NOVEMBER 2010 — For better or worse, the vast majority of time and attention that JV Board Directors spend thinking about the business or asset happens within the narrow confines of Board and committee meetings. As a result, orchestrating the Board’s annual agenda is a critical tool for JV Chairs and CEOs to engage, energize, and get value out of the Board.

Enter your information to view the rest of this post.

"*" indicates required fields

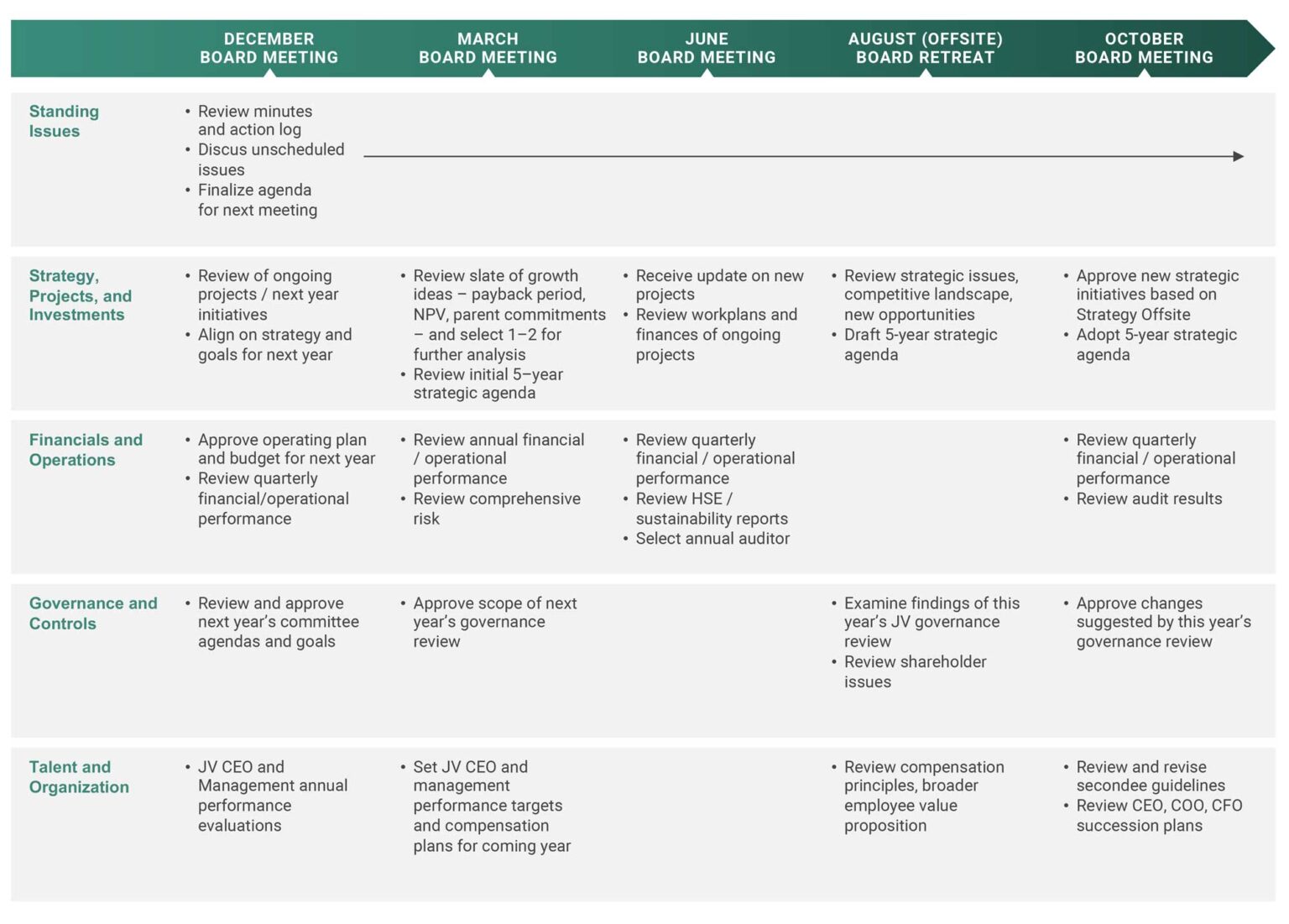

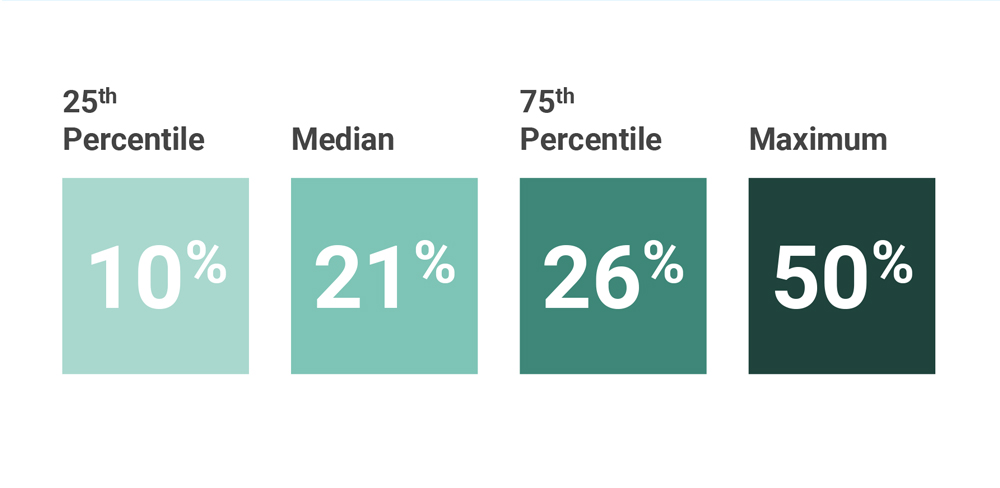

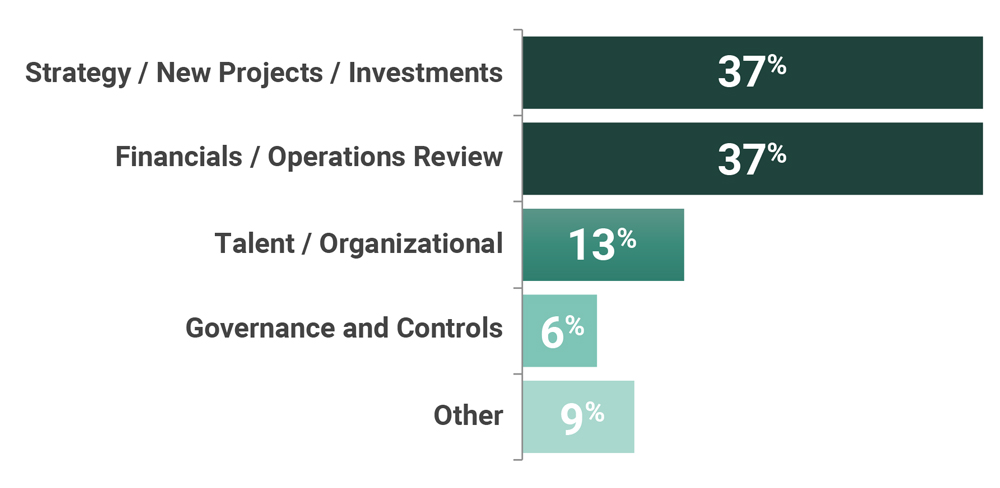

But this valuable time isn’t always optimized. Many Board members tell us that their meetings suffer from disorganization that seriously limits the effectiveness of their time (Exhibit 1). What’s worse is that all too often, near-term items like performance reporting, operations, budget, and other routine matters take up close to 50% of the average JV Board meeting, crowding out important issues like strategy, talent, and self-governance – if they’re even addressed at all (Exhibit 2). Similarly, not enough thought is given to the mix of time – the amount of time spent in full-Board meetings vs. breakouts, and the split between decision vs. discussion time, or formal vs. informal interactions.

Exhibit 1: Problems with JV Meeting Effectiveness

Percent of JV Board Meeting Time That is Not Well Spent

N=20 JVs

Common sources of poor time management:

- Revisiting decisions already taken

- Verbally briefing Board members on pre-read materials

- Working at tactical issues inappropriate for the Board

© Ankura. All Rights Reserved.

Exhibit 2: Average JV Board Time Allocation

Average Allocation of JV Board Time by Topic

N=27JVs

Notable Findings:

- Half of the JVs examined spend zero time on either governance or talent / organizational planning

- Majority of JVs spending less than 20% of time on strategy (average percent elevated due to subset of JVs spending very high portion of time on strategy)

© Ankura. All Rights Reserved.

