November 2011 — TODAY, COMPANIES HAVE MORE than $2 trillion invested in joint ventures around the world. For many large companies – especially in the natural resources, high tech, telecoms, and industrial sectors – the corporate portfolio of JVs accounts for 10-30% of corporate revenue, income, or invested assets.

While many JVs are staffed by outside hires or by individuals who have severed their employment relationship with one of the parent companies, the majority of joint ventures also include at least some staff loaned – or “seconded” – from a parent. Our analysis of more than 100 JVs around the world shows that 55% of large JVs have a seconded CEO, President, or General Manager, and 80% have at least one member of top management seconded from a parent company.

There are many good reasons to use secondees in joint ventures. Secondees allow the parent company to quickly place trusted talent into a key asset or new business. Secondees can help ensure that a JV puts in place processes (e.g., budgeting, financial management, health and safety) that are consistent with the parent company’s standards. Secondees also serve as a key means for the JV to access resources from the parent company – as well as help the parent company access skills from the venture.

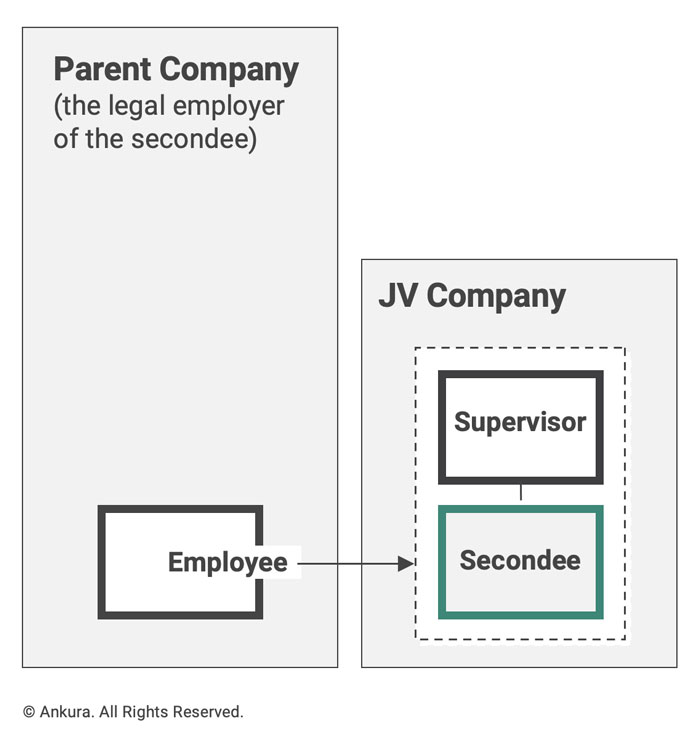

However, the non-traditional employment status of secondees introduces certain choices, and problems not seen in more traditional staffing models. Secondees are left dangling in a “dual world” – working for the joint venture (and often reporting to and / or supervising staff who are not from their parent company) while, at the same time, remaining legally, administratively, financially, and emotionally tethered to their parent company

This unusual construct can leave secondees in a precarious place. To whom do secondees owe their principal loyalty – and how do they manage situations when the interests of the venture and parent diverge? Who will conduct secondee performance reviews and decide on final ratings? If final ratings are determined by the parent, how does the JV ensure that the secondee is not disadvantaged relative to parent company employees when crosscalibrations and forced distributions occur?

Likewise, how can the parent company ensure that secondees are held to tough but appropriate performance standards when they are supervised by non-company staff, who may not share the same managerial philosophies and standards? Who will manage a secondee’s broader career development, and work to reintegrate the secondee back into a better job in the parent company?

Ill-defined secondee policies are a root-cause of JV performance and health issues.[1]For example, Ankura benchmarked the secondee practices and policies of 14 global companies with large portfolios of JVs, many of which included secondees, across roughly 20 different dimensions of … Continue reading When companies do not have a coherent approach to how secondees will be selected, managed, and incentivized – and how the inherently-competing loyalties of serving as a secondee will be addressed – the results can undermine the secondee employee value proposition. High caliber parent company talent avoids JVs, or is quick to exit once there. Secondees that stick it out do not receive the management support and performance feedback they need to grow. We have found that, as an employee class, secondees tend to have lower performance profiles, contain a lower proportion of high-potential talent, and have higher turnover than employees working in wholly-owned businesses.

It doesn’t have to be this way.

