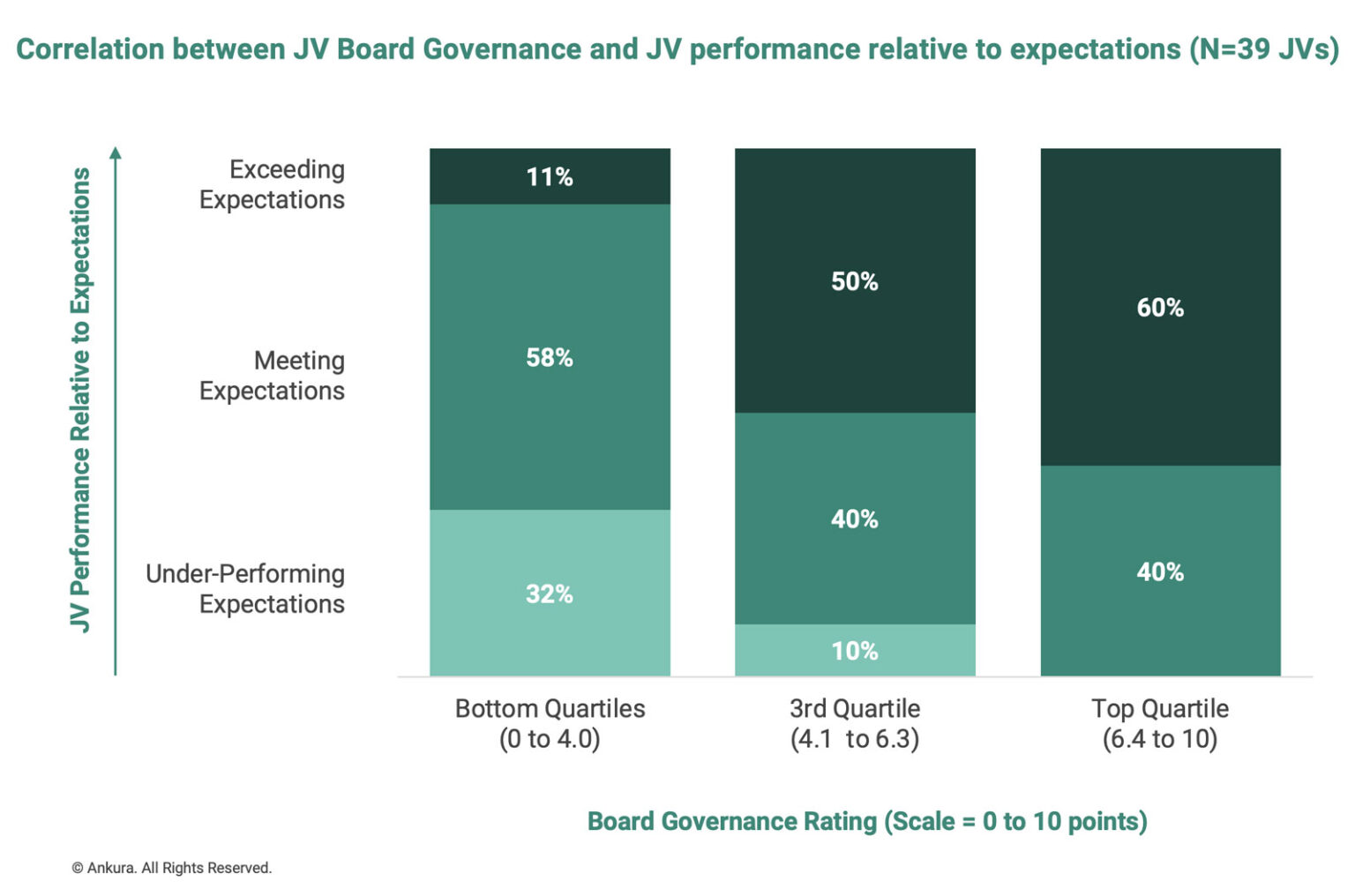

August 2017 — JOINT VENTURE GOVERNANCE is fractionally defined at deal conception – and rarely recovers from this state of incompleteness. Our research and client work has consistently shown that poor governance is a major cause of JV underperformance, and that JVs with weak governance policies and practices have materially lower performance over the medium term (Exhibit 1). [1]See, James Bamford, “Why JV Governance Matters,” The Joint Venture Exchange, September 2015; CalPERS Joint Venture Governance Guidelines (co-authored by James Bamford and David Ernst of Ankura); … Continue reading

Yes, venture legal agreements provide important guidance on governance matters such as voting rights, Board size, quorum requirements, and other legalistic and administrative procedures. And yes, most joint ventures do manage, over time, to establish committee charters and a few other governance policies.