An annual agenda that balances operational reviews alongside discussions of long-term strategy and growth – while also preserving time to address unexpected issues and to return as needed to key topics across the year – is a powerful tool in the hands of a JV Board interested in maximizing the effectiveness of its agenda (Exhibit 3).

This memo focuses on four areas where a JV Chair and CEO considering their upcoming calendar could utilize some best practices to focus on effective Board agenda management: 1) the basic calendar, including the number, type, and length of Board meetings across the year; 2) the mix and sequence of topics; 3) preparation and follow-up; and 4) induction of new Board members.

BASIC CALENDAR

Designing a well-defined Board calendar starts with establishing the format – how often should meetings be held, what kind of meetings, where, and for how long?

Number of Meetings

Some Boards meet twice a year, and some monthly, but our view is that 4–6 meetings per year is usually the right number. Only rarely will a Board need to more than 6 times per year, except during startup or at a crisis point. Similarly, it is difficult for a Board to do its job adequately with just two meetings per year.

Types of Meetings

To fully address their responsibilities, Boards generally need a mix of formal decision-making, semi-formal discussion/debate, and informal networking/one-on-one time. We’ve heard from many JV Board members that they would prefer a strong separation between “discussion” and “decision” meetings, giving them the freedom to talk without being forced to advance an official point of view before they are ready. In addition, it’s critical to flag in advance the topics where decisions will be requested vs. those where only an initial discussion is planned. Done this way, most Board Chairs find that the truly “formal” decision session can be managed in 90-120 minutes, leaving the rest of time for discussion. Some Boards have found it helpful to have meetings split over the afternoon of one day, and the morning of the next. Putting the decision session on the second day allows Board members to revert to senior officers in their companies as needed for approval, in advance of the decision part of the JV Board meeting.

Location of Meetings

Unlike corporate Board meetings, convenience is the most important factor for a JV Board meeting – JV Board members are usually parent executives with significant job responsibilities. Meetings are usually best held at the JV head office or a convenient “hub” airline city. Meetings in exotic “resort” locales should be reserved for one-per-year (if that) strategy off-sites. It’s also helpful to take Board members to important customer or manufacturing sites – typically once per year – in conjunction with Board meetings. And, for cross-border JVs, it can be useful to alternate locations, to allow for the participation of more senior executives from the parent companies.

Length of Meetings

Board meetings should generally be at least 6-8 hours, if not 1.5-2 days in length. It is helpful for every Board meeting to be coupled with at least one meaningful social interaction such as a dinner, with more informal time (e.g., golf, dinner, deep sea fishing) at least once per year.

MIX AND SEQUENCE OF TOPICS

After setting the cadence of when the Board meets, this leads naturally to the question of agendas: What should the Board discuss?

Broadly speaking, most successful JVs make sure to spend time on strategy and people issues – though many give these topics too little time – and most JVs could benefit from a rigorous annual assessment of the JV’s governance performance. While we recognize the specific agenda needs to be tailored to the unique needs of the JV, we can offer some broad suggestions for arriving at a strong and useful agenda:

- Establish the rhythm of agenda topics well in advance. Fourth quarter Board meetings are usually a good time to set the cadence for the following year. Most topics will need to get some attention from the Board on more than one occasion before a final decision is reached, so we suggest planning for the need to manage core issues through multiple meetings (Exhibit 4).

- Regardless of the primary meeting topics, allocate time in each meeting to address standing administrative items, to review unforeseen issues and to review progress against previous Board decisions.

- Consider inviting outsiders – key customers, industry consultants, academics, friendly executives, etc. – to at least some of the discussions on strategy and governance, in order to bring a fresh perspective from outside the JV and to weave in applicable best practices from other industries or ventures.

- Synchronize the timing of when each topic is addressed – especially HR decisions, operating budgets and capital expenditure – with JV parent planning and review cycles, so that the JV Board can be aligned on its requests prior to JV parent decision-making.

- The JV Board should also synchronize subcommittee work with the Board calendar – including aligning agendas and planning for subcommittee chairs to present on key topics at Board meetings – in order to maintain transparency and connectivity between subcommittees and the full Board (Exhibit 5). One Oil & Gas JV Board we recently spoke with is now planning to approve each subcommittee’s annual agenda and goals to ensure such connectivity is firmly established.