In addition, secondee matters are a source of disputes between the partners, exacerbating mistrust. Is it fair for the JV to reimburse the parent companies for all secondee-related costs even when one parent company pays significantly higher wages and calculates secondee annual bonus and long-term compensation payouts based on company (rather than venture) performance? Is it appropriate for secondees to “report back” to functional executives in their parent company – in effect creating a dotted line reporting relationship into which the secondee’s direct supervisor has at best partial visibility? As one JV CEO explained:

“I don’t think there’s some master plan to drive me crazy. But when secondees and parent companies continue to behave like the JV is like any old operating unit, it creates an inherently dysfunctional system. That system is prone to misunderstanding, information and cost asymmetries, and lack of true organizational cohesion. Unmanaged, it creates a steady stream of low- to mid-level disagreements between the partners that are distracting everyone away from the job we are being asked to do.”

Roll this all together, and we have a source of JV underperformance.

JV Secondee Guidelines – An Introduction

To address these issues, Ankura has developed a set of JV Secondee Guidelines – first-of-its-kind standards for how companies should approach the selection and management of secondees in their joint ventures. Our hope is that these Guidelines will advance the dialogue – and serve as “food for thought” for those managing secondees, Board members who oversee JVs containing secondees, those in the corporate center with some responsibility for joint venture policies, and for the secondees themselves.

Beyond advancing the discourse, we hope that companies use these Guidelines as an objective basis against which to evaluate their current secondee practices[2]These Secondee Guidelines are similar in structure – and intended to complement – the set of Joint Venture Governance Guidelines developed by CalPERS and Ankura. – and either will adopt these Guidelines or use them as the basis for developing their own more customized policies. If followed, we believe these Guidelines will lead higher-caliber talent signing up for JVs, staying longer, and performing better when there.

The full set of these Guidelines is available on our website, with additional tools, benchmarking data, sample agreements available to subscribers (Exhibit 1).