But in most cases, these governance documents contain critical gaps, lack strategic orientation, are disconnected from each other, and are not well understood by those involved. The result: Those who oversee and run joint ventures often lack an adequately defined and shared view of how the governance is supposed to work at a practical level. This breeds misalignment, shareholder over-reach, blind spots in oversight, reporting inefficiencies, legal exposures, and other maladies. The fish stinks from the head down, as they say. It doesn’t have to be this way.

The purpose of this note is to introduce the Joint Venture Governance Framework – a simple way for companies to define, in an integrated and accessible manner, how the governance of a joint venture is actually intended to work.

Predictable Pains

If the Marquis de Sade had worked on transactions, he would have specialized in joint ventures. “It is always by way of pain one arrives at pleasure,” the French aristocrat wrote. “In order to know virtue, we must first acquaint ourselves with vice.”

And so it seems with the governance of too many JVs. Our client work and research has shown that poor governance is a consistent cause of under-performance and pain – to venture management, Board Directors, and the shareholders themselves.

JV CEOs often suffer from ill-defined governance. Consider the comment of one JV CEO:

“In large companies like my owners, there is an insatiable curiosity for information. Put functional experts on a committee, and they will ask and ask for information and explanation. And when a senior boss who sits on my Board asks something in the morning, before the end of the afternoon, there are 50 people in his company asking us for information that relates to that question. There are no guardrails on these interactions.”

Minority shareholders also feel the pain. Consider the non-controlling partner in a 60:40 alternative energy JV in Europe. During the deal negotiations, the partner company CEOs verbally agreed that the JV would be operated as an independent company with a separate management team and culture, and jointly governed by both partners. But the partners did not collectively define how the governance and organization would actually work prior to deal close. Today, the majority partner is blocking the minority partner from an active governance role and running the JV as an operated asset fully integrated with its other operations. With promised synergies well below expectations, limited levers to address the issues, the minority partner is evaluating its strategic options, including litigation and exit.

Poorly-defined governance has the potential to create or exacerbate numerous other issues. It weakens oversight, and increases risks to the shareholders, by under-defining expectations of the Board, committees, individual Directors, management, and the shareholder companies. It creates inefficiencies and delays by failing to align the shareholders and their representatives on how they will govern the venture and engage in critical functions and shared interface points, such as strategy, risk management, regulatory affairs, and sales. It imposes a tax on management, and thus distracts those charged with running the company from performing their core job. Many JV Board Directors don’t appreciate that, and part of their role is to ensure the CEO is able to succeed. It truncates the flow of capabilities and other resources from the shareholders to the venture. And it prevents the JV from responding quickly and effectively to the market, internal crises, and the need for restructuring.

JV CEOs often feel these pains most frequently and acutely. But it is the role of the JV Board to ensure that governance is working well, and that the CEO is in a position to succeed.

Developing a JV Governance Framework

Purpose and Features. A JV Governance Framework helps address these ills. In simple terms, it is a single document that defines how the governance of the JV will work. It builds on, and complements, the JV legal agreements. It describes the purpose and workings of the Board and committees, establishes individual Director expectations, and clarifies authorities and reporting. Typically, it is 10-15 pages long, and includes appendices that are built over time. It is not over-specified but contains sufficient detail and clarity as to explain how the governance will work in an integrated way. It is written in plain business language and is approved by the JV Board through a Resolution to provide it with status. It is communicated broadly, and used during onboarding of new Directors, committee members, and management. And it is a “living document” that is periodically updated as new issues arise.

Questions It Answers: JV Governance Frameworks should answer a set of questions, such as:

- What is the role of the Board vs. the shareholder organizations in performing oversight and assurance?

- How involved will the Board be in key governance functions, such as strategy, capital investments, risk management, and talent development?

- What committees will we form – and is their purpose to advise the Board, provide expertise to management, support individual owner assurance, or something else?

