Cross Border Joint Ventures: Confronting National Differences in Board Culture

Why cultural differences are often more acutely felt on joint venture boards – and what it means for companies and executives.

Flo Lugli of Global Hotel Alliance and Jason Mann of Life and Specialty Ventures

October 2019 – JOINT VENTURE BOARDS OF DIRECTORS are prone to frictions stemming from partner misalignments on venture business objectives and strategy. Such misalignments can result in a challenging boardroom culture characterized by divisiveness and tendencies to favor self-interested positions.

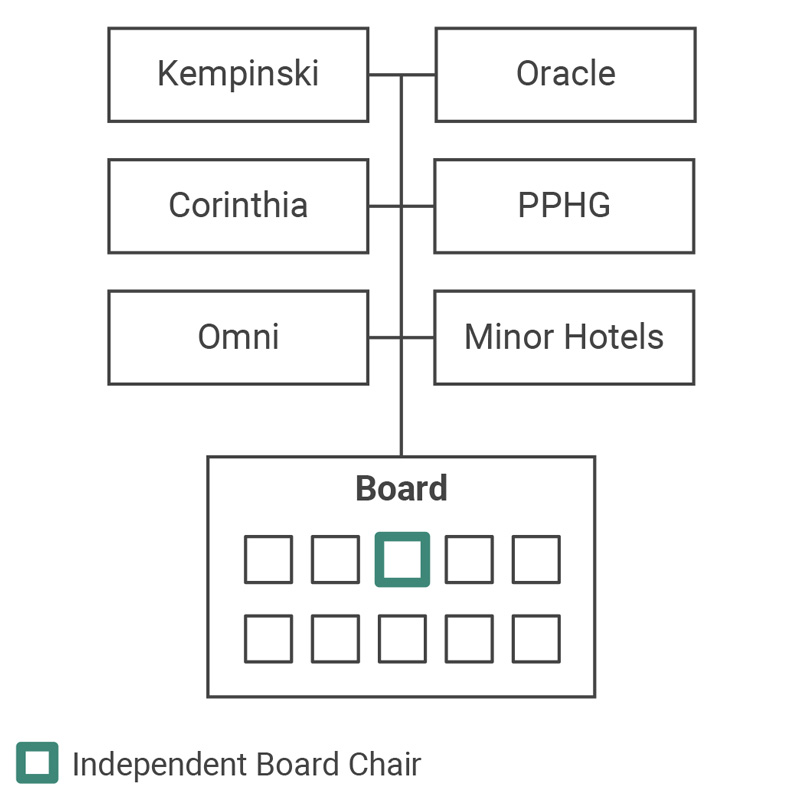

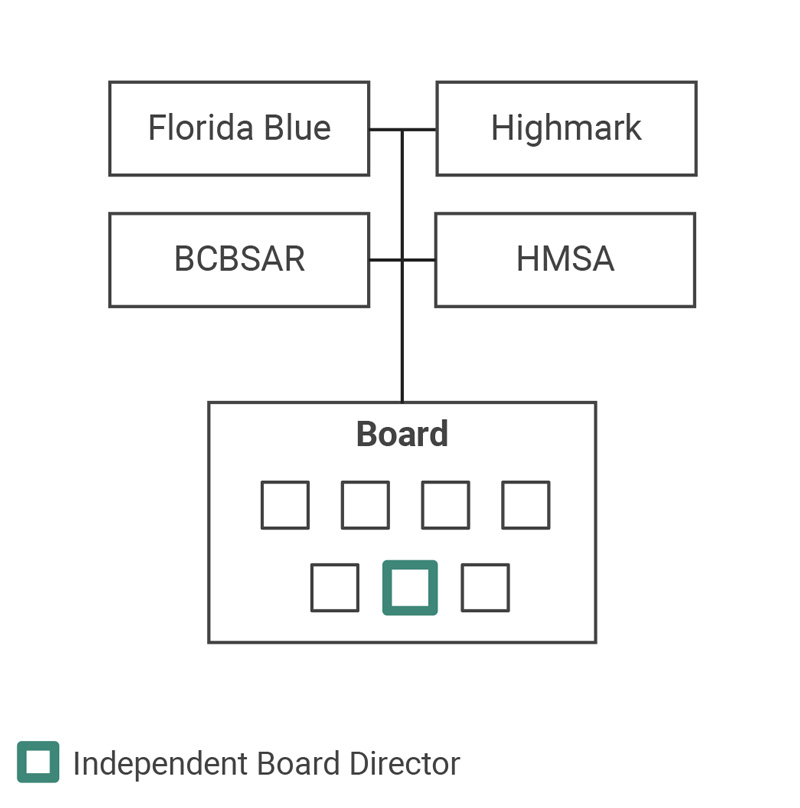

Independent directors represent a potentially valuable, though perhaps underused tool, to help remedy these issues. Ankura defines a joint venture independent director as a board member who is neither a current executive of an owner company, nor a current employee of the joint venture’s management. According to our research of more than 250 joint ventures, less than a quarter of JVs have independent directors on their board (Exhibit 1). Those joint ventures with independent directors rarely start that way – an independent is added, often years after the company’s start, because the owners recognize they need new skills on the Board, or someone to serve as a neutral voice, or as an advocate, for the JV.