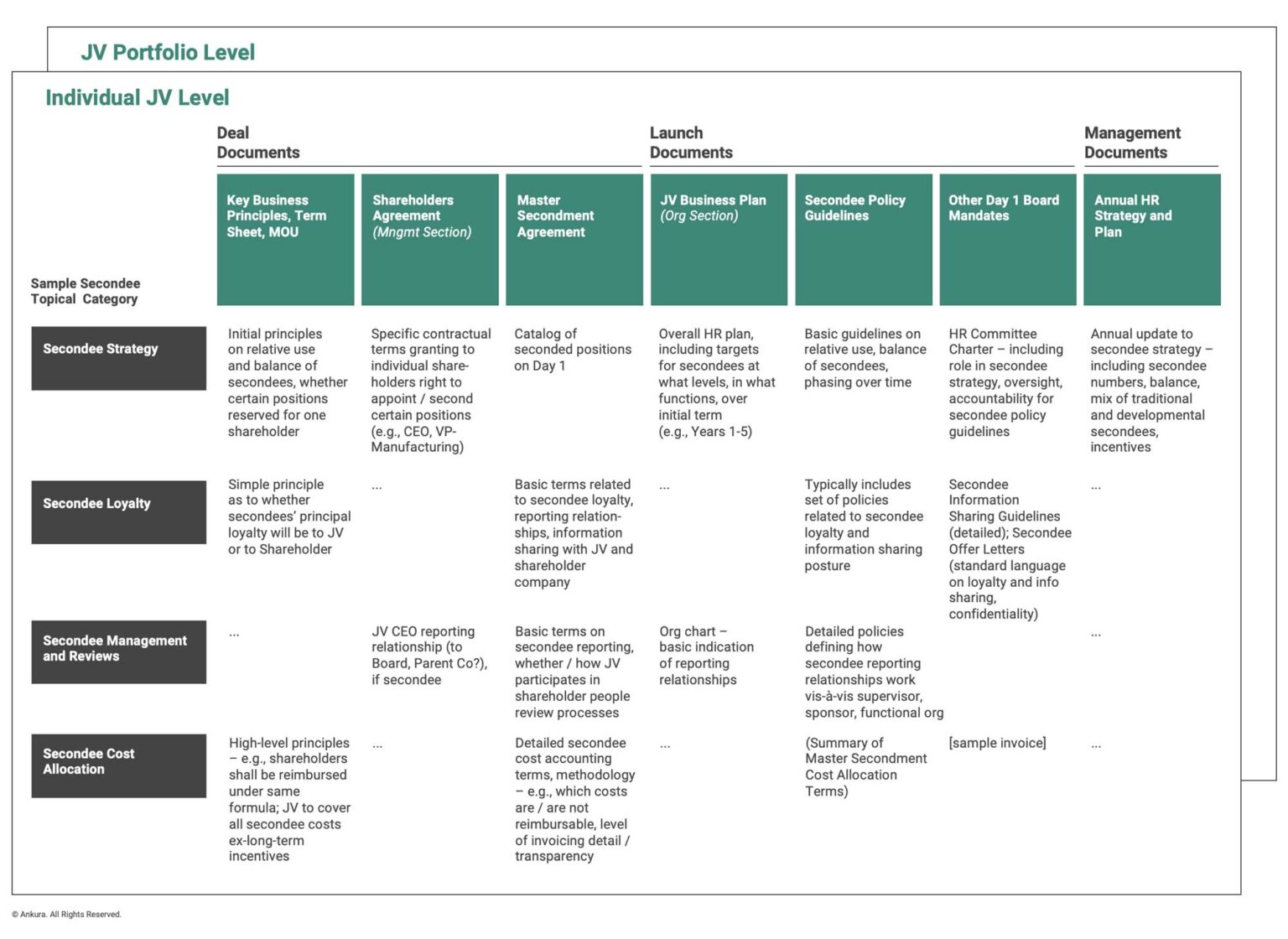

Before outlining some of the Guidelines, a few explanations are in order. First, these Guidelines are most applicable to joint ventures with at least a modest degree of independence – i.e., are not purely operated by the people and on the infrastructure, systems, and processes of one parent company. Second, to fully implement these Guidelines, companies will need to act at both the corporate and joint venture levels (Exhibit 2).

Exhibit 2: Secondee Definition

Secondee – (n): a legal employee of one company who has been temporarily loaned to another organization, including a joint venture in which the company holds an interest, to perform a specific role within that other organization. Typically, a period of secondment will last for 1-5 years.

Third, the implementation of these (or any other) guidelines at the joint venture level will require the shareholders to work through issues across the venture lifecycle, and to memorialize their agreement in different venture documents – initially in the shareholders agreement, master secondment agreement, and the initial business plan; later on, in the JV’s HR policies and secondee offer letters and review processes (Exhibit 3).

The purpose of this memo is to highlight a few of the most important – or most likely to be absent – of these Guidelines, and their underlying context and rationale.

Individual JV-level Secondee Guidelines

Ankura believes that there are a set of minimum requirements for how companies should collectively approach secondees on a range of topics. These topics relate to overall secondee strategy; secondee loyalty; secondee job scoping and selection; secondee management and reporting relationships; secondee performance reviews and ratings; secondee compensation; and secondee cost allocation. We believe that following a set of minimum requirements – or guidelines – will increase partner alignment and trust, increase accountability, and enhance the secondee employee value proposition – thereby improving JV health and performance.

Secondee Strategy

Having a clear and shared understanding of how and what types of secondees will be used in the JV, and how this will change over time, is the cornerstone of good secondee management. Therefore, Ankura suggests:

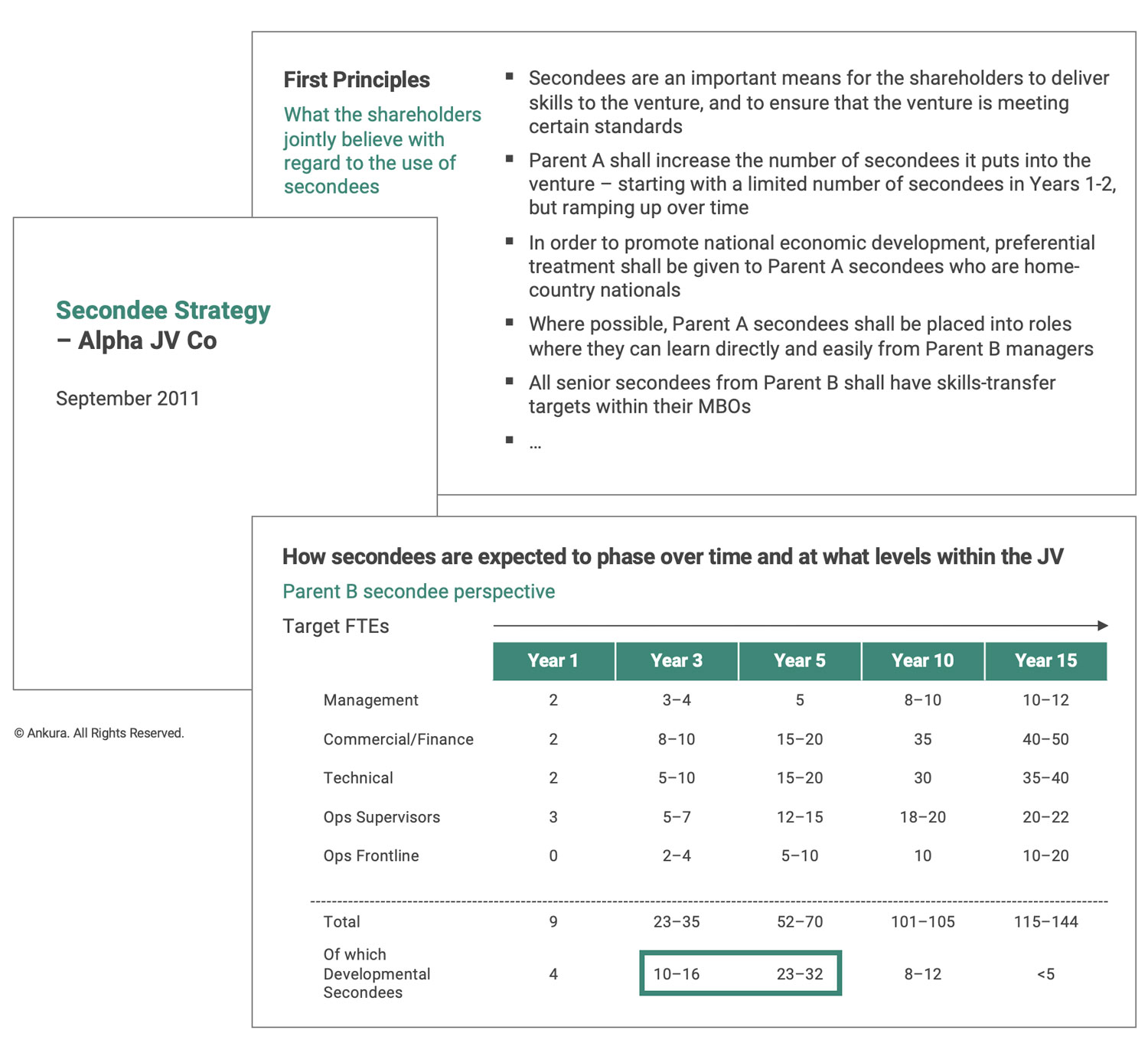

- If the JV has more than a few secondees, the JV Board shall put in place a “Secondee Strategy” that shall include the overall target number of secondees phased over time, the relative balance of secondees between the parent companies, guidance on the types of positions where secondees are most valuable, and other matters (Exhibit 4).

A well-articulated Secondee Strategy might include guidance on how secondees should be placed vis-à-vis other staff – for instance, a general desire to place secondees in direct supervisory or subordinate relationships with non-secondees to promote skills transfer vs. clustering secondees from a single shareholder in order to reduce IP leakage or promote the JV’s ability to follow certain shareholder company processes. In other JVs, a Secondee Strategy might include a view on the relative use of “developmental secondees” – i.e., secondees in early career training or apprenticeship roles.

To understand how this comes to life, consider a multi-billion-dollar JV between a Middle Eastern company and a US partner. The Middle Eastern company was acquiring a 50% interest in a large, global business unit of the US partner, effectively turning that BU into a JV. Because the Middle Eastern partner was entering into the JV to build capabilities and accelerate national economic development in higher-technology sectors, skills transfer was a critical deal driver.

Secondment of staff was a principal mechanism for delivering skills transfer. As such, the Secondee Strategy included not only a detailed view on the traditional secondee strategy elements (e.g., target number of secondees, phasing over time, relative use of developmental secondees), but also other features. These included a view of whether home-country nationals would be given preferential treatment for positions, a target number of reverse secondments (where JV employees are seconded into a parent company), and the extent to which senior JV staff would have explicit skills-transfer objectives within their performance targets.

Secondee Loyalty

It is an untenable position to build an organization with staff who do not share unified goals or operate under the same management structure. Therefore, Ankura suggests:

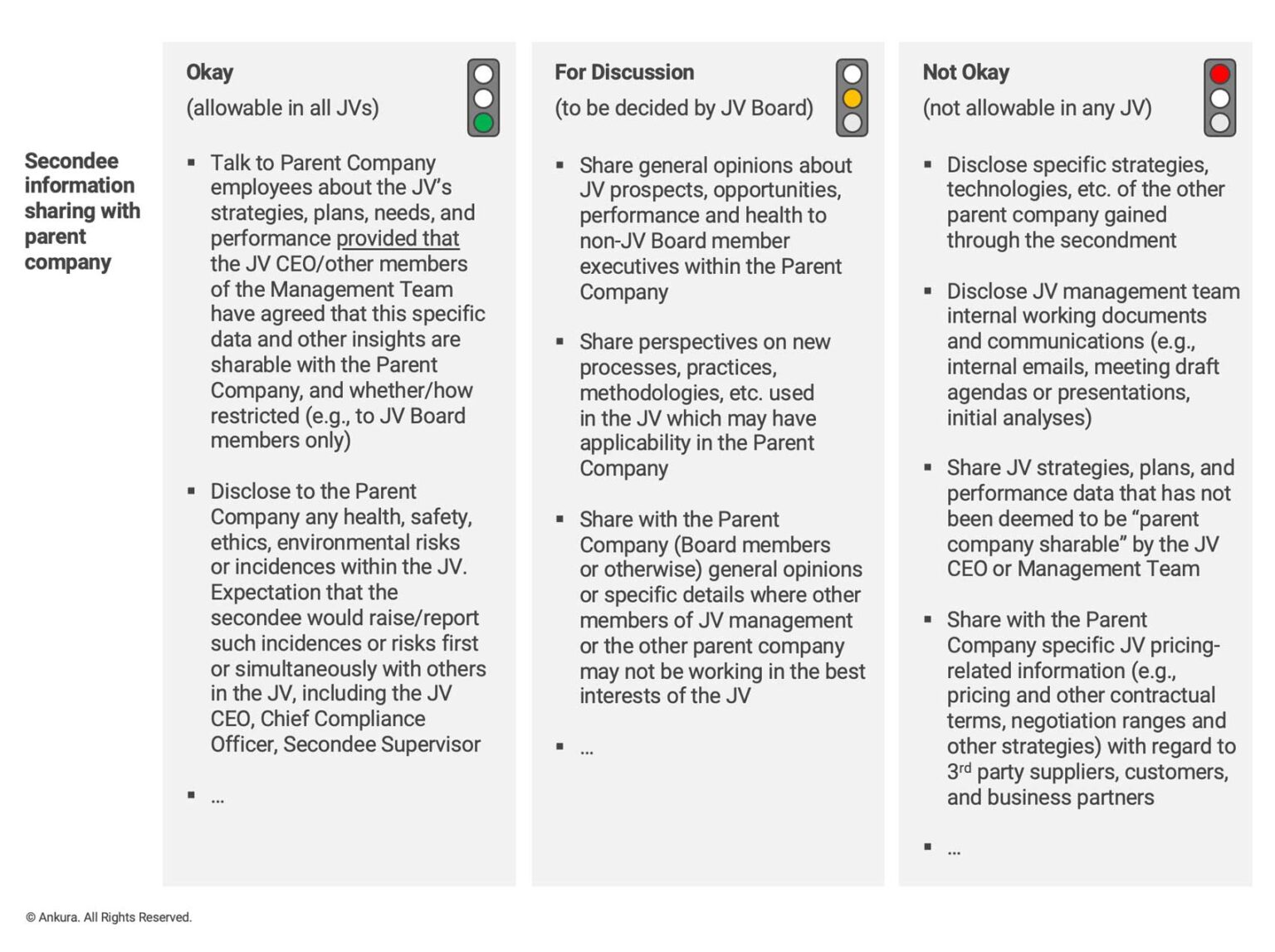

- Secondees shall have their primary loyalty to the JV during their period of secondment and shall not perform – or be asked to perform – activities that undermine that loyalty.

We have developed a set of policies to help clarify the nature of secondee loyalty and information sharing (Exhibit 5). Such guideposts are often necessary as secondees find themselves in a unique position of being legal employees of one shareholder (and dependent on the shareholder for future career opportunities), while simultaneously being asked to advance the interests of a joint venture company for the period of secondment.

Secondee Job Scoping and Selection

We believe deeply in clear accountability and empowering management.3 In a JV, this means that the JV Board should set clear performance expectations, and then hold management accountable for delivering against those targets. This accountability can be seriously undermined if the shareholders impose large numbers of secondees on a venture, do not respect agreed reporting relationships and communications channels, or move secondees in or out of the venture with little warning. Therefore, Ankura recommends:

- The number of “slots” – that is, positions designated in the legal agreements to be reserved for secondees from a particular shareholder – should be kept to a minimum.

- The JV CEO, President or General Manager[3]The exact title for the person leading a joint venture will vary, based on geography, industry, and scope of the business., likely with other members of the management team, shall be accountable for scoping each job, defining requirements, and interviewing and selecting candidates, including secondees.[4]Ankura believes that the JV Management Team, led by the JV CEO, should make the final determination as to who to bring into the joint venture – whether those are secondees or otherwise. For … Continue reading

- For positions not designated as slots, the JV CEO, President or General Manager shall decide to whom to offer the position, including deciding to promote internally, hire externally, or select a secondee. In other words, shareholders should not expect that if they offer only one secondee candidate – or multiple under-qualified candidates – that these candidates shall be accepted by the JV.

- Secondees shall join the JV for a minimum 3-year commitment, which may be extended based on individual, shareholder, and venture needs. The shareholder or the JV shall provide the other party with a minimum 3-month “notice period” prior to repatriating a secondee. Only on an exception’s basis shall the shareholder companies remove secondees prior to the completion of the agreed secondment or with less notice.[5]Developmental secondees – i.e., secondees who are placed into the venture for early career rotation and whose costs are paid by the shareholder – would normally be excepted from this minimum … Continue reading

Ankura benchmarked the prevalence of these and other secondee selection practices in several dozen joint ventures, and found that while compliance remains mixed, there is a trend towards greater adoption of these practices.[6]For subscribers of Ankura Joint Venture Advisory Group, please see “Benchmarking JV Secondee Practices.”

