JANUARY 2023 – Happy New Year!

No rest for the weary. Unlike our friends in investment banking and corporate M&A who are enjoying leisurely holidays (albeit with smaller bonuses), the heady days and nights of dealmakers working on joint ventures and partnerships show no signs of relenting.

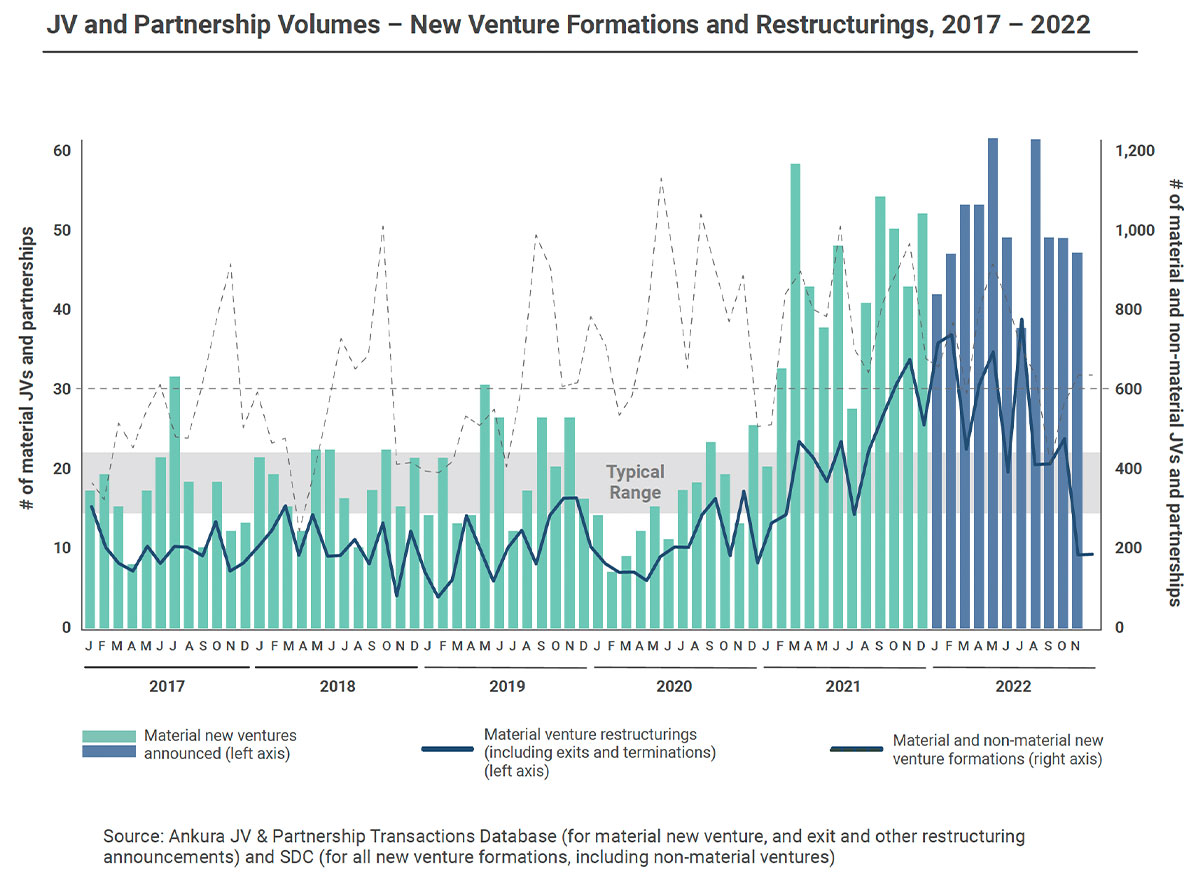

Bucking the year’s step-back in M&A, the volume of new joint ventures and partnerships remained strong across the year, with 2022 outpacing 2021, which shattered historic records. We see no signs of this changing as we enter 2023, where the macro forces driving partnerships remain in place.