Exhibit 4: Tracking a Topic across the Board Calendar

* Separate Committee – composed of mixture of 1 Board member – and 1 non-Board member (typically a strategy executive) – from each parent

© Ankura. All Rights Reserved.

Synchronizing the subcommittee calendar with the Board calendar is a good opportunity to consider pushing a certain level of work and decision-making down to subcommittees. We suggest considering, for example, having only the Compensation Committee approve compensation for management below CEO-level (while the full Board still reviews and approves CEO compensation), or having a Strategy Committee make in-depth reviews and revisions to capex proposals before they get to the full Board. Better use of the subcommittees can help steer the whole Board towards focusing solely on the most-important and well-validated ideas.

How Key Board Committee Functions Sync into Overall Board Calendar

© Ankura. All Rights Reserved.

Finally, even though a Board ultimately needs its own unique agenda, we feel strongly that every Board should also hold a series of topical discussions – either a separate meeting entirely or during a dedicated portion of a regular Board meeting – to help foster partner alignment and strong governance, including:

Executive Session

At least one full Board annual review of JV CEO performance and shareholder issues without the JV CEO or any JV management present. We think that the JV CEO contract is not just a compensation issue, but also an alignment opportunity for the Board – one that’s not used

nearly enough.

Strategy Off-Site

At least one annual in-depth discussion between the Board and JV management on strategy issues, opportunities and choices. These strategy meetings should focus solely on alignment around long-term challenges (Exhibit 6), and might be the best opportunity in the year to hold a meeting at an exotic locale if it’s going to run for multiple days.

Governance Review

An annual session to hold a rigorous assessment of the JV’s governance performance – including input from Directors on whether the agenda has the right mix for their needs.

Service Level Agreement Review

An annual review by the full Board – or possibly a subcommittee – of service-level agreements and parent company delivery against them.

Exhibit 6: Sample Off-Site Strategic Agenda – Board Retreat

| TOPIC | DISCUSSION LEADER | TIME |

|---|---|---|

Welcome + Executive Summary

| JV CEO + Board Chair | 0900-0930 |

JV Market and Competitive Context

| CFO + VP Strategy | 0930-1030 |

Strategic Gameboard Exercise

| VP Strategy + Lead Directors Parents A & B | 1030-1200 |

5 -Year Strategic Agenda Discussion

| VP Strategy + Lead Directors Parents A & B | 1300-1500 |

New Regulatory Requirements and Implications for JV

| General Counsel + Lead Director Parent B | 1500-1530 |

Next Steps

| JV CEO | 1530-1600 |

© Ankura. All Rights Reserved.

PREPARATION AND FOLLOW-UP

The best planned agenda will fall short without appropriate preparation and post-meeting follow-up.

First, pre-reading and syndication in advance of Board meetings is a powerful and inexpensive way to ensure a successful Board discussion. When Board members receive and react to topical materials for the first time at a Board meeting, the focus of the meeting will be on the details – not on the decisions. To avoid this, the JV CEO should draft and deliver pre-reading materials that clearly differentiate between core and additional support materials, and most importantly, clearly articulate the decision the Board will be asked to make, focusing their attention in the meeting.

Second, as part of articulating decisions requiring Board approval, the JV CEO should be syndicating proposals with Board members and JV asset managers / shareholder representatives – not to look for guidance on what to do, but to seek reactions and endorsements from these key decision-makers and influencers. This leads to meetings that can be focused on topics requiring further discussion – instead of giving equal attention to issues that ultimately face no dissent.

Finally, in terms of effective time management, we recommend a series of steps for after a Board meeting. First, the JV CEO and Board Chair should communicate within a week the outcome of Board meetings to other Parent company executives and operational managers. This is often best expressed in the form of a “Board Communiqué” that summarizes the discussion and decisions. Second, the Board should ensure it prepares minutes and an action summary for distribution to Parent and JV executives. Third, to ensure proper execution against Board decisions, the Board should maintain an “action log” that documents previous decisions (e.g., the contents of the action summary) and tracks the status of their implementation (Exhibit 7). If the Board is following our recommendation that every meeting review the status of previous Board decisions, the action log is a key tool for effectively managing that discussion.