Secondee Management and Reporting Relationships

Like any employee, a secondee will benefit from clear reporting relationships and senior counsel in designing the stepping-stones across a broader career. But in too many cases, secondees become structurally unhooked from that “good strong boss relationship.”

A senior US executive who sits on four large JV Boards puts it this way:

“Over the years, I’ve seen lots of situations where people went off as secondees into joint ventures and were viewed as pretty capable when they left. But over time, they tend to fade… and when people at the company look at them again, they say, ‘How did this bozo ever get that position in the first place?’

The problem partly ties back to the profile of the person – who we are picking as secondees. But, more damningly on us, is how secondees are managed – that is, the level, consistency and intensity of performance feedback they get, the amount of coaching, and the level of access to training. In many cases, a secondee’s boss just can’t fully manage a secondee – because they don’t have a full grip on the classic management levers. And when that happens, it’s virtually guaranteed that a decent but not high performer goes into decline.”

Given these and other risks of a clouded performance management picture, Ankura suggests:

- Secondees shall have a solid-line and day-to-day reporting relationship to their direct Supervisor in the JV. The Supervisor in the JV shall lead the secondee’s performance review and rating.[7]In certain exceptional circumstances, a Sponsor may be best positioned to lead the secondee’s performance review. For example, in Qatar, one major international energy company found that when … Continue reading

- Each secondee shall have a named Sponsor within their shareholder company. This Sponsor shall administratively oversee the secondee, provide career counsel, and help plan the secondee’s return to the Company at the end of their secondment.

The Supervisor and Sponsor are the backbone of a strong Secondee Management system.

Beyond the relationship with their Sponsor, secondees (and the JV) will likely benefit from the secondee remaining well-connected to their shareholder company.[8]Some common ways that secondees remain connected to their shareholder company include (1) participation in company training and development; (2) inclusion in the company’s job-specific peer … Continue reading How, as a matter of policy, secondees should maintain this connection should be agreed by the JV Board or HR Committee, and memorialized in the JV’s Secondee Policies, Secondment Agreements, and other materials.

Even more important, however, is spelling out the approach toward secondee dotted-line reporting relationships. In many JVs, at least some secondees arrive from shareholder companies with matrixed organizations – i.e., have a direct boss at the local operating entity level, but have a dotted line reporting relationship to a functional organization elsewhere in the company. For instance, a BU CFO might have a direct reporting relationship to the BU President, but a dotted line to the Corporate CFO. Likewise, a Project Director overseeing the design and construction of a major capital expansion project might report to an Asset, BU or Country Head, but have a (thick) dotted line reporting relationship to the company’s project development organization.

While sensible in a wholly-owned company, this construct can be highly problematic in joint ventures if expectations are not carefully defined. The problem stems from the fact that the shareholders usually approach “dotted-line” reporting in different ways. As one JV Board member told us recently:

“In our partner, dotted-line means just that: a very light line with well-separated dashes. In our company, dotted-line reporting is quite different – the dots run so close together that the naked, untrained human eye sees a thick solid line. People who are staffed in a business or asset are required to report back every week to the functional organization – and the head of that functional organization is held personally accountable for the weekly performance of that function within each operating entity in the portfolio.”

When companies enter into JVs with partners with different approaches to dotted-line reporting, a secondee management system can shudder with stress. This is especially likely when a JV is built on a “mixed staffing model” – i.e., composed of seconded and non-seconded staff, or secondees from multiple shareholders. Therefore, we suggest:

- Unless otherwise and explicitly agreed by the JV CEO or Board of Directors, secondees shall not have a dotted-line or informal reporting relationship to their Sponsor or to other executives within their parent company.

A few JVs have developed interesting ways to retain dotted-line reporting relationships while not undermining the JV. For example, in a 50-50 metals and mining JV, the Board and Management defined a set of secondee policies that stated that all members of the JV management team (including but not limited to secondees) would have dotted-line reporting relationships to functional executives within the shareholders – but that this dotted-line reporting relationship would work under some ground rules. These included: (1) that it would be a “joint and coordinated” dotted line relationship, rather than “dual and separate” reporting to relevant functional executives within each shareholder, and (2) that the dotted-line relationship was “principally for information reporting purposes,” to keep the Department Heads apprised of events in the JV and sufficiently informed to identify potential risks and report internally on JV performance and plans.[9]Other ground rules specified that this dotted line reporting relationship: (1) “Does not create an extra, undue burden on the Joint Venture Company that is dissimilar to the level of operational … Continue reading

Secondee Performance Reviews and Ratings

Since secondees remain legal employees of their shareholder company, and depend on that company for broader career opportunities, it is generally appropriate that:

- In conducting secondee performance reviews, the Supervisor of each secondee, and the JV more broadly, shall fully utilize the HR processes, templates, and ratings system and guidelines (e.g., format and forms, ratings methodology, calendar) of the shareholder company that has seconded the employee.