The year included some extremely large transactions, including GSK and Pfizer IPO’ing their consumer health joint venture, Haleon, that valued the venture at approximately $36.5 billion, making it Europe’s biggest listing in a decade. It also saw a series of restructurings and exits, including the rapid unwinding of many joint ventures in Russia by companies like Ford, Shell, and Uber. And Volkswagen emerged as our Dealmaker of the Year, based on a combination of large new transactions and exits.

Below is our recap of the year that was 2022.

KEY TRENDS

- JV and Partnership Volumes Stay Steady. The headwinds hitting M&A – including increased financing costs due to higher interest rates, recessionary fears that leave corporate boards hesitant to make large capital outlays, and a disconnect between buyer and seller valuations – are not impacting joint venture and non-equity partnership volumes. Overall, through eleven months of the year, the global volume of material new joint ventures and non-equity partnerships has increased by 13% compared to 2021, and enters 2023 with strong momentum. There were large deals in 2022: 15% of last year’s deals involved investments or valuations of at least $1 billion, compared to 11% in 2021. A clear indicator that JVs and partnerships remain the preferred transaction structure for sharing investments, spreading risks, making calculated bets on future opportunities, and ultimately, driving performance improvements.

- Restructurings Spike. 2022 recorded an unprecedented level of venture restructurings, including exits, buyouts, and initial public offerings. In the first half of the year, many restructurings took the form of exits driven by external pressures. Firms like Shell, Equinor, Uber, and McDonald’s clamored to cut ties with Russia and Russian partners, and even on unfavorable terms like massive discounts to current valuations, staggered payments, or costly options to buy back their stakes. Meanwhile, Facebook came under intense scrutiny from regulators and lawmakers, and shuttered its ambitious effort into cryptocurrency, The Diem Association, a partnership that had the backing of big shots like Visa and PayPal. Today, in the wake of FTX’s collapse, that move looks prophetic. Elsewhere restructurings were more deliberate and growth-oriented. Global miner Rio Tinto, for instance, announced a deal to buy out the public shareholders in a Canadian entity that held its interest in Oyu Tolgoi, a massive copper mine joint venture with the Mongolian government. The data continues to show that venture restructuring is a sign of strength, as firms that put their partnership portfolios on the move show higher returns on capital, while, paradoxically, those with higher partner failure rates have higher corporate revenue growth.

- Green JV and Partnership Deals Dominate. Deals focused on preventing or mitigating adverse impacts of climate change comprised 61% of new JV and partnership volumes, up from only 19% three years ago. The hydrogen and ammonia value chain, carbon capture and storage, fixed and floating offshore wind, bio-based fuels and materials, and electric vehicles were hubs of intensive green JV and partnership deal activity in 2022, and will continue to dominate deal making over 2023 as companies up the ante on their sustainability commitments and initiatives. Green hydrogen is spawning a whole series of joint ventures and partnerships by a diverse array of technology start-ups and established energy, power, industrial, and mining players such as Plug Power, BP, Iberdrola, Shell, Siemens, Air Liquide, Equinor, Fortescue, RWE, Osaka Gas, Adani, Repsol, and TotalEnergies.

- Certain Sectors Sizzle: JV and partnership deal activity heated up several industries, each fueled by major underlying trends. In financial services, banks and payment companies continued to partner with fintechs at exponential rates and in increasingly complex deals, despite regulators advising caution and stringent oversight. Automotive companies partnered at a blistering pace to secure supplies of critical battery materials, speed the commercialization of advanced battery technology, build out networks of charging stations, recycle used batteries, and share the multi-billion capex requirements of large-scale production plants. Telecommunication players collaborated for in-country consolidations, network and infrastructure monetization, and satellite to cellphone connectivity. Oil and gas partnerships focused on regional and basin consolidations, exits from troubled geographies, restructurings of conventional asset portfolios, investments in natural gas and carbon capture, and operational efficiency. In metals and mining, predominant deal drivers were electric vehicle and renewable energy metals, and steel decarbonization. Fighter jets, electric defense vehicles, urban air mobility, and green hydrogen applications fed aerospace and defense deal volumes. Plastics recycling, bio-based materials and processes, green ammonia, and portfolio emissions reduction objectives were predominant themes in the chemicals industry. While pharma and biotech companies struck partnerships for mRNA-based therapeutics, cancer treatments, AI-powered drug discovery and development, and molecular glue therapies for protein degradation.