Exhibit 7: Action Log for Tracking JV Board Decisions

| ISSUE | ACTION | PRIORITY LEVEL | COMPLETION AND KEY DATES | RESPONSIBLE PARTY | CURRENT STATUS |

|---|---|---|---|---|---|

|

|

|

|

|

|

© Ankura. All Rights Reserved.

NEW BOARD MEMBER INDUCTION

JV Boards face regular turnover in their membership, which can be disruptive if multiple Board members leave during the busiest time of the year – or if multiple new Board members are trying to learn their job when the Board is facing its most pressing annual issues.

As a simple solution, we recommend JV Boards structure the induction of new JV Board members to occur early in the year, after compensation has been decided and plans approved for the upcoming year, rather than turning the most important annual decisions into the training ground for a new Board member. Additionally, it would be best if multiple new Board members join at once, to minimize the disruption caused by multiple overlapping training and induction processes.

WELL-DEFINED BOARD AGENDAS IN ACTION

To understand how this all comes together – and why a choreographed Board calendar, agenda, and other interactions are so valuable – consider how some JVs have constructed well-defined Board calendars to improve the effectiveness of the Board meetings:

In a large banking venture, the JV CEO recently rebalanced the Board calendar and agenda to now spend 85% of its time focused on JV strategy and growth prospects. This subtle shift has led the JV to creating a high-margin growth seam in an adjacent market – a market that none of the Board members initially understood. The key change that unlocked this value: Instead of presenting financials at the start of each meeting – and then using half the meeting to walk through them – the JV CEO started providing financial statements as a “pre-read” prior to each meeting, with a standing offer to answer any questions about them at the start of each meeting. Now his Board has the time to focus on forward-looking strategy instead of getting bogged down in last quarter’s financial or operational results.[1]Spending 85% of time on strategy is probably not possible for most JVs, given the minimum amount of time a Board needs to spend on HR issues, financials, budget and capex planning, etc., but this … Continue reading

Similar gains await many JVs. For example, in our 2009 study on JV CEOs, we found that 75% of JVs performed well financially and operationally when CEOs spent at least 25% of their time on organizational and talent issues – as opposed to only 41% of JVs when the CEO spent less than 25% of his time on those topics.[2]“Succeeding as a JV CEO: Benchmarking Data and Analysis,” Water Street Partners, May 2009

Consider a mining JV. Here, the global mining major and a local government-owned partner were having difficulties making substantive decisions on time. This was primarily due to the global parent feeling perpetually unprepared to make decisions at Board meetings because the JV management team was providing information of insufficient quality, clarity and depth. On the other hand, the local partner, which was the operator of the JV, felt overwhelmed with information requests that appeared uncoordinated and rarely came with the necessary time to properly prepare a response. The solution was for the partners to design an improved Board calendar specifying, in advance, the required material for each Board meeting, with topics now clearly linked to the required material. The local partner now knows a year in advance when corporate strategy and capex will be discussed – and when it needs to be prepared to present business cases for new projects to the Directors from the global mining parent.

A consolidation JV in the energy industry faced a different challenge. Recently formed by consolidating related businesses of the two parent companies, the JV Board was dealing with a growing number of standing and special items to cover on its agenda, which made it increasingly difficult for the Board to maintain focus on critical annual priorities. Beyond an already-long traditional agenda, the Board was trying to focus on “integration management” – ensuring the consolidation JV was establishing a strong governance system and delivering against estimated synergies. To cope with these requirements, the Board decided to establish a calendar that explicitly laid out the major categories of discussion for each Board meeting, and then created a set of key related deliverables needed to help the Board discuss each meeting topic. Additionally, to stay focused on long-term progress, every Board meeting now includes review of an “action log” that tracks prior Board decisions and their current status (Exhibit 8).

Exhibit 8: Re-defined Board Calendar Constructed by Energy Industry JV

| MEETING DATE | ACTIVITIES | |||

|---|---|---|---|---|

| Performance and Risk | Strategic Agenda | Governance | Other | |

| 10-Feb |

|

|

|

|

| 5-May |

|

|

|

|

| 14-Aug |

|

|

|

|

| 7-Oct |

|

|

|

|

| 15-Dec |

|

|

|

|

© Ankura. All Rights Reserved.

Well-defined Board calendars are simple but effective tools to help Boards better use their most limited resource – time. According to an inscription we once saw:

Time in minutes slips away,

First the hour and then the day.

Small the daily loss appears,

Till it soon amounts to years.

We completely agree.