Board Ballet: Choreographing the JV Board Agenda

An annual agenda that balances operational reviews with discussions of strategy and growth will help JV Boards be as effective as possible.

An annual agenda that balances operational reviews with discussions of strategy and growth will help JV Boards be as effective as possible.

By seriously considering the prospect of JV failure upfront, companies can take action before it’s too late.

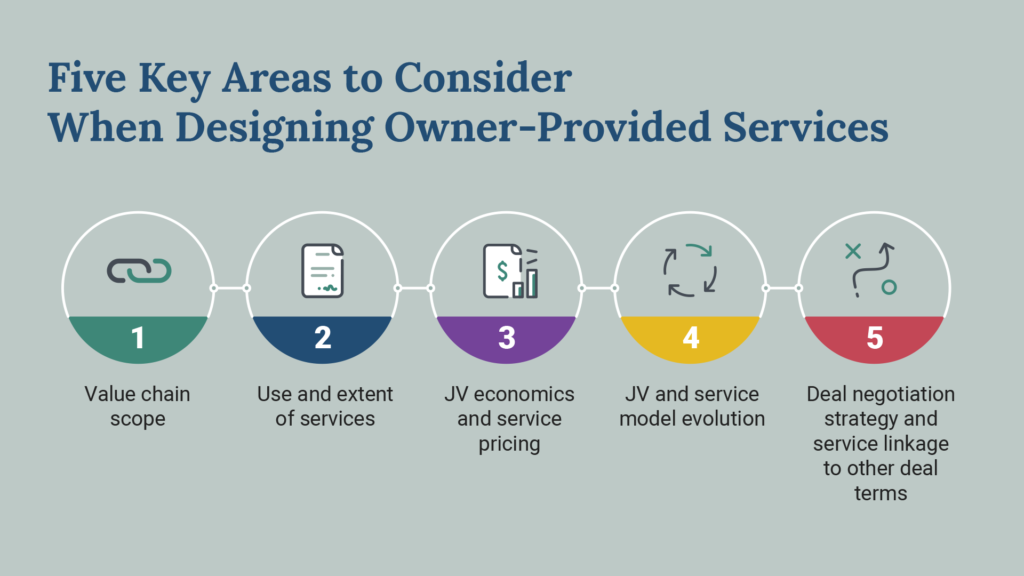

JV transactions have complexities not found in traditional M&A – yet they’re often executed without the help of investment bankers. That can create pitfalls in the deal process.

Why JV negotiations are uniquely challenging

Due diligence for joint ventures is more important than due diligence in an M&A context and requires an approach that exceeds traditional M&A due diligence.

Joint ventures are a critical tool for companies to access or commercialize new technologies and capabilities, share risk, meet local regulatory requirements, gain scale, and pursue capital-light growth.

Where JV committees go bad, and how JV Boards and CEOs can ensure their committees contribute productively to venture performance

Why charting a Capabilities Map of the venture landscape is critical for JV Boards, management, and shareholder governance teams