results are likely to disappoint. In a recent survey of bank and credit union executives commissioned by Synctera, 47 percent responded that they do not have any personnel dedicated to their Fintech partnerships – about the same percentage of Fintech partnerships that ‘fail to fully achieve their objectives’ as reported by PYMNTS.com. Important questions to ask include:

Successful Fintech partnerships find ways to deal with these challenges proactively and effectively, including recognizing when things are not going as they should and then doing something about it!

The intention of partnerships is to create value – for partners, customers, employees, and investors. Optimizing partnership value means optimizing partnership structure, governance, leadership, and resourcing – in order to optimize overall partnership performance.

A useful starting point for those concerned that their Fintech partnership(s) may not be performing optimally is to undertake a structured partnership diagnostic that can help generate objective, fact-based answers to the following questions:

• How is our partnership performing overall, relative to intended objectives and results?

• What specifically is contributing to partnership progress or lack of expected progress?

• What changes or improvements do we need to prioritize, agree on, and implement?

With an objective understanding of what’s working well – and what isn’t – it is then possible for partners to discuss and agree on pragmatic improvement steps going forward, grounded in reality as opposed to supposition or emotion.

Ankura’s experience with hundreds of JVs and partnerships of all kinds – including Fintech partnerships – is that continuous improvement or restructuring can help to realize full partnership value and unlock up to 30 percent of upside by streamlining stagnant governance approaches, resetting ways of working together, and updating partnership economics to reflect today’s reality versus initial, and sometimes unrealistic, expectations. Our research also shows that those who are more active in partnership restructuring over time generate higher returns on investment than their peers. (See our article on Partnerships in Motion.)

For companies with larger partnership portfolios, a structured diagnostic applied across multiple deals can also be useful in revealing common issues that derive from a company’s overall partnership approach, which can be addressed and resolved unilaterally to ensure coherence of cross-partnership decision making and effective management at scale.

In sum, Fintech partnerships are increasingly important for banks, payment companies and others across the financial services sector. These partnerships are not easy, however, and face a number of important challenges. In many cases, they may not be delivering the value that partners expect. For existing Fintech partnerships or partnership portfolios, a focused diagnostic can be a good first step toward optimizing partnership performance and value going forward.

We understand that succeeding in joint ventures and partnerships requires a blend of hard facts and analysis, with an ability to align partners around a common vision and practical solutions that reflect their different interests and constraints. Our team is composed of strategy consultants, transaction attorneys, and investment bankers with significant experience on joint ventures and partnerships – reflecting the unique skillset required to design and evolve these ventures. We also bring an unrivaled database of deal terms and governance practices in joint ventures and partnerships, as well as proprietary standards, which allow us to benchmark transaction structures and existing ventures, and thus better identify and build alignment around gaps and potential solutions. Contact us to learn more about how we can help you.

Comments