Ankura recently sat down with Flo Lugli and Jason Mann, two independent directors serving on joint venture boards. Flo Lugli is the non-executive Chair of Global Hotel Alliance (GHA), which uses a shared technology platform for its 30+ member brands, and operates a multi-brand loyalty program called DISCOVERY. Jason Mann serves as the Chair of Life and Specialty Ventures (LSV), a provider of value-added services, such as life, disability, dental, etc. insurances. Prior to his role as Chair, Mann served as LSV’s CEO for 10 years. (Exhibit 2).

© Ankura. All Rights Reserved.

We discussed their individual experiences as independent directors and aimed to answer why independent directors may make more or less sense in the context of a specific joint venture. An edited transcript of their comments follows.

Adding an independent director seat is dependent upon a variety of factors, such as market context, venture strategy, and partner alignment. In some scenarios, a JV may bring on an independent director due to an explicit trigger event, while in other cases the decision to bring on an independent director may be a slower and more organic process. Trigger events can include external drivers like government regulations or other venture-specific factors like the decision to add new investors.

Mann explains that LSV’s introduction of an independent director was due in part to the company wanting to retain its Chairman, Joe Grantham, who was set to retire from Florida Blue, one of LSV’s owners. “When Joe announced his retirement, LSV created the independent director position so that he could stay on as an independent chair. This worked very well and smoothly because nobody wanted to see Joe go.”

In contrast, Lugli links Global Hotel Alliance’s independent seat to industry-wide technological change and organizational growth: “Technology continued to play a bigger and bigger role in the hotel industry, and was the core value proposition that GHA provided to its member brands. Owners – all hospitality companies – looked to bring in someone who would have the time and experience necessary to better support the CEO in areas of technology, strategy and growth. Global Hotel Alliance wanted to create a longer-term view of where the organization could grow, and how it could continue to add value to the core businesses of its shareholders and members.”

Just as the rationale for adding independent directors may vary, joint ventures that introduce independent directors have a range of options for scoping and structuring the role. For instance, some ventures utilize “quasi-independent” directors – meaning that the director is appointed by one shareholder to occupy one of its allocated board seats. In such cases, the shareholder company may elect to put an outsider in one of its JV board seats because the individual brings needed skills or local market knowledge. Alternatively, other joint ventures have “true independent” directors, which are selected collectively by all of the shareholders. In these cases, duties of the independent director can range from serving as board chair, to coaching the JV CEO, to delivering other value like network relationships or industry expertise.

Based on how the role is scoped, ventures that add independent directors must also consider design questions like expected time commitment, compensation, and whether the independent director holds any voting powers.

Lugli and Mann both described their board positions as primarily oriented towards supporting the JV CEO and advocating for the JV’s interests (vs. those of any individual shareholder). Lugli notes, “A lot of my work is about helping the owners leave their owner hats at the door when they come to board meetings and learning to wear their Global Hotel Alliance hats instead. Sometimes I’m trying to be that bridge between the shareholders and the CEO so that the CEO is free to actually run the business rather than trying to manage the shareholders.” Similarly, Mann connected his independent seat to supporting the CEO: “I’m there to coach the CEO and serve as a sounding board for him while pushing the board for clear and concrete decisions.”

Both Lugli and Mann agree that the expectations of an independent chair are likely to be higher than those of an independent director, as the chair position requires a significant time commitment to the JV. Lugli noted, “There is an expectation that I’m spending a minimum of 5 days a month on Global Hotel Alliance business – an independent director not playing the chair role would likely not have the same expectation in terms of time investment.”

In reviewing the potential effectiveness of an independent director, it is also critical to consider the key traits that comprise effective leadership. While a specific trigger event – like adding new shareholders – may compel a JV to appoint an independent director, there is no guarantee that merely creating the new position will resolve JV board frictions or culture problems. Addressing partner misalignment, mistrust, ineffective governance, etc. requires a conscientious leader who is able to ease tension, build alignment, and, as appropriate, advocate for and prioritize the interests of the venture.

Lugli emphasized two personality traits that define a successful independent director in her eyes: “Restraint is important in that you must put your own ego aside and keep your eye on what the company’s objective is, just as patience is important as you deal with different personalities. The most important thing is making sure you serve the greater good of the JV itself, and work to accomplish what the board has set out as your mandate and that of the company.”

Lugli and Mann employ similar strategies to seek board alignment, such as holding board meetings in neutral locations and timing committee meetings after communal meals. Mann explains that this model, “Allows people to decompress from their day job and reorient themselves around the JV board meeting and the role they are expected to play.”

Although independent directors may make more or less sense in the context of a specific venture, Ankura encourages those structuring a new joint venture or working with an existing one to consider the JV’s Board culture, and whether the right independent voice could help.

We understand that succeeding in joint ventures and partnerships requires a blend of hard facts and analysis, with an ability to align partners around a common vision and practical solutions that reflect their different interests and constraints. Our team is composed of strategy consultants, transaction attorneys, and investment bankers with significant experience on joint ventures and partnerships – reflecting the unique skillset required to design and evolve these ventures. We also bring an unrivaled database of deal terms and governance practices in joint ventures and partnerships, as well as proprietary standards, which allow us to benchmark transaction structures and existing ventures, and thus better identify and build alignment around gaps and potential solutions. Contact us to learn more about how we can help you.

Comments