- What specific powers and authorities (e.g., budget overrun allowance, power to hire and fire all direct reports) will be vested in the JV CEO, versus require Board?

- How will recurring governance decisions, such as the annual budget and new capital investments, actually be made in coordination with JV management and the broader shareholder organizations?

- What do we expect of individual Directors and committee members in terms of commitment, availability, skills, behaviors, etc.?

- What constitutes a conflict of interest, and how are Directors expected to balance their fiduciary duties to the entity with the competing interests of their shareholder?

- Upon whose standards, policies and processes will the JV operate – its own, one shareholder’s, a blend?

- How will the shareholders perform assurance and coordinate audits?

- What information will the JV report to the Board and shareholders – and at what frequency, and in what form?

- How will governance change as the JV evolves?

A JV Governance Framework may also cover matters quite specific to the individual JV’s structure, such as protocols for handling joint customers, using shared assets, managing shareholder-provided services, or placing and managing secondees.

By providing guidance on such matters, the JV Governance Framework complements the legal agreements (Exhibit 2). Not all topics will be relevant to all JVs, of course. Not all relevant topics will be contained in the main body of the document. And not all relevant topics need to be included in the first version of the framework. Many JV Boards build out the Governance Framework over time, adding or revising policies and protocols as needs are identified and as capacity allows.

Exhibit 2: Defining JV Governance — Key Elements and Optimal Location

| Key Elements of JV Governance | Location | |

|---|---|---|

| JVA or JOA | Governance Framework | |

| Voting – Reserved Shareholder Matters | ||

| Voting – Unanimous and Supermajority Board Matters | ||

| Voting – Board Simple Majority Matters | ||

| Board Size and Meeting Frequency | ||

| Board Quorum Requirements | ||

| Board Committees – Formation | ||

| Shareholder Audit Rights | ||

| Dispute Resolution Mechanisms | ||

| Interim Governance | ||

| Guiding Principles | ||

| Governance Model Overview | ||

| Chair Role Description and Expectations | ||

| Individual Director Role Descriptions and Expectations | ||

| Board Workings (including culture, agenda development, minutes) | ||

| Committee Charters – Specific Scope, Size, Frequency, Reporting | ||

| Integrated Board and Committee Calendar | ||

| Decision Process Maps (e.g., annual plan and budget, major capex) | ||

| Delegated Authorities – Board and Management | ||

| Board and Committee Evaluation | ||

| Shareholder Engagement Model for Key Functions (e.g., sales, planning) | ||

| Shareholder Assurance | ||

| Operating Standards and Procedures | ||

| Information Register | ||

| Code of Conduct | ||

| Managing Competitively Sensitive Information (CSI) – Guidelines | ||

| Managing Conflicts of Interest – Guidelines | ||

| Secondments – Guidelines and Key Terms | ||

| Shareholder-Provided Services – Guidelines and Key Terms | ||

| Joint Sales and Customer Protocols – Guidelines and Key Terms | ||

© Ankura. All Rights Reserved.