Such an approach allows the secondee’s review and rating to be easily interpreted and adopted by the shareholder.

That does not mean that JV management should lose sight of – and be denied the right to defend – that performance review and rating when it matters most. As such, Ankura believes:

- The JV CEO, President, or General Manager shall have the right to participate in each shareholder’s internal corporate HR meetings where secondee performance is reviewed.[10]An alternative – though less common – approach is for the shareholder to simply “accept” the JV’s performance reviews and ratings of secondees, and not alter or recalibrate these reviews … Continue reading The JV CEO, President, or General Manager shall have the opportunity to present the secondee reviews, and to answer questions related to those review and rating. Ideally, the JV CEO, President or General Manager shall also have the right to participate in broader calibration discussions within each shareholder where secondees are cross-calibrated with other shareholder employees in similar roles to determine final ratings.

Such participation by the JV CEO is critical to defend management’s performance rating of the secondee, to better understand relative performance and expectations of shareholder employees in similar roles, and to understand and, as their supervisor, be able to communicate with the secondee any Shareholder opinions or changes to the review and rating.[11]An alternative to such participation would be to have each shareholder commit to accepting the JV-generated secondee performance reviews and ratings – and to not alter or re-calibrate in any way … Continue reading

Secondee Compensation and Shareholder Cost Reimbursement

Secondees remain legal employees of one shareholder company. As such, Ankura recommends that, unless secondees are placed on a very long-term basis into a venture, that:

- Secondees shall continue to be compensated by their shareholder company, who is their legal employer. Secondee compensation shall continue to be based on that shareholder company’s compensation framework, including base pay, variable compensation ranges, benefit levels and, relevant, expat allowances and local-country labor market adjustments.

As for what secondee costs the JV – or the shareholder – should shoulder, we believe:

- The secondee cost reimbursement approach (e.g., inclusion of which secondee cost categories, level of invoicing detail provided to the JV) shall be identical for all shareholders, unless there is clear justification and explicit agreement to do otherwise.

- The JV shall reimburse the shareholder company for those costs – and only those costs – directly attributable to the secondee supporting the joint venture. For a full-time secondee, this shall include secondee base pay, standard employee benefits, and those aspects of secondee variable compensation (e.g., annual bonus) that are tied directly to JV performance.

- The allocation of other secondee-related costs (e.g., relocation expenses, expat allowances, tax equalization payments for secondees changing country jurisdictions, inclusion of corporate HR administrative fees, etc.) shall be a matter of negotiation between the shareholders, or between the shareholder and the JV.[12]While not a best practice, the shareholders in certain JVs may approach secondee costs as a true ”negotiation term” – and might see secondee cost reimbursement as means to guarantee a modest … Continue reading

In certain joint ventures – especially in emerging market JVs or those between companies of very different sizes – the shareholders may arrive with very different labor cost structures. For instance, one shareholder may provide employees with much higher overall compensation – or it might have much richer benefit packages, standard annual wage increases, travel allowances, or higher corporate HR overhead changes. Such cost disparities are especially acute in emerging market situations, where the global partner will usually not only have a much higher wage structure overall, but its secondees are sent in with expensive “expat packages.” In these cases, it is not uncommon for the global partner’s fully-loaded secondee costs to be 5-10 times higher than the costs of a local employee or local partner secondee in an equivalent job. There are different approaches to handle such high-wage disparity situations.[13]For further details, please see Ankura Joint Venture Advisory Group Guide “JV Secondee Policies – Cross-Company Calibration of Practices.“ We believe that there is no one right answer and that it is ultimately a matter of negotiation between the shareholders.

Advanced Guideline: Linking Secondee Pay to the JV

We believe that companies function best when staff is focused on the same objectives – and management is compensated based on the same outcomes.

Unfortunately, JVs composed of secondees from multiple shareholders are not structurally set up to deliver this. Typically, a secondee’s variable compensation (annual bonus and long-term incentive award) is based on two factors: individual and group performance. The group component will usually increase in weighting as employees become more senior, such that it may drive 50% or more of variable compensation for those in management positions within an operating unit. While companies define group performance in different ways, it will likely include performance above the employee’s individual operating unit – i.e., include corporate and business unit performance, and sometimes mix in regional or functional performance.