DEALS OF THE YEAR

Here’s our take on the dozen largest or coolest deals of the year:

- Boeing and Northrop Grumman formed Deep Space Transport, a joint venture to provide an estimated $80 billion in launch services to NASA for Artemis missions to the moon or other deep-space destinations

- Orange and MasMovil entered into a $19 billion 50:50 joint venture to combine their fixed and mobile telecommunications operations in Spain

- Renault entered into a 50:50 gasoline engine and hybrid technology joint venture with Chinese automaker Geely that will manage 17 production plants and five R&D centers on three continents, and employ 19,000 people

- GSK and Pfizer IPO-ed their consumer health joint venture, Haleon, in Europe’s biggest listing in a decade

- Lanxess and Advent International entered into a 40:60 JV to jointly acquire DSM’s engineering materials business, and combine it with Lanxess’ high-performance materials unit into a $7 billion business

- Spanish energy company Repsol entered into a $19 billion joint venture with EIG for its entire global upstream oil and gas business

- In the UAE, local state-owned powerhouses Mubadala, TAQA, and ADNOC consolidated their renewable energy and green hydrogen efforts into two joint ventures under the Masdar brand, while ADNOC and Borealis listed their polyolefins joint venture in Abu Dhabi’s largest-ever IPO

- Across the gulf, QatarEnergy formed joint ventures with Shell, ExxonMobil, TotalEnergies, ConocoPhillips, and Eni to undertake a $50 billion expansion of the North Field, as global demand for liquefied natural gas soars in the wake of the Russian invasion of Ukraine

- Finnish pulp, paper, and forestry company Stora Enso entered into a partnership with Northvolt to develop batteries from forestry byproducts, and another partnership with Voodin Blade to develop wind turbine blades from wood

- Kraft Heinz entered into a joint venture with TheNotCompany to develop plant-based meat and dairy alternative versions of Kraft products

- Swiss building materials giant Holcim made an investment in and expanded its partnership with German startup Magment to develop a magnetizable concrete technology for road surfaces that will allow electric vehicles to recharge wirelessly while in motion

- Bosch and IBM entered into a partnership to use quantum computing and simulation technology to find alternatives to the rare earths and battery metals needed for electric vehicles

DEALMAKER OF THE YEAR

Volkswagen is our pick for Dealmaker of the Year. The German automaker announced several partnerships across the electric vehicle value chain and in autonomous vehicles in 2022. VW is selling a minority stake in its US electric vehicle recharging business to Siemens at a valuation of more than $2 billion. It plans to install 8,000 fast-charging spots across Europe by 2024 in a partnership with BP. The company is teaming with Nevada startup Redwood Materials to recycle batteries in the US, forming joint ventures with Huayou Cobalt and Tsingshan Group to secure nickel and cobalt supplies for electric vehicles in China, and planning a joint venture with Bosch in battery production systems. It is also considering a partnership with Foxconn in electric vehicle manufacturing in North America. In autonomous vehicles, the company scrapped its partnership with Argo AI, while expanding its collaboration with Mobileye and entering a nearly $3 billion joint venture with one of China’s leading designers of artificial intelligence chips, Horizon Robotics, to accelerate the development of AI-assisted and driverless cars.

~~~

JV and partnership transactions have shifted into a new gear, achieving and sustaining unprecedented velocity over the last 24 months. Partnerships have emerged as the transaction vehicle of choice for companies to access and commercialize innovation, with an explosion of recent partnership activity most notable in financial services, consumer goods, and food and agriculture – joining sectors like life sciences, healthcare, and tech, which have long relied on partnerships to generate new products and technologies. JVs and partnerships have also become central to developing more sustainable businesses, as we have seen automakers using partnerships to build electric vehicle value chains from scratch, while oil companies using partnerships to move into renewable energy, including wind, solar, and hydrogen. The frenzy is poised to continue.

Comments