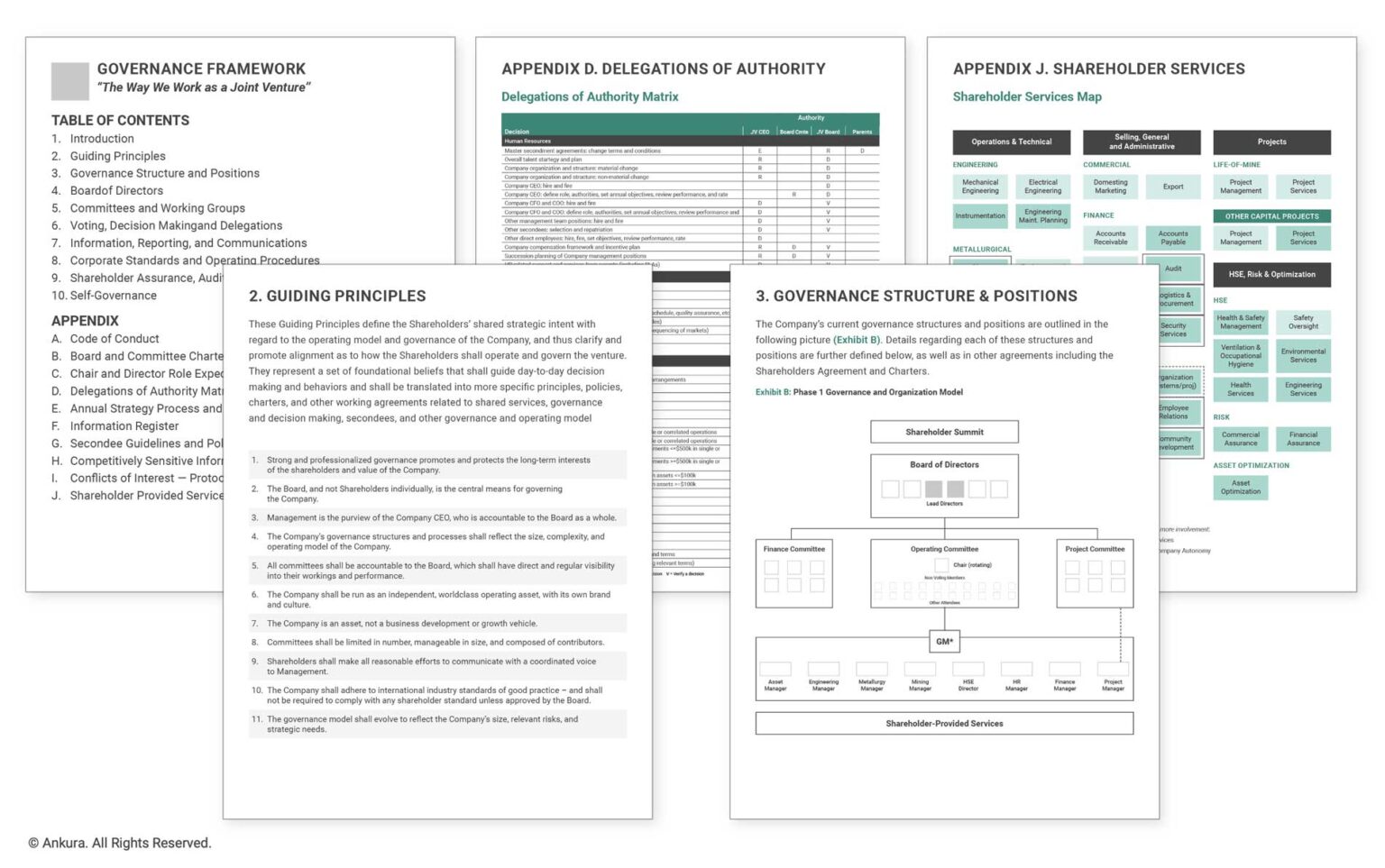

Client Illustration. To get a sense of what a JV Governance Framework looks like, consider a 50:50 industrial JV. Five years after formation, the JV was experiencing a series of governance flare-ups, including significant delays on capital investment and major contractor decisions, rising partner tensions related to differing views on Board and owner company involvement in the business, and how secondees and owner-provided services should be managed. We worked with the JV Board to identify misalignments and gaps relative to international best practice and establish a collaborative process to address these issues. After conducting a diagnostic, we ran a series of workshops to discuss our findings, work through open issues, and collectively define a new governance model.

The result was a JV Governance Framework, approved by the Board and communicated to the owner organizations, that memorialized how the JV’s governance would work (Exhibit 3).

The JV Governance Framework started with a set of guiding principles, including statements regarding the primacy of management in running the venture. It summarized the key governance bodies and roles, and defined management and Board authorities at a fairly granular level. It clarified the shared services model, including confirming management’s right to define specific service requirements to deliver against the Board-approved targets and plan, and to negotiate shareholder service agreements.

Today, the JV is performing extremely well, and the governance is often cited as one of the venture’s core strengths.

When to Create. Ideally, an initial version of the JV Governance Framework will be developed during the first 6-12 months of the JV, when when the teams are starting to operationalize the governance. This version is then expanded over time to reflect additional governance processes and practices. But a JV Governance Framework can be valuable at any point in a venture’s life – for instance, after problems arise, when new owners are added, following the hiring of a new JV CEO, or in advance of a shift in venture phase (e.g., from construction to operations, or from research and development to manufacturing and sales).

It’s time to raise the bar on JV governance. Doing so demands operationalizing the legal agreements and aligning the shareholders on how the governance will actually work. A JV Governance Framework can do just that.

Comments