In JVs with seconded staff, however, this standard approach is problematic. It means that secondees from different shareholders will be compensated based in large part on events inside their separate companies and thus not on the same factors. The more senior the secondees are, the greater these differences will be. The net result, according to one executive who has worked in or sat on the Board of more than ten joint ventures in his career, is the following:

“You end up with a senior management team looking in different directions – wanting to focus on the JV, but realizing that a big part of their pay will be driven by events in their own, different parent companies. At a minimum, it creates theoretical misalignment and, in some cases, actual misalignment. Think about it: with incentives like this, secondees should be motivated to help their company optimize the JV within their broader portfolio of businesses – that is, adopting technologies, suppliers, or systems that the parent is using, or doing small favors for the parent company to support its customers or help it optimize its operations. Those things may be good for the parent company but bad for the venture. And when you have different people doing this for different parents, you end up with a structurally dysfunctional system. Some secondees block this out and do what’s right for the JV, but not all do.”

Recognizing these issues, companies are today experimenting with ways to address this. One approach is to redefine the group performance component in a way that elevates JV performance, and downplays the contributions of broader parent company BU or corporate performance. This may mean including JV performance as an explicit element in the group performance calculation,[14]For example, in a large industrial JV between US and Japanese companies, the shareholders agreed to each include a JV performance factor in the group component of all secondees. In this case, each … Continue reading or in fact to simply define the “group” as the joint venture itself.[15]This can be easiest in very large joint ventures (e.g., $5BN plus in revenues), where the JV is at a scale of a medium to large company business unit. We have also seen situations where the … Continue reading

Another approach is for the Board to award a special “JV Annual Bonus” to all staff, including secondees. In theory, this bonus creates a common incentive across the management team and so has some surface appeal. As a general rule, however, we have found that such JV Annual Bonuses tend to lead to “double compensation” and make it challenging for secondees to return smoothly to positions within their shareholder companies. We also believe that there are other, better mechanisms to ensure that secondee compensation links strongly – and unequivocally – to performance within the venture.[16]These include: (1) Having secondee objectives set – and performance reviews led – by the secondee’s direct Supervisor in the JV, rather than a Sponsor or other executive in the shareholder … Continue reading

Given the above, and extending on the principles of secondee loyalty and strong direct reporting relationships, Ankura recommends:

- A secondee’s short-term compensation – including base pay increases and annual bonus award – shall be based 100% on events within the JV, and not include a group component tied to wider performance in the shareholder company.

Our benchmarking of secondee practices shows that this is in place in approximately 20% of JVs today.[17]See “Secondee Policies – Time for a Relook?”, Joint Venture Exchange. For subscribers to Ankura Joint Venture Advisory Group, also see “Benchmarking JV Secondee Practices”

To the extent that this advanced guideline is not adopted – and a secondee’s variable compensation remains partly tied to broader shareholder company performance – we believe it is inappropriate for the JV to reimburse the shareholder for those costs. To do so it unfair to the JV and at least to one shareholder – who are in effect subsidizing that shareholder paying the largest non-JV group performance awards to its secondees.

Corporate-Level Guidelines

Today, many large companies around the world – including Tata of India, ExxonMobil, Volkswagen, Airbus, and Nestlé – have large portfolios of joint ventures.

When such companies make a habit of placing secondees into their JVs, Ankura believes that these companies should adopt the following set of corporate-level guidelines:

- The Company shall adopt a set of JV Secondee Guidelines (such as those proposed by Ankura and outlined above) which define a set of minimum expectations with regard to the use, selection, management, fiduciary responsibilities, loyalties, and incentives of secondees in individual JVs.

- The Company shall name an officer of the Company to be accountable for the development, refinement, oversight, and compliance of the JV Secondee Guidelines and supporting processes and tools. This Officer is likely to be the Head of Human Resources or similar position.

- The Company shall periodically review its performance against these Secondee Guidelines. Ideally, such a review will occur annually.

Finally, Ankura believes joint ventures should not be a repository for sub-par talent. Therefore:

- The Company shall ensure that its secondees, as an overall employee class, are at a similar performance profile (e.g., performance rating distribution, tenure, percent of high-potentials) as its employees in its wholly-owned operations. In other words, the Company shall not send lower performing or less experienced employees into its joint ventures compared to other businesses or assets.

In developing these Secondee Guidelines, Ankura seeks to articulate what we have learned from over the years from hundreds of JVs, both through our research and client work. We appreciate that these Guidelines take a “Pro-JV” stance, and that not all companies adhere to (or will agree with) what we have spelled out. While recognizing the right for any company to organize itself as it sees fit, we assert that those that follow these Guidelines have a higher chance of success – and lower levels of dysfunction and disagreement – with this critical employee class than those that continue to treat secondees like any other employee.

Comments